- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I moved from Israel to US on permanent resident visa in 2022, I recieved fellowship in 2023, do I need to report it and can I exclude it from tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from Israel to US on permanent resident visa in 2022, I recieved fellowship in 2023, do I need to report it and can I exclude it from tax?

I know treaty between US and Israel exists, but I am not sure if it applies to my situation , I recieved fellowship in 2022-2023 which is not taxable in Israel, whole 2023 I was in US as permanent resident.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from Israel to US on permanent resident visa in 2022, I recieved fellowship in 2023, do I need to report it and can I exclude it from tax?

No. This is not stipulated in the US/Israel tax treaty so this scholarship is fully taxable to you as a US resident.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from Israel to US on permanent resident visa in 2022, I recieved fellowship in 2023, do I need to report it and can I exclude it from tax?

No. If you are a resident alien, then you are subject to the same tax rules as a US citizen. You would not be able to claim a tax treaty for 2023 if you were a resident for all of 2023 on any type of income you receive.

"Generally, only a nonresident alien individual may use the terms of a tax treaty to reduce or eliminate U.S. federal tax on income from a scholarship or fellowship grant". Claiming Treaty Exemption for a Scholarship or Fellowship Grant

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from Israel to US on permanent resident visa in 2022, I recieved fellowship in 2023, do I need to report it and can I exclude it from tax?

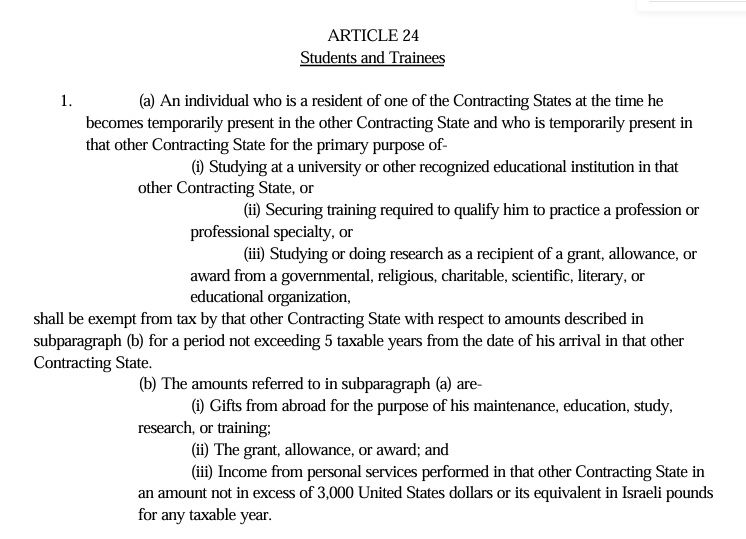

Thank you for reply, I know this, but there is also sitations when becoming resident alien you are still exempt from paying taxes on educational stipends, please take a look at this article of US - Israel tax treaty , what do you think?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from Israel to US on permanent resident visa in 2022, I recieved fellowship in 2023, do I need to report it and can I exclude it from tax?

Thank you for citing IRS website, I looked at it and after the sentence you quoted there is another one:

"A student (including a trainee or business apprentice) or researcher who has become a resident alien for U.S. federal tax purposes may be able to claim benefits under a tax treaty that apply to reduce or eliminate U.S. federal tax on scholarship or fellowship grant income."

Here is a somwhat similar situation where resident alien was exempt from paying taxes (if I understood the thread correctly): https://ttlc.intuit.com/community/taxes/discussion/re-as-a-new-resident-alien-do-i-need-to-report-a-...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from Israel to US on permanent resident visa in 2022, I recieved fellowship in 2023, do I need to report it and can I exclude it from tax?

No. This is not stipulated in the US/Israel tax treaty so this scholarship is fully taxable to you as a US resident.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from Israel to US on permanent resident visa in 2022, I recieved fellowship in 2023, do I need to report it and can I exclude it from tax?

Thanks for answer

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sche454178

Level 2

Xiaoyi

Returning Member

in Education

Gregory16

Level 1

qubitam-gmail-co

New Member

ckuntzman200

Returning Member