- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I have this question again regarding my taxes since I live and work in the UK but the company didn't send me here. None of the sections for Wages & Income pertain to me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have this question again regarding my taxes since I live and work in the UK but the company didn't send me here. None of the sections for Wages & Income pertain to me.

After I answer '0' to all these questions I get the question if I would like to try and exclude my foreign earned income. When I answer yes, it says I need to enter in foreign income but none of the options really apply to me.

When I go to 1099-OID, Foreign Accounts section and select that I have a foreign financial asset (since I have lived in the UK I have a UK bank account and get paid into that through my employer). I have less than the amount specified ($200,000) and it says that I don't need to report my foreign financial assets. Is this the correct path I'm supposed to be on? I want to make sure that I am doing my taxes right.

Please let me know!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have this question again regarding my taxes since I live and work in the UK but the company didn't send me here. None of the sections for Wages & Income pertain to me.

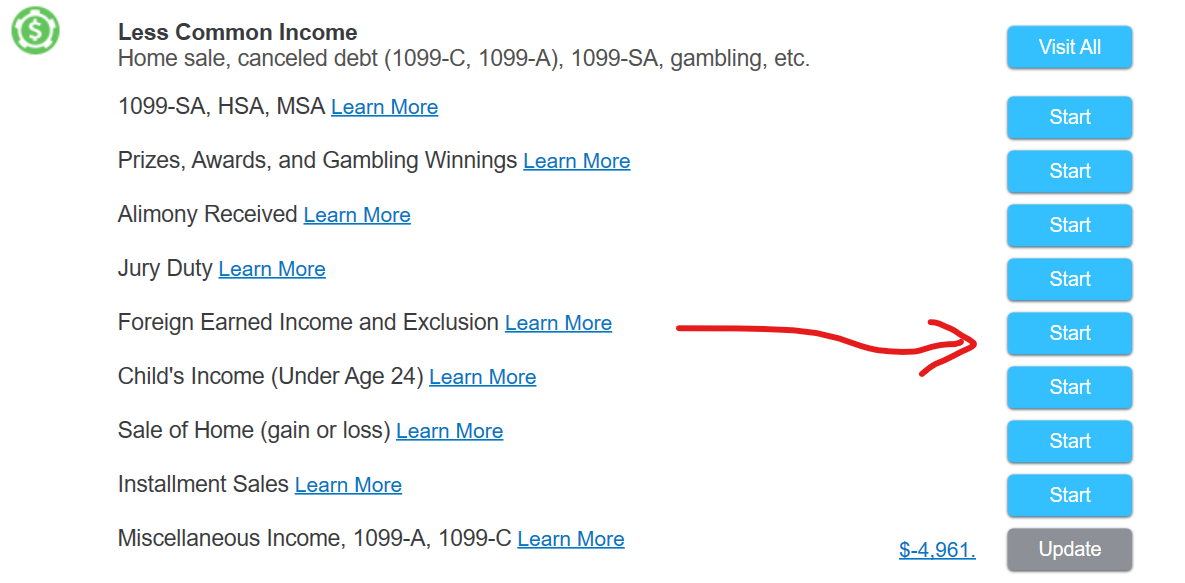

Assuming that you are a US citizen (because you don't need to file a US tax return otherwise) then you'll enter your income down at the bottom of the 'Wages and Income' section of the federal return by clicking here-

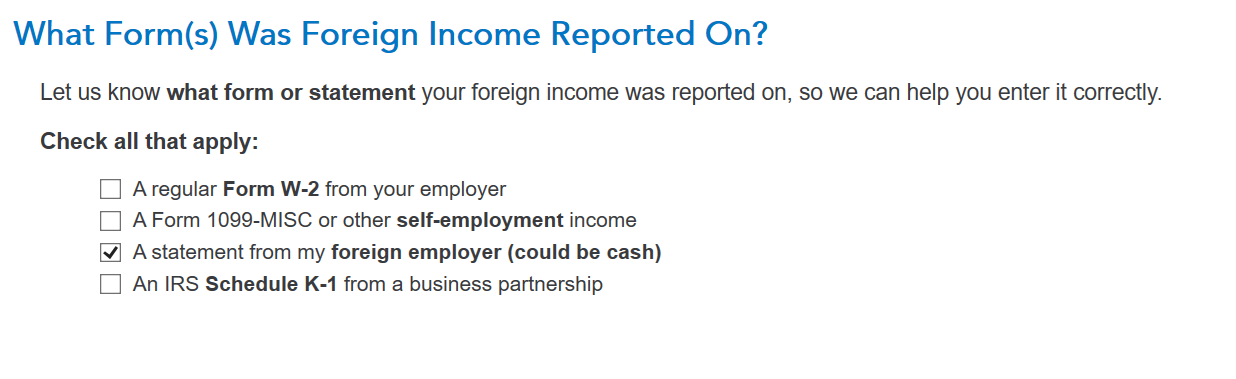

Then you will enter your income for 2023. In order to enter your income you need to tick this box-

Even though you said that it was a US employer you'll tick this box and enter the total amount that you received for the year. Then the system will ask you about additional funds that you received for living expenses (which you already said doesn't apply to you) and then will help you fill out the forms for the foreign earned income exclusion which it sounds like you will have no problem qualifying for.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

HNKDZ

Returning Member

SB2013

Level 2

fellynbal

Level 3

yingmin

Level 1

hojosverdes64

New Member