- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

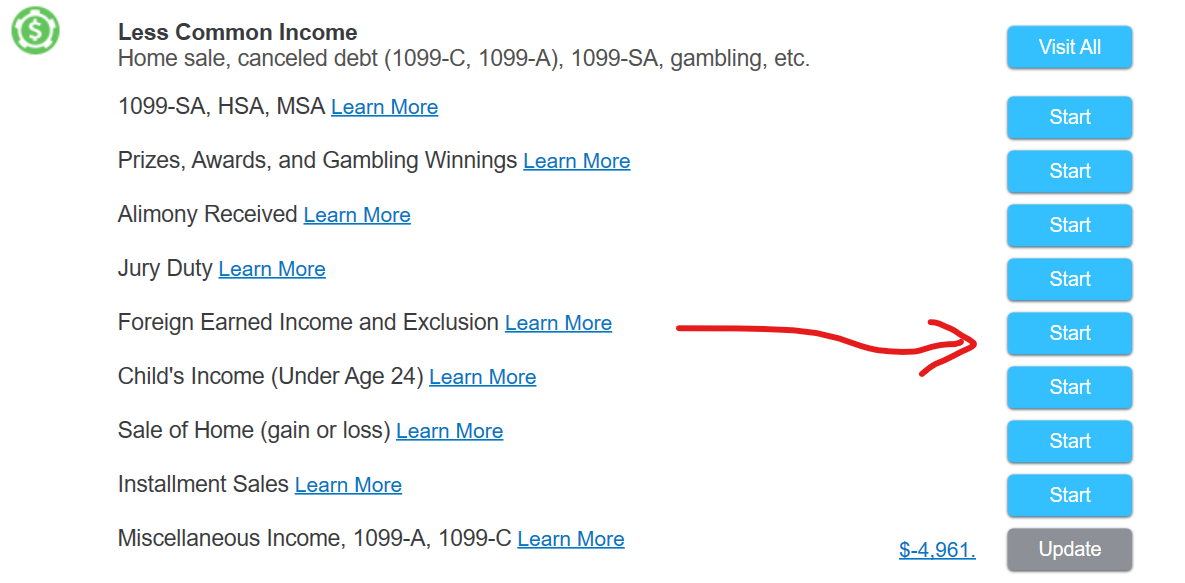

Assuming that you are a US citizen (because you don't need to file a US tax return otherwise) then you'll enter your income down at the bottom of the 'Wages and Income' section of the federal return by clicking here-

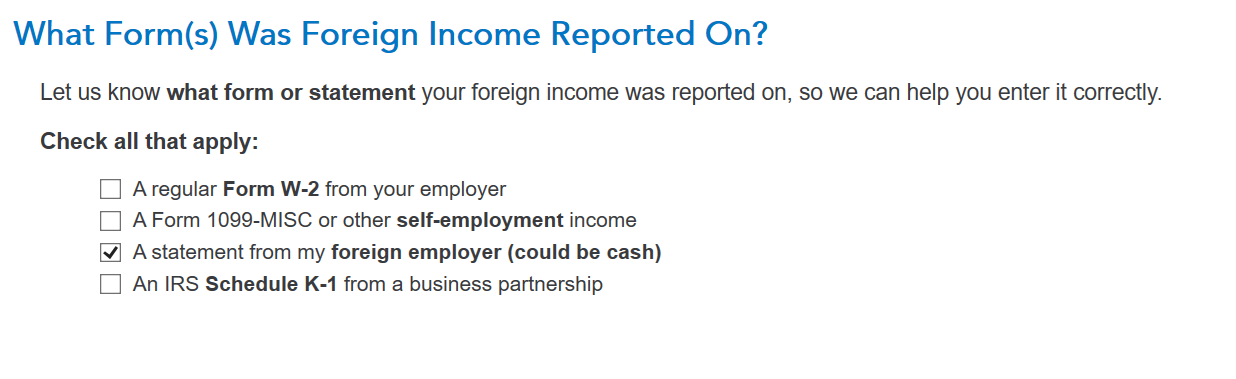

Then you will enter your income for 2023. In order to enter your income you need to tick this box-

Even though you said that it was a US employer you'll tick this box and enter the total amount that you received for the year. Then the system will ask you about additional funds that you received for living expenses (which you already said doesn't apply to you) and then will help you fill out the forms for the foreign earned income exclusion which it sounds like you will have no problem qualifying for.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 19, 2024

12:52 PM