- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: TurboTax Premier 2021 Mortgage Interest Deduction Error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier 2021 Mortgage Interest Deduction Error

I just started entering data into Premier 2021, and the deductible mortgage interest worksheet is double counting the interest entered from the 1098. Limited interest is calculated on line 16 and then the original interest is incorrectly added to it on line 17, resulting in almost a doubling of the allowable deduction entered on Schedule A. Boxes on the limitation worksheet are also either not checked or incorrectly checked given what was entered on the screen prompts. This section of the code needs to be fixed.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier 2021 Mortgage Interest Deduction Error

Much of the program has not be updated and is buggy ... revisit this section later. Click on the REVIEW tab to see when the Sch A is expected to be functional.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier 2021 Mortgage Interest Deduction Error

A new update was issued on 12/22/21, and the mortgage interest deduction calculation is still wrong. The Step-by-Step screen prompts whether the 1098 is the most recent. If "Yes" is checked on the screen, since it's an original loan, the Home Mortgage Interest Limitation Smart Worksheet - A line 2 gets set to "Yes" that the loan was refinanced when it wasn't. With Yes checked, the total interest and points are transferred to Schedule A generating an incorrect $600 refund. When I manually change A line 2 to "No", it generates the Deductible Home Mortgage Interest Worksheet and calculates an interest limitation but ignores the points paid and transfers the wrong amount to Schedule A. The refund changes by $1600 to $1000 owed. If I manually check that the points paid were not on the 1098 but on the HUD-1, then the calculation changes again to $619 owed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier 2021 Mortgage Interest Deduction Error

More updates still to come ... Sch A is not slated to be ready until 1/20 ...

IRS forms availability table for TurboTax individual (personal) tax products

Related Information:

- IRS forms availability table for TurboTax individual (personal) tax products

- State forms availability table for TurboTax individual (personal) tax products

- Which IRS forms are not included in TurboTax?

- TurboTax 2020 release notes for Windows personal tax software

- State forms availability table for TurboTax Business

- IRS forms availability table for TurboTax Business

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier 2021 Mortgage Interest Deduction Error

"Home Mortgage Interest Limitation Smart Worksheet "

Did TurboTax 2021 add this worksheet?

In prior years TurboTax referred you to the IRS Pub 936 to do the calculation yourself.

You may want to plan to continue in that manner this year also.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier 2021 Mortgage Interest Deduction Error

Thanks for the heads up @fanfare . The Limitation worksheet is included. I had already done the calculation using IRS Pub 936 and that's how I know the worksheets in TT Premier 2021 are not calculating properly based on the values entered in the Step-by-Step Screens. The only reason for trying things now was to get a better sense of the Q4 estimated payment in January. I've deleted the file and will start over once everything is released.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier 2021 Mortgage Interest Deduction Error

@Critter-3 Schedule A has been released and the calculation for the mortgage interest deduction limitation is still wrong compared to the Pub 963 worksheet. I have three 1098's because the loan was sold twice during the year, and no matter how I play with the checkmarks in the forms, TT Premier is only limiting the interest on the last 1098, showing a bigger deduction than is allowed on Schedule A.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier 2021 Mortgage Interest Deduction Error

If you would be willing to share a diagnostic copy of your tax file, it could be helpful to examine the situation in more detail. The diagnostic file will not contain personal identifiable information, only numbers related to your tax forms.

To do so, follow the instructions below and post the token number along with which version of TurboTax you are using in a follow-up thread.

Use these steps if you are using TurboTax Online:

- Sign in to your account and be sure you are in your tax return.

- Select Tax Tools in the menu to the left.

- Select Tools.

- Select Share my file with agent.

- A pop-up message will appear, select OK to send the sanitized diagnostic copy to us.

- Post the token number here.

If you are using a CD/downloaded version of TurboTax, use these steps:

- Select Online at the top of the screen.

- Select Send Tax File to Agent.

- Click OK.

- Post the token number here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier 2021 Mortgage Interest Deduction Error

@AnnetteB6 Thanks for looking into this. The token is 902066. I'm using TT Premier 2021 PC Download. This morning a new update downloaded, and it gave me a message that the Deductible Mortgage Interest Worksheet is not finalized for returns with two or more mortgages and limited mortgage interest, which is kind of my situation with a jumbo loan that has been sold twice with three 1098s. I'm glad this is finally getting attention; otherwise, I would have to abandon TT and do my taxes with another solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier 2021 Mortgage Interest Deduction Error

@AnnetteB6 It's March 1st and I updated TurboTax Premier 2021 with the latest updates, and the program says my taxes are ready to file with the calculations guaranteed 100% accurate; however, the Mortgage Interest Deduction calculation is still wrong. The deduction limitation percentage is applied to the cumulative interest, but the points are ignored. The percentage is not applied to the points reported on the 1098 and not included on Schedule A Line 8a as specified in the IRS Pub. 963 instructions p14.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier 2021 Mortgage Interest Deduction Error

@wflord It appears the "Mortgage Interest Deduction" worksheet is working now. I put in a mock situation that may be similar to yours and the calculations appear to be correct.

