- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I got a $100 bonus w/ credit karma and have received the cardbut have not been able to find where to access myreturn nor the extra bonus $100. How do I figure this out?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got a $100 bonus w/ credit karma and have received the cardbut have not been able to find where to access myreturn nor the extra bonus $100. How do I figure this out?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got a $100 bonus w/ credit karma and have received the cardbut have not been able to find where to access myreturn nor the extra bonus $100. How do I figure this out?

You get your income tax refund after the IRS issues the refund.

First, check your e-file status to see if your return was accepted:

https://turbotax.intuit.com/tax-tools/efile-status-lookup/

Once your federal return has been accepted by the IRS, only the IRS has any control. TurboTax does not receive any updates from the IRS. Your ONLY source of information about your refund now is the IRS.

You need your filing status, your Social Security number and the exact amount (line 35a of your 2021 Form 1040) of your federal refund to track your Federal refund:

To track your state refund:

https://ttlc.intuit.com/questions/1899433-how-do-i-track-my-state-refund

https://ttlc.intuit.com/questions/1901548-why-do-some-refunds-take-longer-than-others

If you chose to have your TurboTax fees deducted from your federal refund, that will take some extra time, while the third party bank handles the refund processing.

https://www.irs.gov/refunds/tax-season-refund-frequently-asked-questions

https://ttlc.intuit.com/questions/2840013-does-accepted-mean-my-refund-is-approved

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got a $100 bonus w/ credit karma and have received the cardbut have not been able to find where to access myreturn nor the extra bonus $100. How do I figure this out?

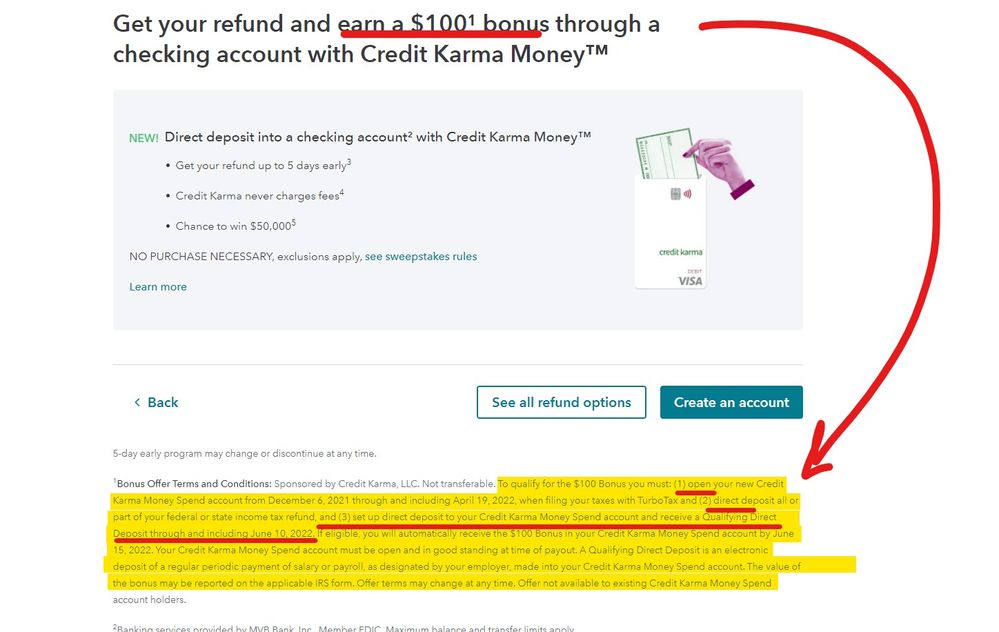

And to get the $100 bonus you had to complete all 3 steps to qualify for it ... read the fine print in the contract ...

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lieber1875

New Member

hmp-e-rockz-outl

New Member

Sheae

Level 1

michelle29204

Returning Member