- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

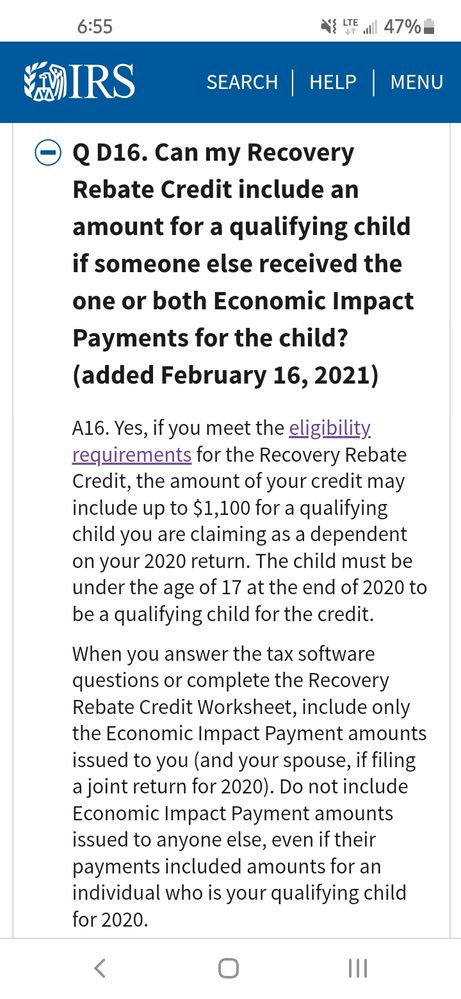

I am adding this now because like you said overriding the system would void your guarantee by turbotax and even through the irs put this out there a turbotax expert told me to override it and add the 500÷600 to each one as if I received it when I never did so now I just amended my return last Friday and talked to a turbotax expert this weekend and she doesn't think I should amend it since my ex wife got the payments because she claimed our child in 2019 but I claimed him in 2020 even though I explained to her why I am eligible. I don't think they keep up with all of the tax laws as they come out because I think this one is very significant because it involves 1,100 credit. Why would the irs put this on their website if it weren't correct? I am actually going to wait a few weeks before I send it in because I received unemployment and paid in taxes and I filed before thay became law and received my refund so I don't want that refund to be delayed. Now with all that said, this mistake was made due to the advice of turbotax do you think that I could lose my guarantee for a employees giving me bad advice?