- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Standard deduction for over 65

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

Did you accidentally check that someone else can claim you as a dependent?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

First, I have nothing on left side of screen that reads Tax Tools. But on the 1040 form line 12a reads $25,100

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

@pweseman Were you both 65 BEFORE the end of 2021?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

Thank you for finally giving me a question other than 'are you sure you entered both of your DOB correctly'. Unfortunately, this is not the answer. That box is not checked on form 1040.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

Yes our DOBs are 1948 and 1949 and yes they are both entered correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

So despite the date of birth you entered in My Info, you are not seeing those boxes checked in the area for Standard Deduction----the boxes that say you were born beforeJanuary 2, 1957 ?

Try this---one of you at a time. Delete the information in My Info---then re-enter your personal information screen by screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

That is correct. The over 65 boxes are not checked and will not allow me to check them. I had previously erased and redid the personal info, but I just did it again. No change.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

@pweseman I am mystified. What software do you have? Are you using online? Or do you have the CD/download? If you have the CD/download--what version?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

Me too and obviously at least 3 people from Turbo Tax who I've spoken with. I installed the Home and Business version from a CD. Is that what you mean by version?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

@pweseman Yes---that is what I meant. I have not seen any other reports of this as a problem with that version of the software. Are you using Windows or are you on a Mac? Have you updated your software?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

I have Windows and it automatically updates always.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

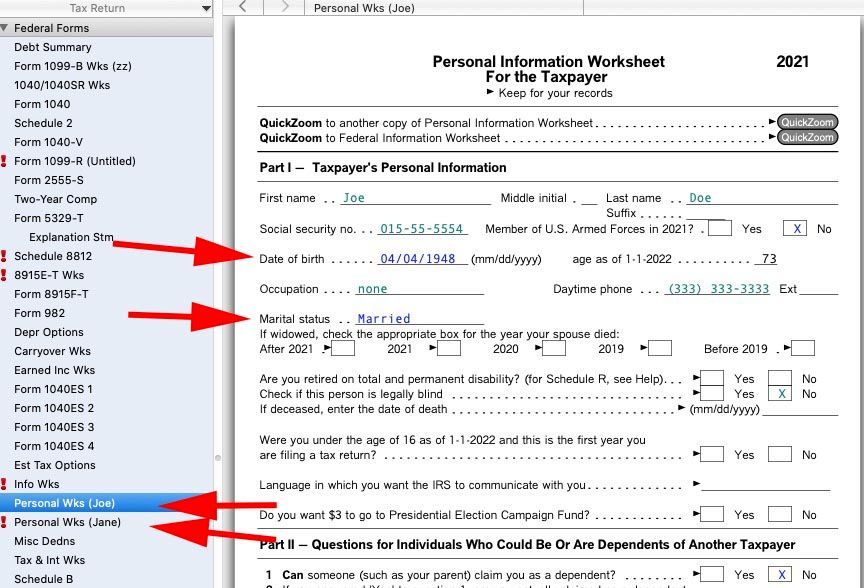

If you are using the Windows desktop then switch to the forms mode and select the "Personal Information" in the left side column and see if your DOB and marital status is correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

Have looked at the forms so many times, my eyes hurt. Everything is right.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

@pweseman wrote:

Have looked at the forms so many times, my eyes hurt. Everything is right.

By any chance is the "yes" box checked on the "Personal Info" form on Part II line 1?

Again using the forms mode to view the "1040/1040SR Worksheet" scroll down to "Standard Deduction" - are ANY boxes checked - which ones?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard deduction for over 65

How are you entering the dates? Should be mm/dd/yyyy. Maybe check your computer settings for date. Especially the short date.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

elliott1917

New Member

bmbfreeman

New Member

dunyele

New Member

aljenfosberry

New Member

monarob

New Member