- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Schedule 8812: Advance payments received must be entered? / Principal Place of Abode and Letter 6416 Information Smart Worksheet

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812: Advance payments received must be entered? / Principal Place of Abode and Letter 6416 Information Smart Worksheet

Essentially all taxpayers are asked the same question. Advance Child Tax Credit is new for 2021. If that credit does not apply to you, enter 0 when you get to the Schedule 8812.

Follow these steps to fill out Schedule 8812:

With your federal return open:

- Click on Show more next to You and Your Family under Deductions & Credits

- Click on Start or Revisit next to Advance payments, Child and Other Dependent Tax Credits

- Answer the questions on the screens that follow

- Done

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812: Advance payments received must be entered? / Principal Place of Abode and Letter 6416 Information Smart Worksheet

How do I correct the advance payments ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812: Advance payments received must be entered? / Principal Place of Abode and Letter 6416 Information Smart Worksheet

To edit the amount of your Child Tax Credit advance payments, please follow the instructions below:

- Open your return.

- Search child tax credit with the magnifying glass tool.

- Select the Jump to child tax credit link at the top of the search results.

- Edit your advance payments received on the screen, We'll start off with advance Child Tax Credit payments.

- Follow the on-screen instructions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812: Advance payments received must be entered? / Principal Place of Abode and Letter 6416 Information Smart Worksheet

I'm not sure what you are having me do. I have already electronic emailed my tax return and reach a refund. Also, I have never had any child in my lifetime, I don't need advance credit on children.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812: Advance payments received must be entered? / Principal Place of Abode and Letter 6416 Information Smart Worksheet

Hope your tax return and refund were processed correctly.

For the record, the $1,400 third stimulus payment and Recovery Rebate Credit are reported on line 30 of the 2021 Federal 1040 tax return.

IRS Form 1040 Schedule 8812 refer to advance payments of the Child Tax Credit and are reported on line 28 of the 2021 Federal 1040 tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812: Advance payments received must be entered? / Principal Place of Abode and Letter 6416 Information Smart Worksheet

I did not put the $2400 on line 30. I have already received my refund for 2021. How do I make or correct my 2021 taxes return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812: Advance payments received must be entered? / Principal Place of Abode and Letter 6416 Information Smart Worksheet

To clarify

would you be so kind as to state what you are asking or ask a new question.

You have added to a long thread and it is not clear if you are asking about the Recovery Rebate Credit and if you DID get that amount (2,400) as a stimulus payment already OR you want to get the 2,400 as a credit listed on your 1040 line 30.

You can only get the credit on line 30 if you DID NOT receive the payment.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812: Advance payments received must be entered? / Principal Place of Abode and Letter 6416 Information Smart Worksheet

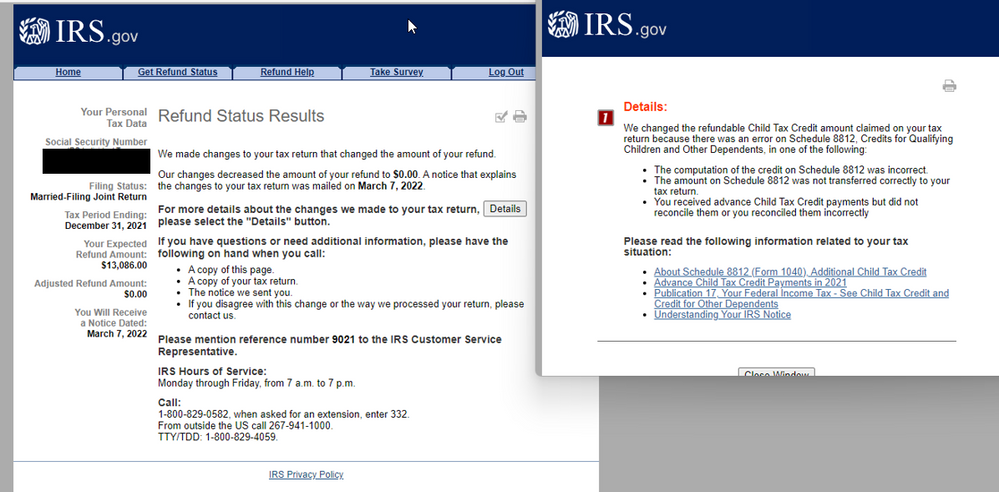

My refund was zeroed out. How do I fix this issue?

Will an amendment fix this issue?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812: Advance payments received must be entered? / Principal Place of Abode and Letter 6416 Information Smart Worksheet

Does this mean I have to file an amendment?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812: Advance payments received must be entered? / Principal Place of Abode and Letter 6416 Information Smart Worksheet

@saliriagwu Please clarify your question.

- Have you already filed your tax return?

- Was the refund zeroed out when you filed it?

- Was the refund for the return of wage withholdings, or for a credit that was disallowed?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812: Advance payments received must be entered? / Principal Place of Abode and Letter 6416 Information Smart Worksheet

Yes, I already filed and it was zeroed out. Getting hold of IRS rep is impossible.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812: Advance payments received must be entered? / Principal Place of Abode and Letter 6416 Information Smart Worksheet

The pop box on the right in your post states you either did not enter your Advance Child Tax Credit payments you received or you input the incorrect amount. The IRS matched up your input to their records and determined the change.

If you would like to see the details of the change you can Get Your Tax Record on the IRS website and request a transcript of your 2021 return.

@saliriagwu

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812: Advance payments received must be entered? / Principal Place of Abode and Letter 6416 Information Smart Worksheet

What advance payments received are you talking about when you ask me to complete form 8812 and enter the amount of the payment amounts. I am filing single and using standard deduction. I have no dependents.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812: Advance payments received must be entered? / Principal Place of Abode and Letter 6416 Information Smart Worksheet

@Nancy3665 wrote:

What advance payments received are you talking about when you ask me to complete form 8812 and enter the amount of the payment amounts. I am filing single and using standard deduction. I have no dependents.

Everyone is being asked this question since TurboTax does not know if the user was one who received these advances from the IRS in 2021.

Enter a 0 (zero) when asked to enter a number on the Schedule 8812. This will correct the issue and remove the Schedule 8812 from your tax return so that you can file the return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812: Advance payments received must be entered? / Principal Place of Abode and Letter 6416 Information Smart Worksheet

Thank you for this helpful tip! I accidentally entered a non-zero number for that number they asked, but it should have been 0 for me (I have no children or dependents). I couldn't find that number on my own, but your instructions worked!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

joroberts07040

Returning Member

KJ88

Returning Member

ArchesNationalPark

Level 3

renda000

Returning Member

vahart50

Returning Member