- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Confused about at-risk losses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about at-risk losses

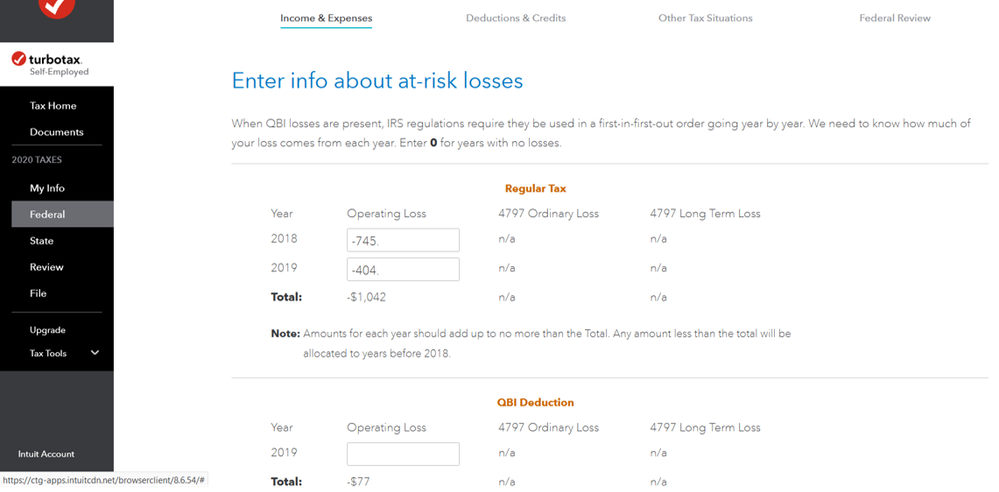

I have completed filling out my tax return online. When I get to the end "Federal Review", I am asked to "Check this entry". It says "At-Risk operating loss...sum of losses in individual years should not be greater than the total loss". I am ultimately directed to a section under Income & Expenses where I am asked to "Enter info about at-risk losses" (see screenshot). Under Regular Tax, the numbers shown for operating loss for 2018 and 2019 were not manually entered by me. They must have been pulled or calculated from somewhere. Clearly, these numbers do not add up to the "Total" shown underneath them. Am I supposed to change these numbers to make them add up to the Total? I don't know what I'm supposed to do, or what this even means. I am equally confused about the operating loss for 2019 not adding up to the total in the QBI Deduction section. Any help is sincerely appreciated. Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about at-risk losses

The issue seems to be the at risk losses for 2018 added to 2019 is greater than the total listed there of 1,042. I think the total is the total accumulated loss through the current year, so the totals for 2018 and 2019 could not be greater than that amount, since the total would be all years added together.

I don't think it would matter what years the amounts came from, so you could probably change the 2018 number $-637 and that would make the total less that the $-1,042.

The QBI number is also an accumulated figure, so the $-77 is probably from the current year so that entry should be OK.

The at risk loss amount will not impact your tax return until a year when you have money at risk in the venture, and it would reduce your income in that year to the extent you are at risk.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about at-risk losses

'At-risk' and passive activity losses can be quite complex. Are you reporting Schedule E rental income? I'm sorry, I cannot read the numbers on your screenshot.

This TurboTax Help states:

What are passive activities and how do they affect me?

As a general rule, rental properties are, by definition, passive activities and are subject to the passive activity loss rules. These rules are quite complex. In general, the passive activity rules limit your ability to offset other types of income with net passive losses.

Have tax returns from previous years computed these entries and carried them forward to the 2020 Federal 1040 tax return? Is that what you are seeing? You should be able to verify these numbers by going to the previous year's tax return.

QBID loss is similar in that these entries have been computed from previous years tax returns and also carried forward to the 2020 Federal 1040 tax return.

Please do not override these numbers until you understand what is happening to your tax return. And please write them down or retain a screen shot should you override them and need to return to these numbers.

QBI passive carry-forward is the amount of the Qualified Business Income Deduction that is is not allowed due to the passive income rules. The rules related to calculating the Qualified Business Income Deduction were recently changed and the IRS is still working on approving the form for filing.

This IRS Publication 925 states:

Definition of passive activity loss.

Generally, your passive activity loss for the tax year is the excess of your passive activity deductions over your passive activity gross income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about at-risk losses

Hi James!

Thanks for responding. No, I am not reporting Schedule E rental income. These losses are related to businesses in which I have ownership. The numbers on the screenshot show:

Regular Tax

2018: -745 (operating loss)

2019: -404

Total: -$1,042

QBI Deduction

2019: 0

Total: -$77

I went back and looked at my 2018 and 2019 returns, and it seems like the Regular Tax numbers are being pulled from Form 6198 At-Risk Limitations. I do not know where the Total of -$1,042 is coming from or why it doesn't add up to the numbers being pulled from my 2018 and 2019 returns. Similarly, I don't know where the $0 from 2019 under the QBI section is coming from and why it doesn't match the Total of -$77.

Full disclosure: in 2018 I had indicated I had at-risk losses on my first filing. I spoke with a CPA afterwards and found that nothing I have is at-risk, so I had to file an amended return. Since then, I have not indicated anything I have is at-risk. That said, I'm not sure why I have Form 6198 on my 2018 and 2019 returns. Moreover, I'm not sure how much all of this matters if I'm taking the standard deduction other than for the sake of filing accurate numbers. I'm not sure if any of that helps or not; just trying to be transparent.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about at-risk losses

The issue seems to be the at risk losses for 2018 added to 2019 is greater than the total listed there of 1,042. I think the total is the total accumulated loss through the current year, so the totals for 2018 and 2019 could not be greater than that amount, since the total would be all years added together.

I don't think it would matter what years the amounts came from, so you could probably change the 2018 number $-637 and that would make the total less that the $-1,042.

The QBI number is also an accumulated figure, so the $-77 is probably from the current year so that entry should be OK.

The at risk loss amount will not impact your tax return until a year when you have money at risk in the venture, and it would reduce your income in that year to the extent you are at risk.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about at-risk losses

Changing the 2018 number so that the sum of the 2018 and 2019 numbers added up to the Total allowed me to finish my taxes. Thank you for the explanations!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DX-hound

Level 2

Retiredgranddad

Returning Member

Sam123

Level 1

ABM3

New Member

kmjgoon

Level 2