- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Why would my kids be marked as exemptions on my 2020 tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why would my kids be marked as exemptions on my 2020 tax return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why would my kids be marked as exemptions on my 2020 tax return?

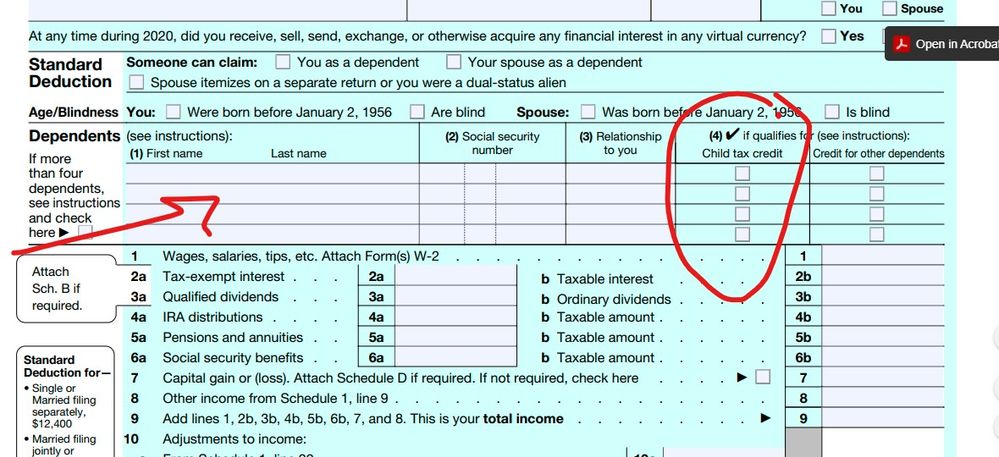

Ok ... the dependents are either marked as "qualified for CTC" or "credit for other dep" depending on their age. Even though there are no dependent exemptions from 2018 to 2025 they still are eligible for one of the credits even it you don't get them.

Now to get the CTC you had to have earned income which unemployment is not ... and to get the other credit you had to have federal taxes to negate which you also may not have.

So did you have earned income on the 2019 return ? If so in the EIC or CTC section you had the option to use the "lookback" function to see if you qualify for either of these credits on the 2020 return using the 2019 information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why would my kids be marked as exemptions on my 2020 tax return?

Ok ... the dependents are either marked as "qualified for CTC" or "credit for other dep" depending on their age. Even though there are no dependent exemptions from 2018 to 2025 they still are eligible for one of the credits even it you don't get them.

Now to get the CTC you had to have earned income which unemployment is not ... and to get the other credit you had to have federal taxes to negate which you also may not have.

So did you have earned income on the 2019 return ? If so in the EIC or CTC section you had the option to use the "lookback" function to see if you qualify for either of these credits on the 2020 return using the 2019 information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why would my kids be marked as exemptions on my 2020 tax return?

Maybe they fixed it (but maybe not), but I seem to recall that TurboTax was NOT prompting people for the lookback provision when there was currently $0 of earned income.

So *IF* that is still the case, I'm not sure how you would access that (unless you are using the CD/downloaded version).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why would my kids be marked as exemptions on my 2020 tax return?

My wife worked in 2019 so we did have earned income then.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

henryway

Returning Member

secondnook

New Member

kwhite7777

New Member

Kaloyan Komsiyski

New Member

JeanA_2009

Level 1