- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Standard Deduction for those over 65 - No explanation/breakdown provided when reviewing

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard Deduction for those over 65 - No explanation/breakdown provided when reviewing - Feedback for Intuit

Hi,

I turned 65 last year and Turbotax CORRECTLY calculated the standard deduction. The standard deduction is greater for those over 65. That's NOT my question.

My question is about providing an EXPLANATION in the worksheets about how the number is calculated. There exists an explanation about the standard deduction for those under 65, but none for those over 65. When I reviewed my taxes and saw a higher standard deduction than I expected, there was no explanation about the calculation no matter how far down I drilled in to the worksheets. I had to go online to other sites to find the information about the standard deduction being higher for those 65 and older.

My Request: Please place some information in the worksheets about how the standard deduction is calculated for those over 65. In the worksheets show a line for the standard deduction, a second line for the increased deduction amount for those over 65, and a third line showing the total standard deduction.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard Deduction for those over 65 - No explanation/breakdown provided when reviewing - Feedback for Intuit

In case they do not change all the worksheets for you---here are the standard deduction amounts for the upcoming 2021 tax returns:

2021 STANDARD DEDUCTION AMOUNTS

SINGLE $12,550 (65 or older + $1700)

MARRIED FILING SEPARATELY $12,550 (65 or older + $1350)

MARRIED FILING JOINTLY $25,100 (65 or older + $1350 per spouse)

HEAD OF HOUSEHOLD $18,800 (65 or older +$1700)

Legally Blind + $1350

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard Deduction for those over 65 - No explanation/breakdown provided when reviewing - Feedback for Intuit

Great suggestions. To actually submit Feedback, you need to include the word Feedback on the title of your post to this forum and one of the moderators will submit it for you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard Deduction for those over 65 - No explanation/breakdown provided when reviewing - Feedback for Intuit

George,

Thank you for your reply. Is there a way to update the title to include the word "Feedback" so the moderator will see this post?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard Deduction for those over 65 - No explanation/breakdown provided when reviewing - Feedback for Intuit

Click the three dots at the upper right of the post and chose edit. If it does not let you edit the title, you can cut and and paste your suggestion into another entry and put Feedback in the title.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard Deduction for those over 65 - No explanation/breakdown provided when reviewing - Feedback for Intuit

Thank You! The title has now been updated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard Deduction for those over 65 - No explanation/breakdown provided when reviewing - Feedback for Intuit

If you are 65 or older you would have filed on a Form 1040SR----did you look at the last page of the form that shows the standard deductions for 2020?

https://www.irs.gov/pub/irs-pdf/f1040s.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard Deduction for those over 65 - No explanation/breakdown provided when reviewing - Feedback for Intuit

I appreciate you trying to help, but your answer is not quite correct:

1.) From the IRS website ( this is a quote from the website):

Form 1040-SR is available as an "optional" alternative to using Form 1040 for taxpayers who are age 65 or older. Form 1040-SR uses the same schedules and instructions as Form 1040 does.

2.) Turbotax chose form 1040 not form 1040SR for me:

I used TurboTax to create a new return. Turbotax transferred the data from my previous return and chose to create a form 1040 even with the information that I was 65 years old. I was not prompted to choose form 1040 or 1040SR. Using form 1040, TurboTax CORRECTLY calculated the standard deduction for my age. TurboTax did not need form 1040SR to correctly calculate the deduction. However, when I drilled down into the worksheets there is no information about the increased deduction. When I right clicked, and sought additional information there was none. Users buy TurboTax to prepare their taxes AND to provide guidance and information. I truly hope you try this first should you decide to make an additional comment.

The problem I reported is valid and I am requesting an update for this problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard Deduction for those over 65 - No explanation/breakdown provided when reviewing - Feedback for Intuit

