- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about at-risk losses

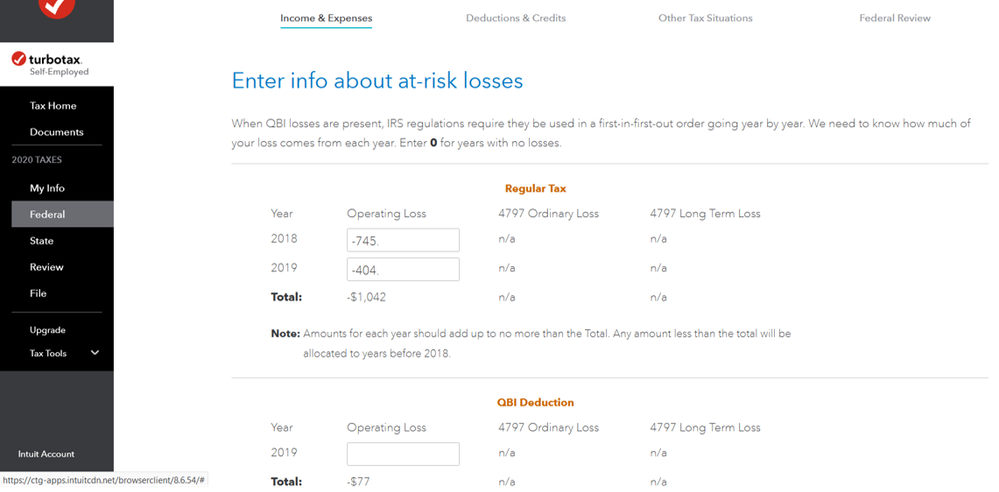

I have completed filling out my tax return online. When I get to the end "Federal Review", I am asked to "Check this entry". It says "At-Risk operating loss...sum of losses in individual years should not be greater than the total loss". I am ultimately directed to a section under Income & Expenses where I am asked to "Enter info about at-risk losses" (see screenshot). Under Regular Tax, the numbers shown for operating loss for 2018 and 2019 were not manually entered by me. They must have been pulled or calculated from somewhere. Clearly, these numbers do not add up to the "Total" shown underneath them. Am I supposed to change these numbers to make them add up to the Total? I don't know what I'm supposed to do, or what this even means. I am equally confused about the operating loss for 2019 not adding up to the total in the QBI Deduction section. Any help is sincerely appreciated. Thank you.