- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

If this is a hobby then the income is reported on Sch 1 which will require at least the Deluxe edition and you will not be able to deduct any expenses against the income on the federal return any longer ... however you will not have to pay SE taxes ... if this is a business reported on a Sch C where you can take expenses then you need the Self Employed version.

You can report it as other income on Form 1040 line 21. Here's how to enter it in TurboTax.

- Click the Federal Taxes tab.

- Click Wages & Income.

- Click "I'll choose what I work on."

- On the screen "Your 2014 Income Summary," scroll all the way down to the last section, "Less Common Income."

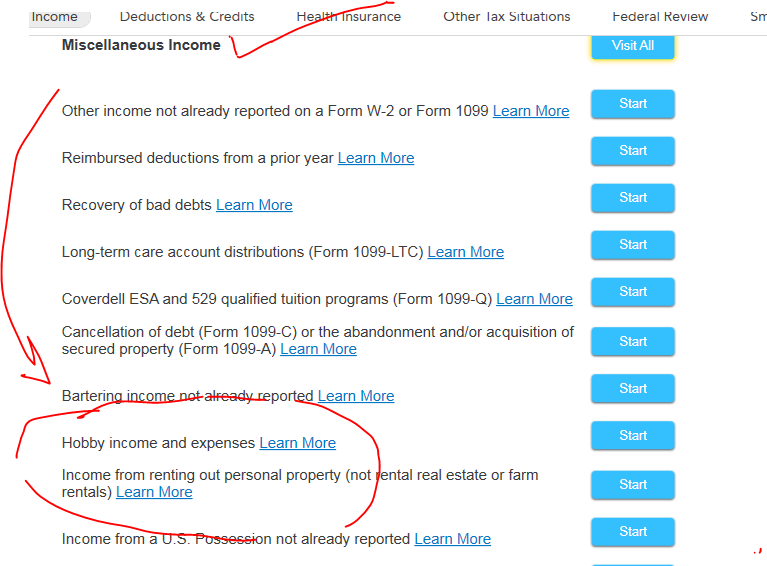

- Click the Start or Update button for the last topic, "Miscellaneous Income, 1099-A, 1099-C."

On the next screen, "Let's Work on Any Miscellaneous Income" then follow the hobby income interview screens.

November 24, 2019

8:46 AM

3,297 Views