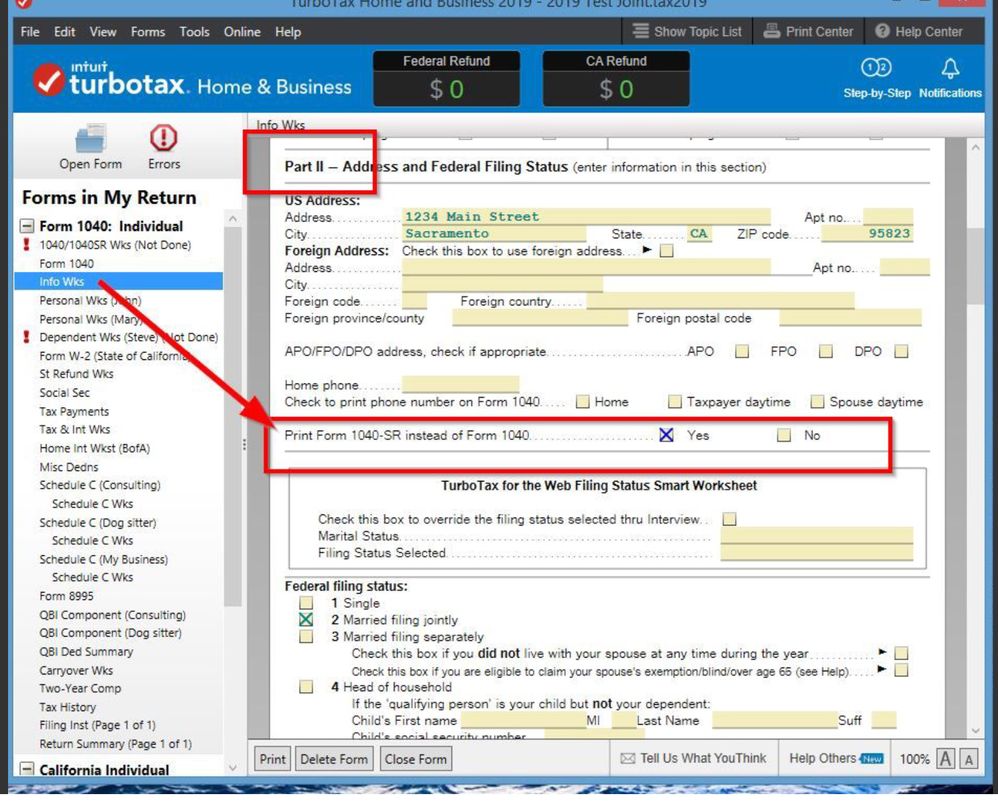

You don't get prompted. If you are using the Turbo Tax online version it automatically gives you the 1040SR if you or your spouse is 65 or older. It may show the regular 1040 on the screen but if you print it should be the 1040SR.

In the Desktop program it will give you the 1040SR but you can select which one to use. You can switch to forms and the Info Wks part II has a selection to select 1040SR or not.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard Deduction for those over 65 - No explanation/breakdown provided when reviewing - Feedback for Intuit

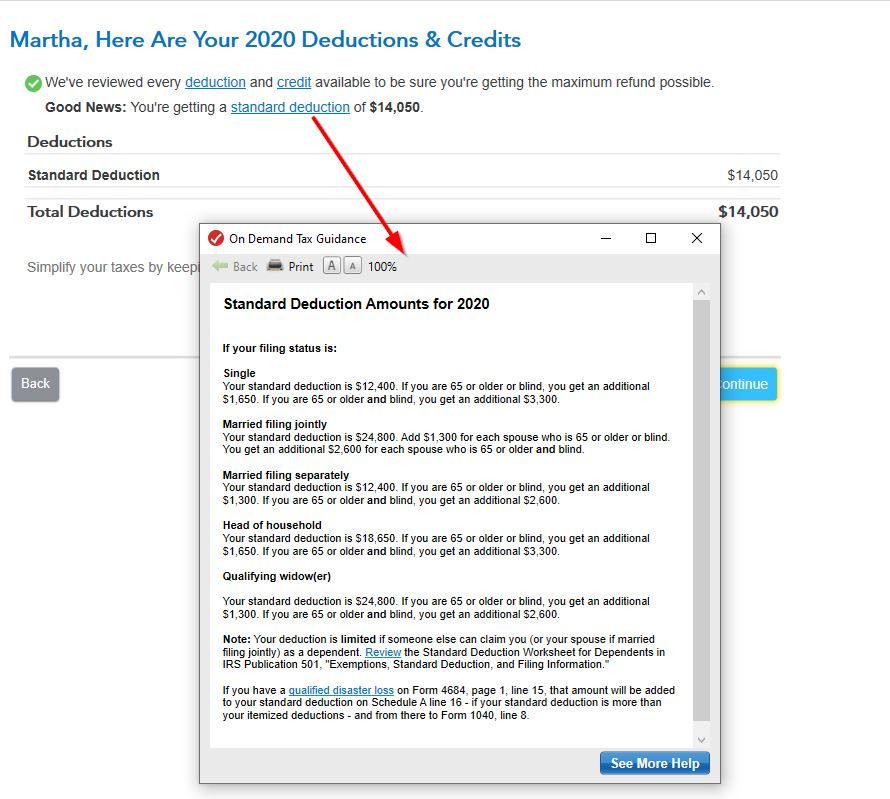

If you are using the Desktop program (and probably in Online also) you can click on Standard Deduction to see the help box. It is on this screen and the next screen. Is this what you are looking for?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard Deduction for those over 65 - No explanation/breakdown provided when reviewing - Feedback for Intuit

