- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I work a full time job but I have a few "side hustles". They don't make me much, and it doesn't even make a quarter of my income for the year. How do I file this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work a full time job but I have a few "side hustles". They don't make me much, and it doesn't even make a quarter of my income for the year. How do I file this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work a full time job but I have a few "side hustles". They don't make me much, and it doesn't even make a quarter of my income for the year. How do I file this?

You have to report all income.

The side amount is still taxable income to you and yes, it should be reported.

You can report this as Misc Income or just add it as cash income on the Sch C you are filing. When you add it to a Sch C, and say it is $350, then you get a Qualified Business Deduction (QBI) of $70 (20% of $350), and if you already have the software the Sch C is the best place for it. However, it appears that you're now using the Turbo Tax online free edition, which does not have Schedule C.

You’re considered self-employed—even if it’s just something you do on the side, like drive for Uber, babysit, or blog.

Your taxes are handled differently than when you’re an employee of a company.

As a self-employed individual you:

- will pay self-employment tax (because income tax and Social Security aren’t deducted from your pay)

- will get a 1099-MISC or 1099-K (unless you only accept cash or personal checks)

- file a Schedule C, Form 1040 (this is how you report business expense or loss of income)

- can deduct money you spent on work-related expenses (like mileage, home office expenses, and mobile phone use)

- can estimate the taxes that are due and make quarterly estimated tax payments during the year

Get started by entering your income from self-employment. We’ll handle the rest, from creating the forms you need to reviewing work-related expenses that can help reduce your taxes.

**If this post is helpful please click on "thumbs up"**

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work a full time job but I have a few "side hustles". They don't make me much, and it doesn't even make a quarter of my income for the year. How do I file this?

You need to report any income--either as "misc. income" or on Schedule C as self-employed. The litmus test for which it is is "Are you pursuing this as a hobby or a business?" If it is a business, you may have some deductions for travel, etc., that you don't have if it is a hobby, but you will also have to pay self-employment tax. You can have both a hobby AND a business if you have more than one source of extra income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work a full time job but I have a few "side hustles". They don't make me much, and it doesn't even make a quarter of my income for the year. How do I file this?

Per the IRS:

In making the distinction between a hobby or business activity, take into account all facts and circumstances with respect to the activity. A hobby activity is done mainly for recreation or pleasure. No one factor alone is decisive. You must generally consider these factors in determining whether an activity is a business engaged in making a profit:

- Whether you carry on the activity in a businesslike manner and maintain complete and accurate books and records.

- Whether the time and effort you put into the activity indicate you intend to make it profitable.

- Whether you depend on income from the activity for your livelihood.

- Whether your losses are due to circumstances beyond your control (or are normal in the startup phase of your type of business).

- Whether you change your methods of operation in an attempt to improve profitability.

- Whether you or your advisors have the knowledge needed to carry on the activity as a successful business.

- Whether you were successful in making a profit in similar activities in the past.

- Whether the activity makes a profit in some years and how much profit it makes.

- Whether you can expect to make a future profit from the appreciation of the assets used in the activity.

See https://www.irs.gov/faqs/small-business-self-employed-other-business/income-expenses/income-expenses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work a full time job but I have a few "side hustles". They don't make me much, and it doesn't even make a quarter of my income for the year. How do I file this?

I would still pay self-employment tax even if it was a hobby versus a business? What is the difference in tax rate? (if there is one) What is the least expensive way to file my taxes for these additional avenues of income? (like could I pay for the next up or do I have to purchase the self-employed package?)

Thank you to everyone for your replies.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work a full time job but I have a few "side hustles". They don't make me much, and it doesn't even make a quarter of my income for the year. How do I file this?

Are you saying there's no self-employment taxes if I file it as a hobby? The line between business vs hobby seems very vague and easily crossed, lol. Thank you for your reply.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work a full time job but I have a few "side hustles". They don't make me much, and it doesn't even make a quarter of my income for the year. How do I file this?

You would not need to pay self-employment tax on the money if it was a hobby. It would just be extra income and treated like any other income. You say the book sales is a hobby. If you choose to claim the editing as a hobby, you should be able to use the same Free Edition of TurboTax. If you want to claim it as self-employment, then you would need to purchase the edition of TurboTax that supports Schedule C. There is a chart showing which program covers which tax situations on the main TurboTax page.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work a full time job but I have a few "side hustles". They don't make me much, and it doesn't even make a quarter of my income for the year. How do I file this?

Thank you!

So I would just file it as misc income beside my W2 for my normal job? Like, as a separate W2? Or is there another specific way to file it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work a full time job but I have a few "side hustles". They don't make me much, and it doesn't even make a quarter of my income for the year. How do I file this?

If this is a hobby then the income is reported on Sch 1 which will require at least the Deluxe edition and you will not be able to deduct any expenses against the income on the federal return any longer ... however you will not have to pay SE taxes ... if this is a business reported on a Sch C where you can take expenses then you need the Self Employed version.

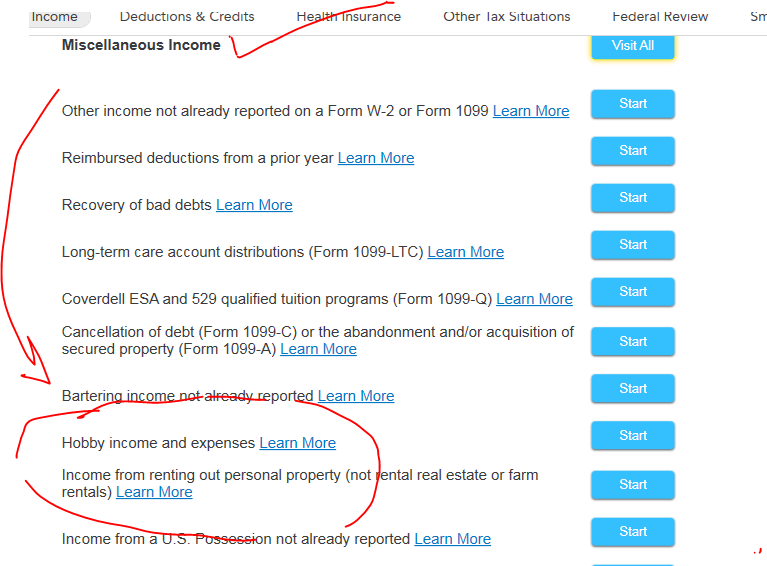

You can report it as other income on Form 1040 line 21. Here's how to enter it in TurboTax.

- Click the Federal Taxes tab.

- Click Wages & Income.

- Click "I'll choose what I work on."

- On the screen "Your 2014 Income Summary," scroll all the way down to the last section, "Less Common Income."

- Click the Start or Update button for the last topic, "Miscellaneous Income, 1099-A, 1099-C."

On the next screen, "Let's Work on Any Miscellaneous Income" then follow the hobby income interview screens.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rwallner1

New Member

user17611423359

Level 1

relliott4224

Returning Member

Happy24

Level 3

user17581195285

Returning Member