- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How to adjust cost basis of a matured market linked certificate of deposit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to adjust cost basis of a matured market linked certificate of deposit?

I bought a market-linked CD. And for the past five years, I reported (let's say) $200 in my 1099-OID each year.

In 2021, the CD matured and my 1099-B reported that I have a ordinary gain of $3000 (sale price minus the purchase price).

In my 1099-INT, the only non-zero number is interest shortfall on contingent payment debt of -$1000 (to my understanding, the total OID reported during the past five years).

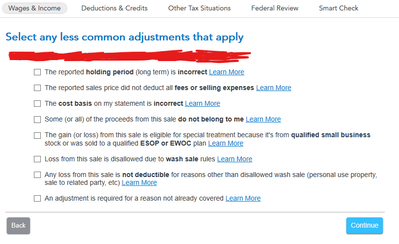

Should I adjust my cost basis by + 5*$200 = $1000 and only report $3000-$1000 = $2000 as my ordinary gain in 2021. The reason is that I have already reported the $1000 in the form of OID as taxable income in previous years. Does this sound correct? Should I adjust it in the third option in the attached picture? I would greatly appreciate any suggestion! Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to adjust cost basis of a matured market linked certificate of deposit?

Yes. Add the amount of previously taxed original issue discount to your cost basis.

The IRS says "In general, to determine your gain or loss on a tax-exempt bond, figure your basis in the bond by adding to your cost the OID you would have included in income if the bond had been taxable."

See Publication 1212 (01/2022), Guide to Original Issue Discount (OID) Instruments

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Hari1

Level 1

l-benes1958

New Member

Yujin-Bao

Level 1

helen-reading1

New Member

sallythiel

New Member