One again, thank you for your answer , but it does not address this problem

I am using the desktop version of TurboTax. I was not prompted for the choice of form 1040 or 1040SR. By default TurboTax chose form 1040, not 1040SR. As I walked through the process of preparing taxes, the standard deduction for someone 65 or older was calculated CORRECTLY even using form 1040.

Using form 1040 is a VALID choice, form 1040SR is "optional" for seniors ( IRS website ).

I am not asking about choosing between form 1040 or form 1040SR. I am reporting that there is no information about the calculation for the increased standard deduction for someone 65 or older when you drill down into the worksheets.

As for using form 1040SR, has anyone responding here who is recommending 1040SR, filled out form 1040SR and drilled down to get the explanation on how the standard deduction is calculated? You may get the same result as I did with form 1040. Should you decide to respond, please try that first. Even then, TurboTax desktop did not prompt for a choice of forms, and I am not about to sift through TurboTax documentation for a form that is optional and possibly get the same result I did with form 1040.

My point is still valid and I am requesting an update by TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard Deduction for those over 65 - No explanation/breakdown provided when reviewing - Feedback for Intuit

I don't know why you didn't get the 1040SR it is automatic unless you go and select Yes or No as on my screen shot from the Desktop program. The Forms Mode just shows you the plain 1040 but if you print it out you will get the 1040SR. See on my screen shot it says....PRINT 1040SR instead of 1040. Or double check your birth dates. When did you turn 65? But if you got the increased Standard Deduction then it knows your age.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard Deduction for those over 65 - No explanation/breakdown provided when reviewing - Feedback for Intuit

TurboTax gave you the deduction you're entitled to.

see the note on the left of Form 1040 line 12, where it says, see instr. which stands for see instructions, which is what you did in a roundabout way, after the fact.

TurboTax 2020 has a lot of issues/bugs.

This is probably the least of them, even if it did confuse you for a while.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard Deduction for those over 65 - No explanation/breakdown provided when reviewing - Feedback for Intuit

@DweedleDee wrote:

One again, thank you for your answer , but it does not address this problem

I am using the desktop version of TurboTax. I was not prompted for the choice of form 1040 or 1040SR. By default TurboTax chose form 1040, not 1040SR. As I walked through the process of preparing taxes, the standard deduction for someone 65 or older was calculated CORRECTLY even using form 1040.

Using form 1040 is a VALID choice, form 1040SR is "optional" for seniors ( IRS website ).

I am not asking about choosing between form 1040 or form 1040SR. I am reporting that there is no information about the calculation for the increased standard deduction for someone 65 or older when you drill down into the worksheets.

As for using form 1040SR, has anyone responding here who is recommending 1040SR, filled out form 1040SR and drilled down to get the explanation on how the standard deduction is calculated? You may get the same result as I did with form 1040. Should you decide to respond, please try that first. Even then, TurboTax desktop did not prompt for a choice of forms, and I am not about to sift through TurboTax documentation for a form that is optional and possibly get the same result I did with form 1040.

My point is still valid and I am requesting an update by TurboTax.

The 1040SR is only for paper forms that are in larger type. That is the only difference. Congress thought those over 65 didn't see very well so they made the IRS print forms in larger toe for seniors. Electronic forms are not paper and they are all the same.

Your age (DOB) that is entered in the personal information section tells TurboTax that you are over age 65 and it automatically adds the additional standard deduction amount on the 1040 form line 12 - nowhere else

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard Deduction for those over 65 - No explanation/breakdown provided when reviewing - Feedback for Intuit

"so they made the IRS print forms in larger toe[sic] for seniors. "

But all the other related forms other than 1040 are still the same, so how does that help, exactly?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Donald-Palmadessa11

New Member

TEAMBERA

New Member

roses0305

New Member

alvin4

New Member

ericasteven2017

New Member