- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I need to talk to customer service

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to talk to customer service

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to talk to customer service

Phone support is not provided for the free version of TurboTax.

If you are using a paid version or need product support, use the link below.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to talk to customer service

Phone support is not provided for the free version of TurboTax.

If you are using a paid version or need product support, use the link below.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to talk to customer service

I am paying for a tax advisor and he does not answer my messages. The taxes are done and I have a question but he doesn't answer my messages to set up appointment!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to talk to customer service

Please click here for the fastest methods to connect with an expert while using TurboTax Live.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to talk to customer service

My computer was hacked this morning. The hackers got into the computer. I recently efiled my tax returns which include my personal information. Do you have any suggestions as to what I can do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to talk to customer service

You can surf through the information about Tax Identity Theft.

Note that it used to be that taxpayers in some states could ask for an IP PIN from the IRS (once you get one, it is required for e-filing) even without a confirmation of tax identity theft.

I don't know what the current rules are, but please look at the link above and see if you can apply for an IP PIN.

Note that the IP PIN comes to you from the IRS in the mail, which the hackers don't have access to.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to talk to customer service

Dear customer service,

I am having problem with e-file.

Problem: last step of e-file at "transmit your return" asking for update which after updating after i received confirmed update still does not finish the transaction.

Please call me at [phone number removed]

Regards,

Amir

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to talk to customer service

Thank you for your question, but you will need to call TurboTax because your phone number has been removed from the question. Please call so that you can be assisted.

Here is how to contact us:

The best and most efficient way for you to connect with the right person to get the help you need is to select the version you are using below.

We're open daily from 5:00 AM to 9:00 PM PT.

To get help, select your product below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to talk to customer service

i need to file an extension

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to talk to customer service

@Val1427 Please follow the steps here: How do I file an IRS extension (Form 4868) in TurboTax Online?

Keep in mind: An extension doesn't give you extra time to pay your taxes — but it will keep you from getting a late filing penalty. (You'll still owe interest if you pay after the deadline).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to talk to customer service

I e-filed my taxes last night but didn’t include my social security.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to talk to customer service

As soon as the return is accepted, start an amended return to add the missing income.

Keep in mind that only Georgia, Michigan, New York and Vermont accept amended state returns. The other states require the amended return to be mailed.

For more information, see:

How do I amend my 2020 TurboTax Online return?

Can I e-file my 1040X to amend my return?

Do I need to amend my state if I amend my federal?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to talk to customer service

Can someone help me please

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to talk to customer service

Can someone call me? [phone number removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to talk to customer service

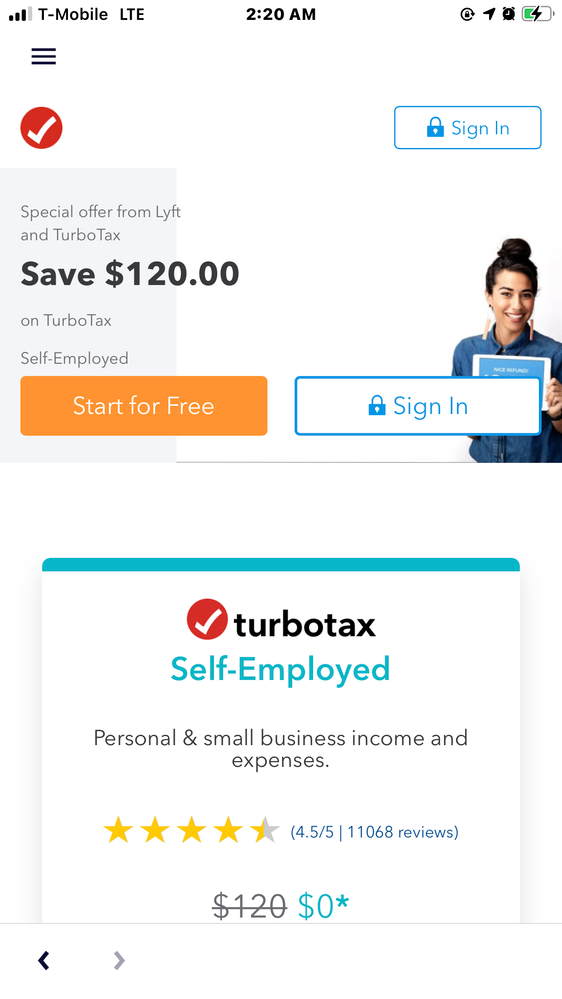

Hello I drive for Lyft and when I started the tax prep it said the filling was free?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17571041717

New Member

user17570196598

New Member

MakeItsDeductilbleOpenSource

New Member

gssulte7

Level 3

scantler

Level 2