- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

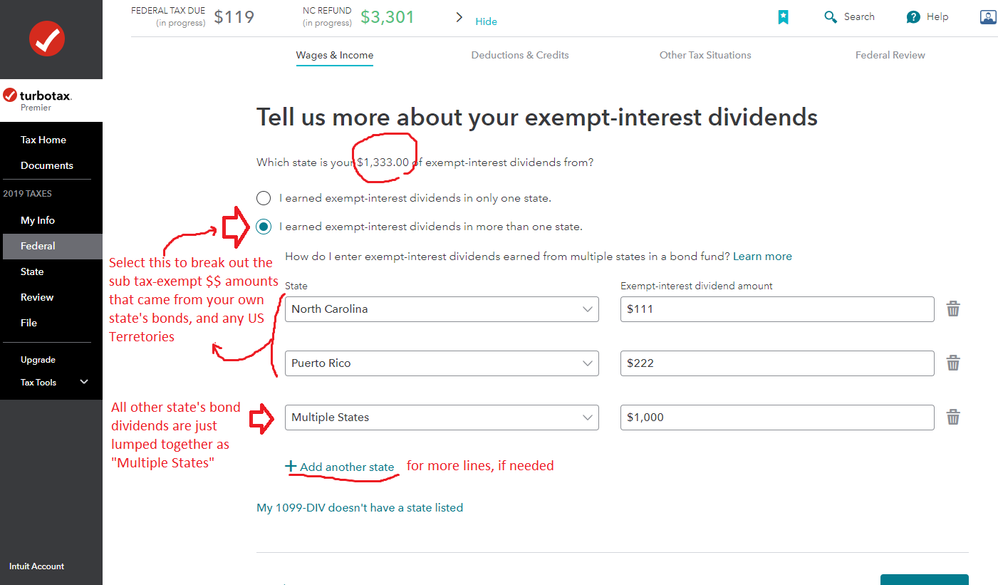

Here's a picture of the break-out page....you only enter the $$ for your own state's bonds, and any US Territories. But if you are a resident of one of the non-income-taxing states (like TX and FL.....and several others) you just say it's all from "Multiple States".

And you are not forced to break out your own state's $$ either, you can just call it all as Multiple States" and move on.

Example below is for an NC resident:

_________________________________

____________*Answers are correct to the best of my knowledge when posted, but should not be considered to be legal or official tax advice.*

February 10, 2021

1:26 PM