Here is the mock situation and TurboTax entries: Begin by deleting all 1098's you have entered and "Done" to get back to the original state.

1st 1098 box 1 - 5,000 Box 2- 800,000 Box 3- 3/3/2021 Box 7- checked

- Follow on page about points checked "This is a new loan on which I paid points in 2021.

- Loan start date 3/3/2021

- Length of loan 30

- Points paid 2000

- Checked this loan was paid off

- "No" this is not the most recent form 1098

- "Yes" this is the original loan

First time mortgage sold 1098:

Box 1- 1000 Box 2- 798,000 Box 3- 3/3/2021 (same as original loan) Box 7 checked Box 11 8/8/2021 (date mortgage sold)

- Select "I have no points to deduct"

- "No" it is not the most recent 1098

- "Yes" it is the original loan (not a refi just sold)

Second time mortgage sold 1098

Box 1 - 1000 Box 2- 797,000 Box 3- 3/3/2021 (same as original) Box 7 checked Box 11- 11/1/2021 (date mortgage sold)

- Select "I have no points to deduct"

- "Yes" this is the most recent 1098

- "Yes" this is the original loan (not refi just sold)

"Done"

Put in purchase dates for all three loans (Should all be the 3/3/2021 for the original loan)

Put in the pay off principal for original loan (Box 2 principal amount on 2nd 1098) and date loan acquired (Box 11 second 1098)

Put in the pay off principal for 1st time mortgage sold (Box 2 principal amount on last 1098) and date loan acquired (Box 11 last 1098)

Put in end of year balance for last/current mortgage holder

"Continue"

Got to Forms View to check Schedule A - you should see amounts on 8A and 8C (both limited due to post 12/17 $750,000 limit) and then the total on line 10.

You can also check the "Ded Hom Mort" worksheet and the "Home Int Wkst(s)" to see calculations.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier 2021 Mortgage Interest Deduction Error

@DMarkM1 Thanks for your reply and step-by-step. I did exactly as you said, and there is nothing entered on Schedule A 8c. TurboTax assumes the points were reported on the first 1098, as they were, and the points are ignored when the limitation is calculated. To get a value on Schedule A 8c, I have to override the check marks on the first Home Inst Wkst and say the points were NOT reported on the 1098 but on the HUD1. While that will give me a correct total on line 10 as in your mock example, it's actually an inaccurate Schedule A being filed with the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier 2021 Mortgage Interest Deduction Error

Yes, although it may be a slightly different Schedule A, it doesn't impact your return with the IRS.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier 2021 Mortgage Interest Deduction Error

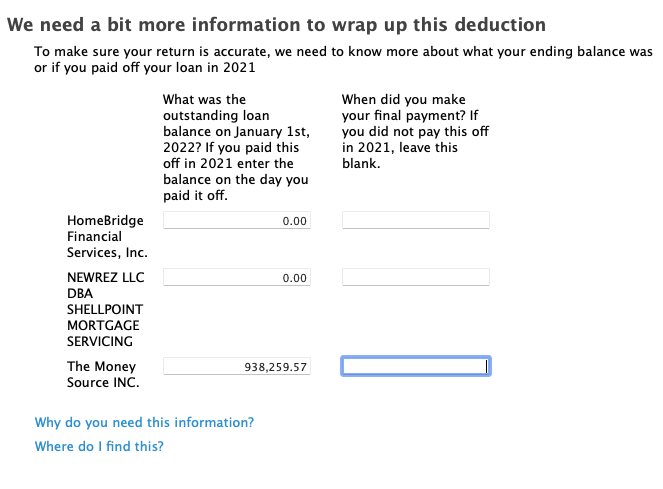

I have this exact same problem. I don't have quite enough expertise to tell if the program is working correctly. That is why I pay for TT. This advice above is contrary to some that I have read in these forums which state NOT to check the "this loan was paid off" because it is still the original loan, not a refi, and the fact that it was sold by the lender makes no difference. In particular - this is the screen that I don't know how to answer below. I can't enter $0 without triggering an error. I've tried entering the same amount ($900xxx) in all three, and I've tried enter $1 in the first two. I get the same result which leads me to believe this screen is not impacting the worksheets at all. I don't know what to say about the final payment, since I never paid off the loan. Any advice would be appreciated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier 2021 Mortgage Interest Deduction Error

@Fiery-Dragon Just split the year-end value of the mortgage evenly between the two. Half on one, half on the other. That way the system has the correct totals for the IRS.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

M_S2010

New Member

Opus 17

Level 15

deannarippy

Level 2

PatricioE

Level 1

mc510

Level 2