- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How I report the sale of MLP shares in Turbo Tax. I sold all shares.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

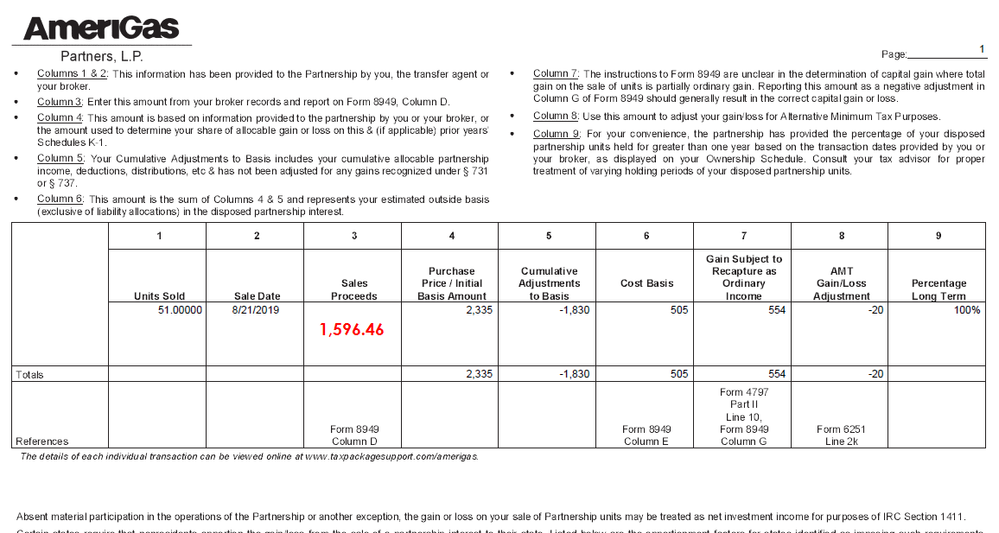

@Boyan Its a good example, but to really answer it you'd need to look at past K-1s for a couple things. But in essence you're on the right track:

- The cash you spent years back was $2335.

- The cash you just got was $1596. So a loss of $733 at first glance.

- But the $1830 'adjustments' is critical here. Every dollar of that $1830 was either cash to you, or was a tax break somewhere.

- The distributions you collected each quarter are included in that $1830. Note that you referenced $554, but the 'recapture' number is not the same as distributions. You're total distributions show up on the K-1 each year on line 19A.

- There's a bunch of that $1830 that's a suspended passive loss, which you get to claim this year because you did the disposition. That number isn't on your sales schedule anywhere, but TT has been tracking it. And it will show up on Sched E this year.

- There are other items in the $1830, but the above are the 2 major categories.

- The key point is that, although only some of that $1830 showed up as cash, the rest of it has been flowing through your taxes as deductions (either in past years, or this year when you get to release the 'suspended' losses).

- So when you add that $1830 back into the equation, you didn't take a loss on the deal. You spent $2335, but received $1596+$1830, for a profit of $1091. So congrats -- you actually made some money on an MLP 😊

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@Oldguy Did the sales schedule break those totals out by lot? Typically they do. What you provided here is fine for completing the K-1 Part 2. But to adjust the 1099-B, you need to calculate the cap gain for short term separate from long term.

But if we pretend that the short-term didn't exist, and all the Sales Schedule numbers applied to the long term, then the math is:

- Total Gain = $9502 (Proceeds) - $4205 (Basis) = $5,297

- Total Gain = 'Gain Subject to Recapture' + 'Capital Gain', so

- 'Capital Gain' = Total Gain - 'Gain Subject to Recapture'

- Capital Gain = $5,297 - $2,729 = $2,568

So on your 1099-B, you need to adjust the cost basis to produce a $2,568 gain.

- 'Cost or other basis' on the 1099-B = $9502 (Proceeds) - $2,568 (Cap Gain) = $6,934

- So that's what you'd change the 1099-B to reflect.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

Thank you for confirming the calculation. The Sales Schedule only had one line on each of the K-1s I got.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

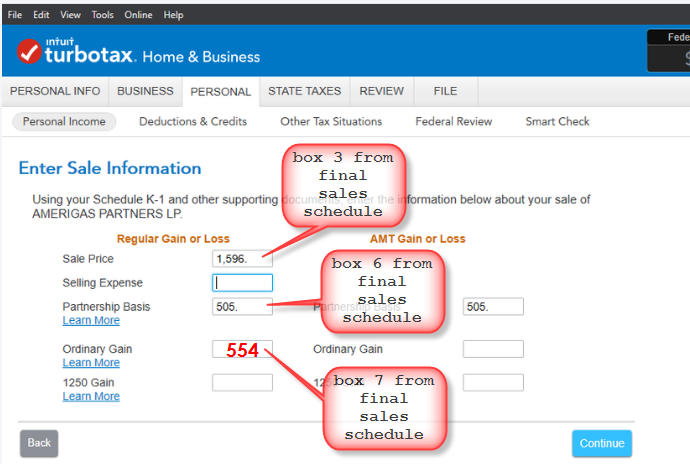

Hey guys, just a sanity check that I am interpreting the words for the final K-1 interview. Does this look correct to you?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

Yes! that looks like you did it exactly correct!

Good job!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

Where would we put the AMT gain/loss in the above example from @Boyan ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@nexchap I'm sharing an observation here and I'm a bit stumped since the very fist post of this uber helpful discussion clearly says that placing a check mark on the K1 interview "this partnership ended in 2019" will create a 1099-B. In my case it did not. I don't know why - I'm using TT 2019 Home & Business Maybe something changed in TT; maybe it detected the imported brokerage 1099-B. It only auto-generated 8949 and 4797.

