- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Turbo tax Not calculating stimulus correctly

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax Not calculating stimulus correctly

Did you get the 1st Stimulus payment last April last Year? It was for $1200. If you didn't get that one either then your refund should be 1200+600 = 1800.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax Not calculating stimulus correctly

Another question. Did you efile? If you only get Social Security you might not be able to efile. Or did you print and mail your return? Better check and see if you efiled and it went through.

You can check your efile status here

https://turbotax.intuit.com/tax-tools/efile-status-lookup/

When you efile you get back 2 emails. The first email only confirms the transmission. The second email says if the IRS (or state) Accepted or Rejected your efile.

When you log into your account you should also see the status and if it was Accepted or Rejected, Started, Printed, Ready to Mail, etc. What does it say?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax Not calculating stimulus correctly

When can I expect the $ $ 600.40

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax Not calculating stimulus correctly

Only the IRS can tell you. Are you reading all the replies and questions we have posted to you?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax Not calculating stimulus correctly

I'm stating the fax I'm supposed to get $ 2000. why are they telling me $ 1800.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax Not calculating stimulus correctly

Yes $ 600. Is on line 30 and for being on Soc. Sec. I get $ 40. For that. Thanks I'll just call the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax Not calculating stimulus correctly

Who is telling you 1800? Is that the refund showing on your Tax return? I explained that. You get 1800 instead of 600. You get 1800+1400. The 1400 is separate and comes separately.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax Not calculating stimulus correctly

if you already received stimulus #1 for $1200 and you did not receive stimulus #2 for $600 and Line 30 of your tax return is $600, than patience is the virtue to practice.

No one on this board can help you as everything is correct. Please call the IRS to discuss.

ps there is no additional $40 for being on social security. can you please post an article where you read that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax Not calculating stimulus correctly

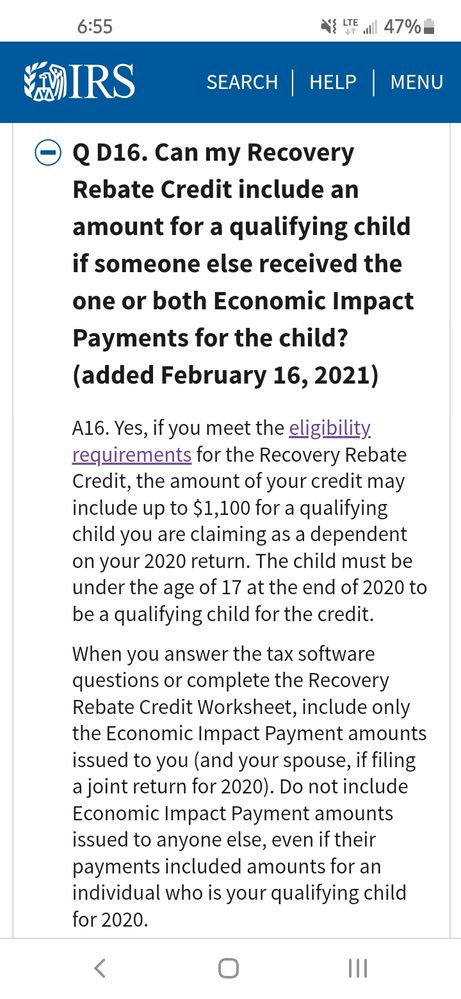

I am adding this now because like you said overriding the system would void your guarantee by turbotax and even through the irs put this out there a turbotax expert told me to override it and add the 500÷600 to each one as if I received it when I never did so now I just amended my return last Friday and talked to a turbotax expert this weekend and she doesn't think I should amend it since my ex wife got the payments because she claimed our child in 2019 but I claimed him in 2020 even though I explained to her why I am eligible. I don't think they keep up with all of the tax laws as they come out because I think this one is very significant because it involves 1,100 credit. Why would the irs put this on their website if it weren't correct? I am actually going to wait a few weeks before I send it in because I received unemployment and paid in taxes and I filed before thay became law and received my refund so I don't want that refund to be delayed. Now with all that said, this mistake was made due to the advice of turbotax do you think that I could lose my guarantee for a employees giving me bad advice?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax Not calculating stimulus correctly

The IRS is right. If you are claiming a child on your 2020 return you can get both the 500+600 amounts for him even if you ex got the payments based on her 2019 return. That is a loophole in the IRS. You can both get the Stimulus payments.

You should not need to override your tax return. If should automatically give it to you if you qualify. It will be on line 30. Unless you don't qualify for another reason like if he turned 17 in 2020 or your income is too high.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax Not calculating stimulus correctly

That is correct but I didn't know about any of it so that is why I called a "turbotax expert" for advice and they told me to override it so now it's on me to amend my taxes and explain to the irs why I lied to them about overriding the system and adding money.

I read a lot about people ho underreported stimulus money but how many you think did what I did? Lol..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax Not calculating stimulus correctly

There keeping the 600 stimulus for back taxs thats not right

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax Not calculating stimulus correctly

Both the IRS and TurboTax are not calculating my stimulus correctly. I filed my 2019 taxes as MFJ and my AGI was less than $150,000. I have 3 dependents (ages 3-10), and that is how it is entered in TurboTax. With 2 adults and 3 dependents I should have received $3,900 for the 1st stimulus and $3,000 for the 2nd, but I received $3,400 for the 1st and $2,400 for the 2nd (one dependent short each time), and that is what TurboTax is saying that I should receive. I clearly have 3 dependents entered . What am I missing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax Not calculating stimulus correctly

Your dependents have to be under 17 years old to qualify for the 1st or 2nd stimulus payment, that may be your problem.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax Not calculating stimulus correctly

the recovery rebate was listed on the form i have never received it. the irs reduced my rebate by 1200.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

girishapte

Level 3

hijyoon

New Member

Acanex

Level 2

karunt

New Member

dcstacymiller

New Member