- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I must say the IRS can make a simple question very complicated to answer. One shouldn't have to consult several publications to flesh out an answer to this question. It should be smack dab, front and center, in the Instructions for 2441. My earlier quotes from those directions certainly seemed to suggest that one could exclude dependent care FSA expenses even if one did not claim the child as a dependent. In fact, that conclusion is completely logical as well.

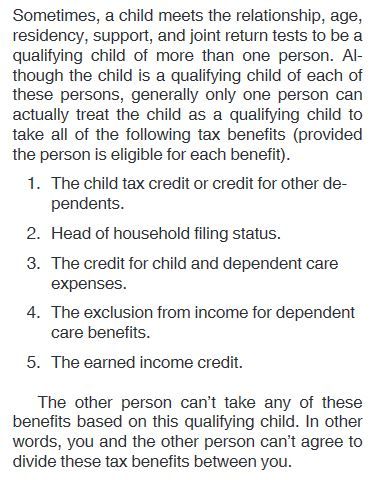

That said, @Opus 17 , I am now inclined to believe you are correct. I reached that conclusion after looking at Pub. 501, with the pertinent section quoted below:

Note in particular, item 4 and the statement: "The other person can't take any of these benefits . . . . " Wouldn't it be great if the IRS would just spell this out clearly and succinctly in the Instructions for 2441.