- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

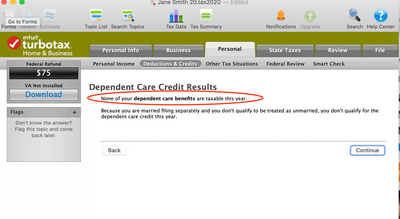

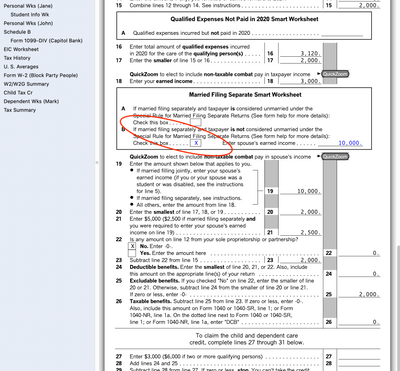

@MarilynG1 this answer is incorrect. A parent filing MFS can't claim the credit, but they are allowed to use a Dependent Care FSA for up to $2500, and that requires entering the expenses on form 2441.

@williasp please don't keep creating new posts to ask about the same issue. Did you find the worksheet as mentioned here?

Don't enter the entire credit directly on the form and don't do any overrides. Try clicking the box in 18A, then go back and see if the interview works.

[Edited]

My mistake, it's line 18B. I could enter the situation fine with no blocks or errors. Did you correctly list your dependent? When filing MFS, you+ can only use the FSA to pay for your child's care if you are the parent who claims the child as a dependent, if the other parent claims the child, you can't use the FSA and the money is added back to your taxable income.