- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to adjust cost basis of a matured market linked certificate of deposit?

I bought a market-linked CD. And for the past five years, I reported (let's say) $200 in my 1099-OID each year.

In 2021, the CD matured and my 1099-B reported that I have a ordinary gain of $3000 (sale price minus the purchase price).

In my 1099-INT, the only non-zero number is interest shortfall on contingent payment debt of -$1000 (to my understanding, the total OID reported during the past five years).

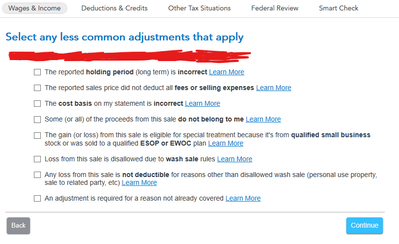

Should I adjust my cost basis by + 5*$200 = $1000 and only report $3000-$1000 = $2000 as my ordinary gain in 2021. The reason is that I have already reported the $1000 in the form of OID as taxable income in previous years. Does this sound correct? Should I adjust it in the third option in the attached picture? I would greatly appreciate any suggestion! Thanks!