- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Standard deduction for over 65

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

The Tax Reform Act of 1986 removed the extra personal exemption for being 65 or older, and replaced it with an increase in the standard deduction. If you are 65 or older, you get an increase of $1,250 (married), or $1,550 (single). Turbotax makes the adjustment automatically, based on the date of birth that you entered and your filing status.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

The Tax Reform Act of 1986 removed the extra personal exemption for being 65 or older, and replaced it with an increase in the standard deduction. If you are 65 or older, you get an increase of $1,250 (married), or $1,550 (single). Turbotax makes the adjustment automatically, based on the date of birth that you entered and your filing status.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

Do we no longer check a box for each individual and then another box for each one of age 65+, making 4 checked boxes for MFJ couple, both 65+? That would be a standard deduction of 30,000, not 27,400.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

@4Gayle wrote:

Do we no longer check a box for each individual and then another box for each one of age 65+, making 4 checked boxes for MFJ couple, both 65+? That would be a standard deduction of 30,000, not 27,400.

There is no box to check. It is automatic based on the date of birth entered in the personal information.

$27,400 is correct for filing joint and both over 65.

$30,000 if both over 65 and both also legally blind.

2020 standard deductions

$12,400 Single

$18,650 Head of Household

$24,800 Married Jointly

Add an additional $1,300 for over age 65 or blind

This amount increases to $1,650 if the taxpayer is also unmarried.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

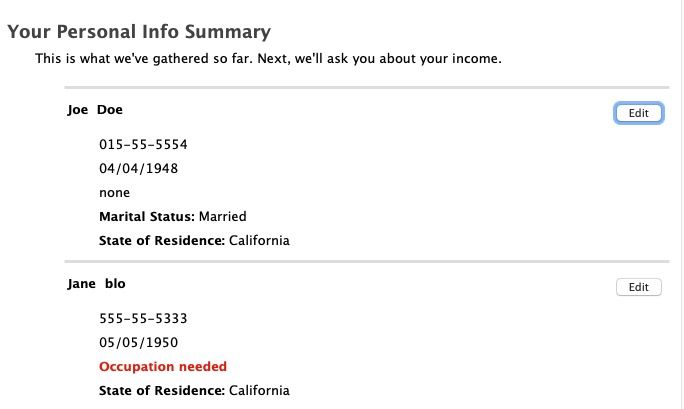

You sound so sure of your answer for how to handle 2021 standard deduction when over age 65 in Turbo Tax. Please tell me how you know this for sure. My husband and I are both over 65. Our birth dates are 1948 and 1949. Turbo Tax did not check the over 65 boxes, won't let me check them and only gives us 25,100 standard deduction. I called Turbo Tax. First person couldn't help me and was supposed to call me back. Never did. I called again. Second person contacted first person who said she would call back. Still never did. Second person did call back, but was no help resolving issue. She wanted me to find a form for schedule R and import it into Turbo Tax to report that I was over 65. I said that was unacceptable and asked to speak with supervisor. Supervisor, person number three, also could not help and is going to investigate and call me back. So I'm curious how you are so sure that Turbo Tax actually does handle over 65 standard deductions correctly. Pat

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

@pweseman wrote:

You sound so sure of your answer for how to handle 2021 standard deduction when over age 65 in Turbo Tax. Please tell me how you know this for sure. My husband and I are both over 65. Our birth dates are 1948 and 1949. Turbo Tax did not check the over 65 boxes, won't let me check them and only gives us 25,100 standard deduction. I called Turbo Tax. First person couldn't help me and was supposed to call me back. Never did. I called again. Second person contacted first person who said she would call back. Still never did. Second person did call back, but was no help resolving issue. She wanted me to find a form for schedule R and import it into Turbo Tax to report that I was over 65. I said that was unacceptable and asked to speak with supervisor. Supervisor, person number three, also could not help and is going to investigate and call me back. So I'm curious how you are so sure that Turbo Tax actually does handle over 65 standard deductions correctly. Pat

Go to the personal information section and check the DOB that was entered. It works fine for me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

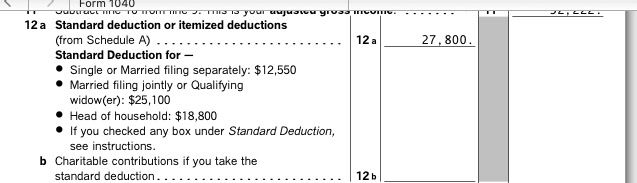

The standard deduction for Married Filing Jointly with both people over 65 is $27,800. If you are both over 65 then double check your date of birth in the personal info section of your return. TurboTax will automatically increase the standard deduction and put a check mark in the box for you based on your birthdate entered.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

Yes this is what I expected, but not what is happening and yes I have checked and rechecked that I have entered out DOB correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

Yes I have checked no less than 15 times. I have looked at the step-by-step and also at the form. When I entered the information for 'other deductions' under 'elderly or disabled deduction', it never asked about our age, only if we retired because of disability. When I answered 'no' it said were not eligible and that our elderly or disabled deduction was zero.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

So on line 12a you are seeing $25,100?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

@pweseman wrote:

Yes I have checked no less than 15 times. I have looked at the step-by-step and also at the form. When I entered the information for 'other deductions' under 'elderly or disabled deduction', it never asked about our age, only if we retired because of disability. When I answered 'no' it said were not eligible and that our elderly or disabled deduction was zero.

The stranded deduction in on line 12a on the 1040 form, not in "other deductions".

The "Elderly & Disabled" credit has not been adjusted fo inflation for years and very few qualify for it. Your Adjusted gross income must be less than $24,999, non-taxable income (including social Security) ,must be less then $7,499 and the credit, if you qualify, is not a refundable credit, it can only offset your tax, but not to less than zero. Most people with low enough income to qualify do not have any tax to reduce so it is meaningless.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

Yes and the boxes for over 65 are not checked and will not allow me to check them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

It does not!!!! Everyone keeps telling me the same thing, but I am telling everyone that I have our DOB entered correctly and it is not saying we are over 65.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

@pweseman What amount do you see on line 12a of your Form 1040?

PREVIEW 1040

https://ttlc.intuit.com/questions/1901539-how-do-i-preview-my-turbotax-online-return-before-filing

Click on Tax Tools on the left side of the screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jbeattyakamimi

New Member

ramonwi

New Member

j-evers

New Member

linwinggo

New Member

kwood

New Member