Be it as it may, I can edit the basis of my brokerage 1099-B since it's marked as "basis not reported to IRS" and TT allows an edit. I know how to figure out my cap gains and ord gains. What I'm really asking is a sanity check, if all is said and done correctly does one end up with a tax return which includes:

a) one 1099-B correctly edited for the cap gains (provided by the brokerage, correctly flagged as basis non-reported to IRS and edited by me for the proper cap gains basis)

b) two 8949s - one which is married to the 1099-B and reflects cap gains and the other which is the auto-generated product of the K-1 final sales (that partnership ended in xxx) interview and reflects the ordinary gains?

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

Hi nexchap, I hope you could tell me how you would calculate separately the long and short-term basis for this example. Thank you so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@Boyan -- I just did a quick test, and can confirm that there's no longer a 1099-B being created. But the potential duplication remains. If you don't force the "Enter Sale Information" interview to calculate $0 gain, TT will create a form 8949 for transactions "not reported on Form 1099-B". This 8949 has either box C (short term) or box F (long term) checked.

So if you decide to do it this way, you'll need to get rid of any 1099-B provided by the broker -- the 8949 created by TT should have the correct Cap Gain and it will flow to Sched D correctly.

In the end, you want to make sure that

- Sched D has the correct Cap Gain. In a complete disposition, where everything is either short or long-term, you have the choice of getting it there through the 1099-B from the broker, or the 8949 created by TT. Just make sure its only getting there once.

- Form 4797, Part II shows the Ordinary Gain

- Sched E, Part II has all the suspended losses that are released by the sale.

Note that, if you want to force the interview to show $0 for Cap Gain (so you do your edits in the broker's 1099-B), you'd

- enter $0 for Sales Price

- put -554 in Partnership Basis

- put 554 in for Ordinary Gain

- in the AMT column, you'd have 534 for Ordinary Gain (554-20), so you'd use -534 in the Partnership Basis.

- The above would avoid creating the new 8949, and allow the 1099-B to be adjusted

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@Anonymous -- if you're referring to the example @Oldguy provided, where the K-1 just lists that 96% is long-term, I'd treat 96% of the basis adjustments, and 96% of the Ord Gain, as long term and 4% as short-term. Then the Cap Gain can be figured separately, using the actual sales proceeds from the short term lots and the long term lots

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@nexchap Thank you so much for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@nexchap already then, thank you for confirming what I suspected. This is turning into a moving target due to TT's software changes but I really think TT owes you kick back because without you all of us would be lost in this mush! So since we've confirmed TT no longer generates 1099-B I would like to, if I may summarize the 2 schools of though here applicable to the easiest of all use cases - full disposition of all-long term units:

a) edit broker 1099-B with the correct basis as to generate correct capital gains and still one MUST do the final K1 interview but enter 0 for selling price so that it doesn't generate capital gains but only ordinary gains on 8949. We still end up with TWO 8949s; one which is married to the 1099-B (for all of the other non-MLP transactions which I assume one had) and the other 8949 for the MLP's ordinary gains "not reported on 1099-B" which is auto-generated by the final K1 interview. If one ONLY has one transaction on 1099-B for the MLP disposition then I would assume we end up with ONE 1099-B and ONE 8949.

OR

b) delete 1099-B from broker all together and use the final K1 interview while entering all pertaining info from the final K1 scheduled (don't enter 0 for selling price as in case A above) so that it will auto-generate 8949 (gains not reported on 1099-B) this time containing both capital and ordinary gains on that auto-generated 8949. Here we end up with NO 1099-B (assuming no other brokerage transactions occurred for the tax year) and one 8949.

Discussion: I don't see how (B) is viable in the general case since even a modest investor will have other transactions listed on the same brokerage 1099-B so killing the form won't work. Editing the form by means of removing the MLP sale transaction is complicated so there would have to be a way to "negate" the 1099-B specific to just that one MLP while leaving all other transactions reported there intact. I would solicit feedback from the masters here (@nexchap) on how to make option (B) easier to grasp? Is that where you edit the basis to match the proceeds on that 1099-B so that absolutely no gain is reported and nothing flows to 8949? Even if we have a legit way to negate the MLP transaction from the 1099-B I contend that we still end up with multiple 8949s? yes?

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@Boyan -- almost, but your 'option a' isn't correct. If you follow the original answer that started all this, you don't get a second 8949. You have to enter 0 for 'sales price', AND you have to enter a number into the 'partnership basis' that cancels out the ordinary gain. If you do BOTH of those things, the next screen will show $0 for Cap Gain and TT won't generate a new, unnecessary, redundant 8949.

That eliminates all the questions about how to get rid of a 1099-B. Which is why I handle all my MLP sales this way.

If you're intent on pursuing B, though, then one option is to edit the 1099-B in Forms mode, blanking out all the entries for the offending MLP. OR, set the cost basis to match the sales proceeds, setting cap gain to 0 on that 1099-B entry.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@nexchap Duly noted. Thank you. On another note I discovered that TT has failed to track my suspended losses correctly as I've changed several computers since my original MLP purchase. I have records to allow me to re-create the cumulative losses throughout the years. Do I just do that and enter it into the final K1 this year as this is the final year and I want the correct suspended losses released? What about all the prior year balances being wrong? I hope I don't have to file corrected returns for 5 years going back? LOL

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@Boyan -- the suspended losses in prior years don't get reported to the IRS, so no need to refile if your actual taxes didn't change. For this year, when you get to the screen asking about prior year suspended losses, you'd just put in the correct amount (TT will pull from last year's return if its available, and it can match the K-1, but you can replace that number).

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17549413515

New Member

user17546016839

New Member

Arieshilan321

Returning Member

pchicke

Returning Member

user17523314011

Returning Member