- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I enter dependent care FSA expenses if I file MFS and don't claim the child as a dependent?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter dependent care FSA expenses if I file MFS and don't claim the child as a dependent?

I am filing MFS (for student loan reasons) and do not claim our child as a dependent on my tax return. My wife claims the child on her tax return. We live together with the child in the normal married manner.

I have a dependent care FSA account through my employer who has reported the FSA contributions in Box 10 on the W2. I have submitted child care expenses to the FSA Administrator for 2020 and expect to be reimbursed shortly.

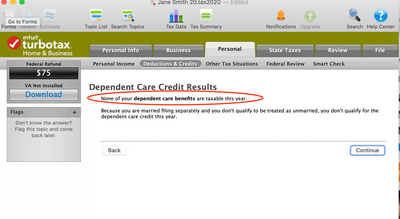

My question is where do I place the dependent care FSA expenses in TurboTax so it goes into the proper place on the 2441? It seems that once TT sees I am filing MFS, it wants to freeze me out, saying I am not eligible for the child tax credit. But I'm not trying to get the child tax credit. I'm trying to zero out the FSA account - or at least part of the account since some part is carried over into 2021. In other words, I'm trying to avoid having my FSA contribution considered taxable income by putting my child care expenses on the 2441 in the right place.

Please be specific in your answer. Where is the proper interview step and what answers/check boxes should I make? I am even willing to manually fill in the 2441, but I'm not exactly sure what lines need to be filled in. For example, I believe I have to enter the name, address and SSN of the child care provider and the amount paid. Where does this go? Again, I am NOT trying to claim a tax credit. I am trying to zero out the FSA money shown in Box 10 of the W2 so it is not taxed.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter dependent care FSA expenses if I file MFS and don't claim the child as a dependent?

I must say the IRS can make a simple question very complicated to answer. One shouldn't have to consult several publications to flesh out an answer to this question. It should be smack dab, front and center, in the Instructions for 2441. My earlier quotes from those directions certainly seemed to suggest that one could exclude dependent care FSA expenses even if one did not claim the child as a dependent. In fact, that conclusion is completely logical as well.

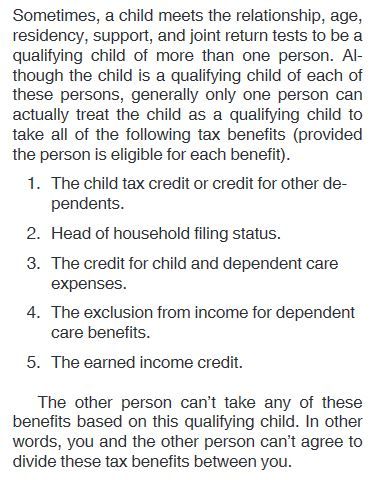

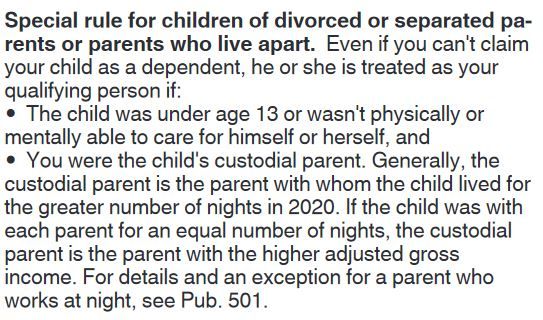

That said, @Opus 17 , I am now inclined to believe you are correct. I reached that conclusion after looking at Pub. 501, with the pertinent section quoted below:

Note in particular, item 4 and the statement: "The other person can't take any of these benefits . . . . " Wouldn't it be great if the IRS would just spell this out clearly and succinctly in the Instructions for 2441.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter dependent care FSA expenses if I file MFS and don't claim the child as a dependent?

Since you are not claiming your child as a Dependent, and are filing as Married Filing Separately, you won't be able to enter Child Care Expenses in TurboTax.

Without entering expenses, (even though you don't want the credit), your FSA will be taxable income, as it was not applied to qualified expenses.

Click this link for more info on Married Filing Separately.

[Edited 3/9/2021 | 11:20 am]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter dependent care FSA expenses if I file MFS and don't claim the child as a dependent?

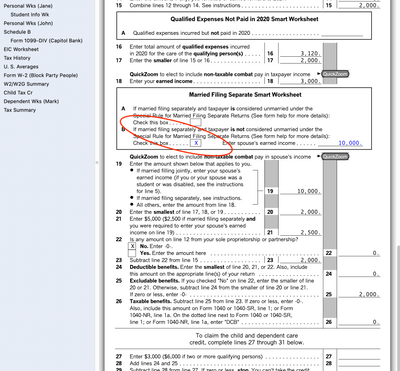

@MarilynG1 this answer is incorrect. A parent filing MFS can't claim the credit, but they are allowed to use a Dependent Care FSA for up to $2500, and that requires entering the expenses on form 2441.

@williasp please don't keep creating new posts to ask about the same issue. Did you find the worksheet as mentioned here?

