- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

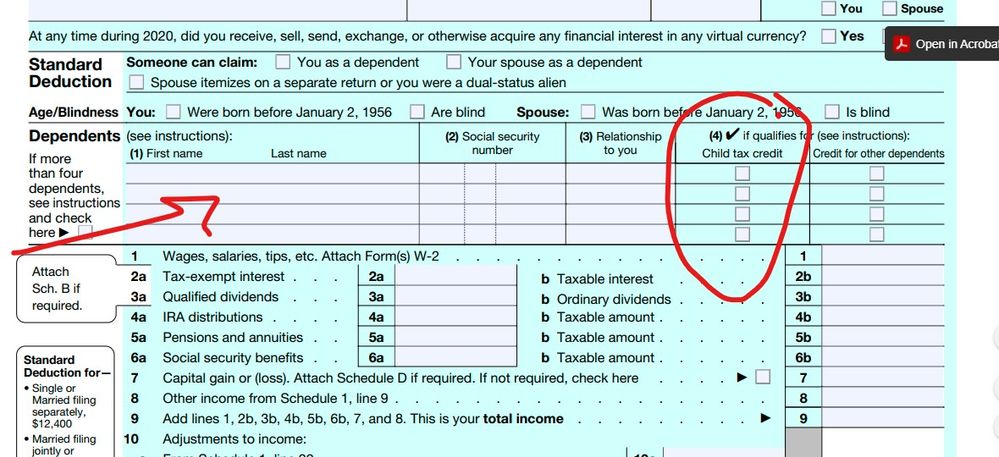

Ok ... the dependents are either marked as "qualified for CTC" or "credit for other dep" depending on their age. Even though there are no dependent exemptions from 2018 to 2025 they still are eligible for one of the credits even it you don't get them.

Now to get the CTC you had to have earned income which unemployment is not ... and to get the other credit you had to have federal taxes to negate which you also may not have.

So did you have earned income on the 2019 return ? If so in the EIC or CTC section you had the option to use the "lookback" function to see if you qualify for either of these credits on the 2020 return using the 2019 information.

July 19, 2021

6:19 AM