- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I enter Form 4868 and prepayment made last January?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Form 4868 and prepayment made last January?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Form 4868 and prepayment made last January?

@mnhegg wrote:

The ultimate Catch-22. My online version does not allow including a previously filed form 4868 and estimated tax amount but I shouldn't file without including the 4868 amount! SMH !!! Who knew?

What versions allow filing the 4868? And does upgrading automatically sweep up the work I've already done or do I have to re-enter everything?

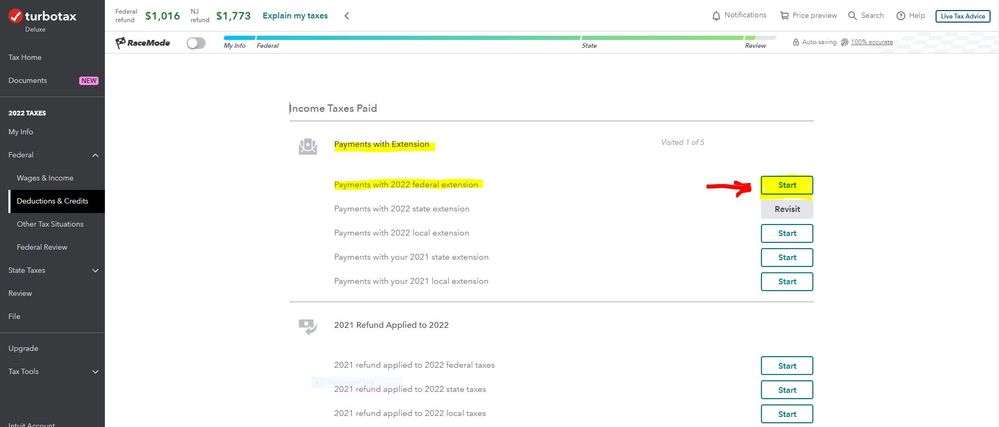

To enter, change or delete a payment made with an extension request (Federal, State, Local) -

Click on Federal Taxes (Personal using Home and Business)

Click on Deductions and Credits

Click on I'll choose what I work on (if shown)

Scroll down to Estimates and Other Taxes Paid

On Income Taxes Paid, click on the start or update button

On the next screen select the type of extension payment made and click on the start or update button

Or enter federal extension payment in the Search box located in the upper right of the program screen. Click on Jump to federal extension payment

The federal extension payment will be shown on Schedule 3 Line 10. The amount from Schedule 3 Part II Line 15 flows to Form 1040 Line 31

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Form 4868 and prepayment made last January?

When you requested your extension you were supposed to pay your estimated tax due. Did you enter the payment you made into your tax return? Go to Federal>Deductions and Credits>Estimates and Other Taxes Paid>Other Income Taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Form 4868 and prepayment made last January?

Yes, I sent my I paid my estimated tax due with the 4868 Application for an extension in January on my own.

The online program doesn't allow entering the already paid amount from the 4868 correctly. If entered into 'Estimated quarterly tax', 'Other payments', it will not be recognized as related to the 4868 and instead appear on Q Estimated Taxes paid. There is no way to enter the amount prepaid from the 4868 so it shows up on the correct line of the 1040 using the online TurboTax.

It appears there are other payments and credits not included in the basic online 1040 TT either. It's a fail.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Form 4868 and prepayment made last January?

Go through the FILE steps and look carefully for the question about payment with extension.

If you don't find that, do not press the TRANSMIT RETURN button.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Form 4868 and prepayment made last January?

The ultimate Catch-22. My online version does not allow including a previously filed form 4868 and estimated tax amount but I shouldn't file without including the 4868 amount! SMH !!! Who knew?

What versions allow filing the 4868? And does upgrading automatically sweep up the work I've already done or do I have to re-enter everything?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Form 4868 and prepayment made last January?

@mnhegg wrote:

The ultimate Catch-22. My online version does not allow including a previously filed form 4868 and estimated tax amount but I shouldn't file without including the 4868 amount! SMH !!! Who knew?

What versions allow filing the 4868? And does upgrading automatically sweep up the work I've already done or do I have to re-enter everything?

To enter, change or delete a payment made with an extension request (Federal, State, Local) -

Click on Federal Taxes (Personal using Home and Business)

Click on Deductions and Credits

Click on I'll choose what I work on (if shown)

Scroll down to Estimates and Other Taxes Paid

On Income Taxes Paid, click on the start or update button

On the next screen select the type of extension payment made and click on the start or update button

Or enter federal extension payment in the Search box located in the upper right of the program screen. Click on Jump to federal extension payment

The federal extension payment will be shown on Schedule 3 Line 10. The amount from Schedule 3 Part II Line 15 flows to Form 1040 Line 31

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Form 4868 and prepayment made last January?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Form 4868 and prepayment made last January?

"Or enter federal extension payment in the Search box located in the upper right of the program screen. Click on Jump to federal extension payment"

This recommendation worked! I thank you.

Seriously though, it's a bit much to ask a user to be entering THAT phrase to get the option to enter the amount of 'estimated tax due' for an extension so it appears in the correct line on the 1040. I looked for the Form 4868 and NO OPTION was presented for entering the amount of pre paid tax already paid, just an option to file for an extension. This function needs to be consolidated for the option to enter an amount already paid.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Form 4868 and prepayment made last January?

TurboTax SEARCH only works when you enter the exact phrase that is expected by TurboTax for that item, but nobody to know what that is.

It's sad.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

girishapte

Level 3

MikeB5

Level 1

TomDx

Level 2

pandam97

Level 1

MJ-RR

Returning Member