- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I successfully import my E*trade brokerage account data in Turbotax Home & Business 2020?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I successfully import my E*trade brokerage account data in Turbotax Home & Business 2020?

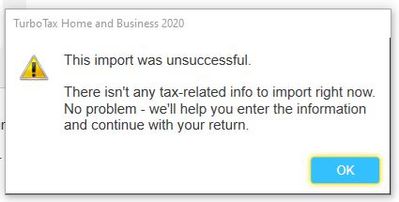

Everytime I try to use the import feature I get this error message (see below). Yet, the tax data is available from E*trade and I can download the PDF and CSV files of my trades from Etrade.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I successfully import my E*trade brokerage account data in Turbotax Home & Business 2020?

At tax time, you have the option to summarize your transactions by Sales Category.

IRS requires details to be listed on a Form 8949,

or on your other forms (e.g. consolidated 1099-B) which have the same information and in the same manner as Form 8949.

Either way, if you choose to summarize, you have to mail the transaction details to the IRS within three business days of IRS accepting your e-Filed tax return.(unless you have attached a PDF of the transactions details to your e-Filed return. TurboTax does not offer this feature).

Exception: if you summarize Category A or Category D, Form 8949 is not needed for transactions without adjustments. No mailing is necessary.

---

As an active investor, be aware that your category Box A or Box D sales without adjustments do not require Form 8949, so there is no reason to import or key in those transactions.

Instead use the "enter a summary" option to put your numbers on Schedule D Line 1a or Line 8a.

--

If you have wash sales, it gets more complicated since those adjusted transactions have to be itemized on Form 8949 and the summary totals adjusted accordingly.

Enter the wash sales on Form 8949, then use the subtotal results on the bottom of that form (Line 2) to know how much to subtract. Be sure to NOT check the adjustments box in the summary window.

--

Alternatively, if entry of Wash Sales is too tedious,

summarize and check the box for adjustments and enter the disallowed amount.

This summary will go on Schedule D Line 1b.

You will be making the mail-in election.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I successfully import my E*trade brokerage account data in Turbotax Home & Business 2020?

When selecting your financial institution or brokerage from the list, be sure to select the right one. For example, several participating partners' names start with First National Bank and if you select the "wrong" First National Bank, you won't be able to import. Also, the forms may not be available for import yet, please see the following link to check: When will I be able to import my 1099?

"HelenaC New Member"

Where do i go to download my etrade 1099 in turbo tax?

- Type import in the search bar and click search.

- Click on Jump to import.

- Click start/edit/add on 1099-INT or 1099-DIV or Stocks, Mutual Funds, Bonds, Other.

- Continue with the onscreen interview and identify your financial institution.

- Type in the Online ID and Passcode.

Related information:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I successfully import my E*trade brokerage account data in Turbotax Home & Business 2020?

Thanks for trying, but that answer doesn't help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I successfully import my E*trade brokerage account data in Turbotax Home & Business 2020?

At tax time, you have the option to summarize your transactions by Sales Category.

IRS requires details to be listed on a Form 8949,

or on your other forms (e.g. consolidated 1099-B) which have the same information and in the same manner as Form 8949.

Either way, if you choose to summarize, you have to mail the transaction details to the IRS within three business days of IRS accepting your e-Filed tax return.(unless you have attached a PDF of the transactions details to your e-Filed return. TurboTax does not offer this feature).

Exception: if you summarize Category A or Category D, Form 8949 is not needed for transactions without adjustments. No mailing is necessary.

---

As an active investor, be aware that your category Box A or Box D sales without adjustments do not require Form 8949, so there is no reason to import or key in those transactions.

Instead use the "enter a summary" option to put your numbers on Schedule D Line 1a or Line 8a.

--

If you have wash sales, it gets more complicated since those adjusted transactions have to be itemized on Form 8949 and the summary totals adjusted accordingly.

Enter the wash sales on Form 8949, then use the subtotal results on the bottom of that form (Line 2) to know how much to subtract. Be sure to NOT check the adjustments box in the summary window.

--

Alternatively, if entry of Wash Sales is too tedious,

summarize and check the box for adjustments and enter the disallowed amount.

This summary will go on Schedule D Line 1b.

You will be making the mail-in election.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I successfully import my E*trade brokerage account data in Turbotax Home & Business 2020?

fanfare,

Thank you for the explanation. Without being able to electronically download the data, I chose to summarize by transaction type and mail in the 1099-B detail because I had wash sales.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I successfully import my E*trade brokerage account data in Turbotax Home & Business 2020?

Super !

I've posted this scores of times.

You're now the second person only to reply back favorably.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I successfully import my E*trade brokerage account data in Turbotax Home & Business 2020?

Turbo Tax import from E*trade is not working!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I successfully import my E*trade brokerage account data in Turbotax Home & Business 2020?

Right. I gave up on the import and typed it in by hand.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I successfully import my E*trade brokerage account data in Turbotax Home & Business 2020?

Unfortunately I have 150 pages of trades along with wash sales which make it more complicated. E*Trade is aware of the issue but says the problem is entirely Turbotax. I cannot find any resolution in Turbotax. Why do I have this program if I have to type it in and then send 150 pages of paper to the IRS. Call me FRUSTRATED!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I successfully import my E*trade brokerage account data in Turbotax Home & Business 2020?

The thread that has been provided by clicking here will guide you on importing your data.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I successfully import my E*trade brokerage account data in Turbotax Home & Business 2020?

Is this issue resolved yet by TT? How are others filing their taxes? Is H&R block having similar issues? Please advise/help. Thank you all!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I successfully import my E*trade brokerage account data in Turbotax Home & Business 2020?

Are you having trouble with the negative values of your 1099-B?

If so, this has been an issue this year with the multitude of changes that have taken place. However, we have a dedicated team to assist with this situation. Please follow the instructions in this Help Article to reach out to them for further assistance.

How do I fix my 1099-B negative values?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I successfully import my E*trade brokerage account data in Turbotax Home & Business 2020?

If you are using secondary verification login process for Etrade (such as a VIP Symantec which Etrade supports) it probably will not work (as mine does not either). I guess you could remove secondarily verification for doing the import, but I only had a several transactions so I just entered myself.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I successfully import my E*trade brokerage account data in Turbotax Home & Business 2020?

not answering the question

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I successfully import my E*trade brokerage account data in Turbotax Home & Business 2020?

it depends. Are you certain you are using the correct username and password for your Etrade account?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17522833981

Returning Member

csktx

Level 1

alec-ditonto

New Member

puneetsharma

New Member

MikeInPA

Returning Member