Don't enter the entire credit directly on the form and don't do any overrides. Try clicking the box in 18A, then go back and see if the interview works.

[Edited]

My mistake, it's line 18B. I could enter the situation fine with no blocks or errors. Did you correctly list your dependent? When filing MFS, you+ can only use the FSA to pay for your child's care if you are the parent who claims the child as a dependent, if the other parent claims the child, you can't use the FSA and the money is added back to your taxable income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter dependent care FSA expenses if I file MFS and don't claim the child as a dependent?

I just had a brain wave, did you list your child as a dependent? When filing MFS, you can't use an FSA to pay for dependent care expenses unless you are the parent who claims the child as a dependent.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter dependent care FSA expenses if I file MFS and don't claim the child as a dependent?

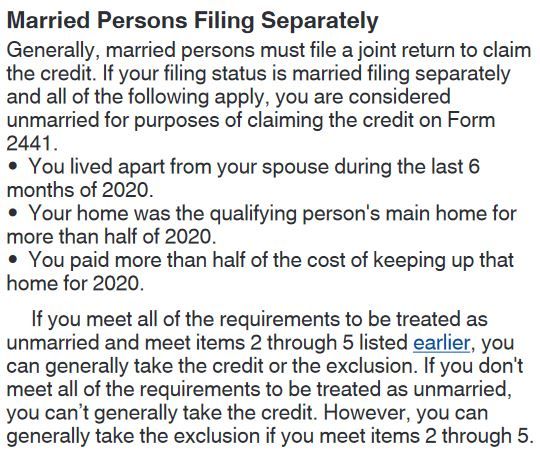

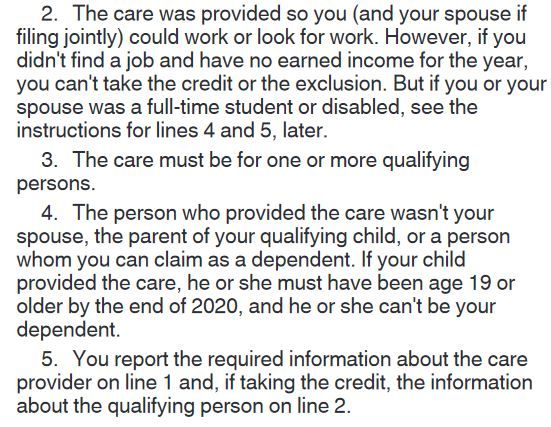

IRS rules/directions for form 2441.

So how do I get TT to correct its program so it will fill out the 2441 correctly for someone filing MFS with a child not claimed as dependent, but who should be a qualifying person for child care expenses covered by an FSA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter dependent care FSA expenses if I file MFS and don't claim the child as a dependent?

@williasp wrote:

IRS rules/directions for form 2441.

So how do I get TT to correct its program so it will fill out the 2441 correctly for someone filing MFS with a child not claimed as dependent, but who should be a qualifying person for child care expenses covered by an FSA.

Did you live apart from your spouse for all of the last 6 months of 2020 (from July 1 onward)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter dependent care FSA expenses if I file MFS and don't claim the child as a dependent?

I must say the IRS can make a simple question very complicated to answer. One shouldn't have to consult several publications to flesh out an answer to this question. It should be smack dab, front and center, in the Instructions for 2441. My earlier quotes from those directions certainly seemed to suggest that one could exclude dependent care FSA expenses even if one did not claim the child as a dependent. In fact, that conclusion is completely logical as well.

That said, @Opus 17 , I am now inclined to believe you are correct. I reached that conclusion after looking at Pub. 501, with the pertinent section quoted below:

Note in particular, item 4 and the statement: "The other person can't take any of these benefits . . . . " Wouldn't it be great if the IRS would just spell this out clearly and succinctly in the Instructions for 2441.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter dependent care FSA expenses if I file MFS and don't claim the child as a dependent?

I am having a somewhat similar issue that is not solved by this thread. I am not trying to get the Dependent Care Credit. However, I do make dependent care FSA contributions and have FSA expenses that exceed my contributions. We file MFJ and claim our children as dependents. The question is, how do I enter my dependent care expenses if I am ineligible for the dependent care credit? I am using Turbotax Online. The only option I see is Deductions & Credits > Dependent Care Credit. When I click on that, it asks me eligibility questions and then says I am ineligible for the credit (which I already know) and takes me back to the Deductions & Credits window. This means that my Form 2441 makes it look like I had only FSA contributions without any expenses, so the whole amount gets added back to my income on 1040 line 1e. How do I manually enter my dependent care expenses even though I am ineligible for the tax credit. Very frustrated here. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter dependent care FSA expenses if I file MFS and don't claim the child as a dependent?

You will not enter the expenses if you aren't eligible for the credit. Your FSA amount is added to your taxable income, which is what you are saying is happening.

The FSA funds have to be used for eligible expenses. Eligible expenses are those that would qualify for the Child and Dependent Care Credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

leahlashae43

New Member

mgregg231

New Member

529Tax

New Member

shacora275

New Member

alyssamkolb4

New Member