- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Exempt-Interest Dividends

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Exempt-Interest Dividends

I have two mutual funds that invest in Tax-Exempt Municipal funds. The software is asking me what states are the states are your $xx.xx of exempt-Dividends from? Since both funds have Tax-Exempt municipal Funds in their port folio, what do I put in the entry.

Dan Pophin

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Exempt-Interest Dividends

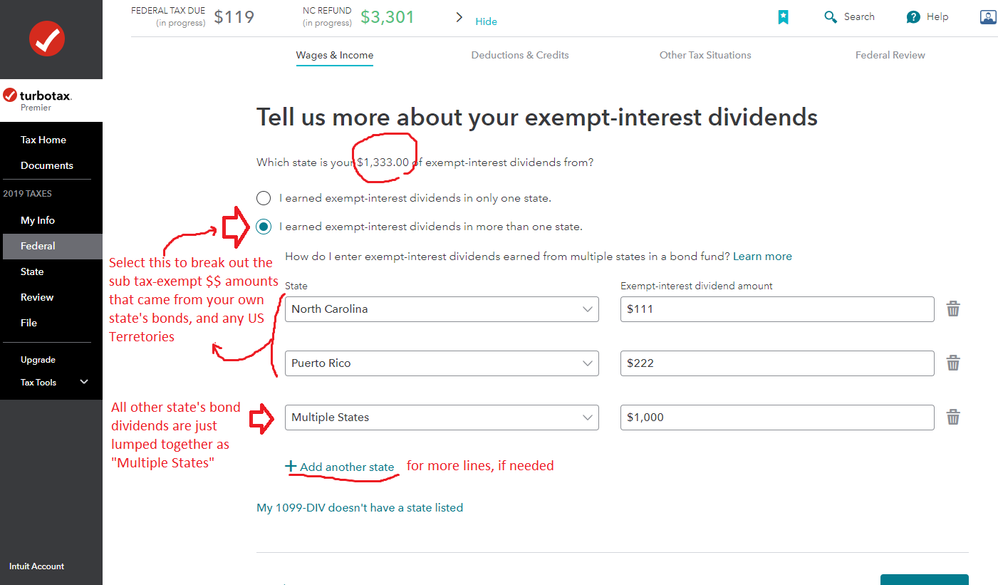

In addition to the interest from muni-bonds being exempt from federal tax, they are exempt in the state that issued them. So if the funds you own, invested in bonds from your state, that portion of the interest is tax free for state tax purposes. Your year-end tax package from your broker will list the percentage of interest from each applicable state. Your state may be zero or a very small amount. The easiest way to handle this is to enter "More than one state" which is the last option in the list of states and territories.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Exempt-Interest Dividends

Here's a picture of the break-out page....you only enter the $$ for your own state's bonds, and any US Territories. But if you are a resident of one of the non-income-taxing states (like TX and FL.....and several others) you just say it's all from "Multiple States".

And you are not forced to break out your own state's $$ either, you can just call it all as Multiple States" and move on.

Example below is for an NC resident:

_________________________________

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

taxdoofus

Returning Member

ddranalli

Returning Member

aerdengi

Level 1

Kofian

New Member

slowreader

Level 4