- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: received a notice CP87A from the IRS. They say my child cannot file a return if I claim her on my return and want her to amend her return. She checked the "someone can claim you as a dependant box...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

received a notice CP87A from the IRS. They say my child cannot file a return if I claim her on my return and want her to amend her return. She checked the "someone can claim you as a dependant box. she made less than 2000 dollars.

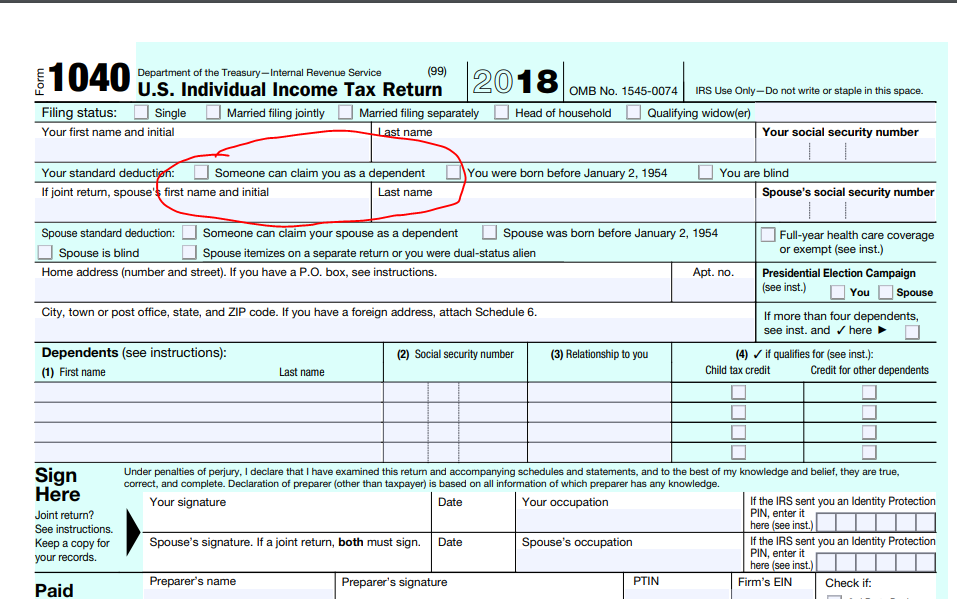

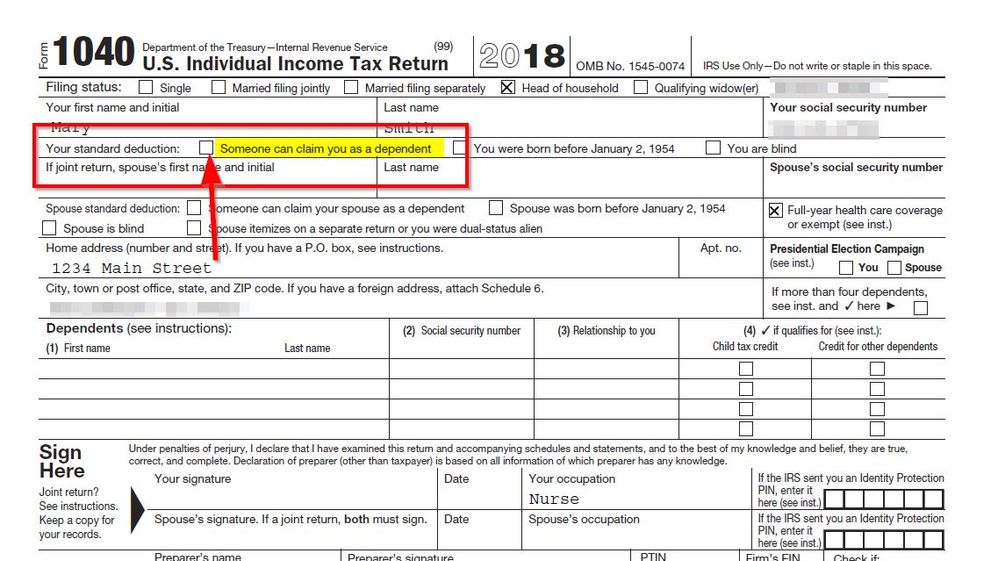

Look at her 1040 form ... is this box marked ? If so she did the return correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

received a notice CP87A from the IRS. They say my child cannot file a return if I claim her on my return and want her to amend her return. She checked the "someone can claim you as a dependant box. she made less than 2000 dollars.

The CP87A notice from the IRS has absolutely nothing to do with your daughter's return in any way, shape, form or fashion. It's only addressing "YOUR" return, and that's it.

The IRS is saying that **YOU** ***PERSONALLY*** are not qualified to claim your daughter as a dependent, because someone else claimed your daughter as a dependent on their tax return.

Are you not married to the father of your daughter? If you are married and you filed as Married Filing Separate, then only one of you can claim the child as a dependent. If not married and you filed as single or head of household, then it "sounds" like the father may have claimed her as a dependent on his tax return. If so, then both you and the father received the CP87A notice. So one of y ou needs to "PROVE" to the IRS that you are qualified to claim your daughter as a dependent.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

received a notice CP87A from the IRS. They say my child cannot file a return if I claim her on my return and want her to amend her return. She checked the "someone can claim you as a dependant box. she made less than 2000 dollars.

If it was not the child claiming herself then it was SOMEONE ELSE ... most likely someone you both know HOWEVER it could have been a complete stranger ...

If your Social Security number is compromised and you know or suspect you are a victim of tax-related identity theft, take these additional steps:

- Respond immediately to any IRS notice; call the number provided.

- Complete IRS Form 14039, Identity Theft Affidavit. Then print and mail or fax according to the instructions.

- Continue to pay your taxes and file your tax return, even if you must do so by paper.

Additional Resources

The IRS has a host of useful information and resources on tax-related identity theft:

- A special section at IRS.gov dedicated to identity theft issues, including YouTube videos, tips for taxpayers, and an assistance guide.

- For victims, the information includes how to contact the IRS Identity Protection Specialized Unit. For other taxpayers, there are tips on how taxpayers can protect themselves against identity theft.

- Taxpayers who may be at risk for identity theft (for example, your wallet, purse, or computer was recently stolen) should visit the IRS identity protection page.

- If you receive a suspicious email that appears to be from either the IRS or an organization closely linked to the IRS (such as EFTPS), visit the Report Phishing page at IRS.gov.

- Click here for general information on how to report tax-related fraud to the IRS.

- To prevent tax-related identity theft, see Protect Yourself from Identity Theft.

These sites can help you understand identity theft and how to protect yourself:

- FTC Identity Theft Resource Center (www.ftc.gov/idtheft)

- Identity Theft Resource Center (idtheftcenter.org)

- OnGuardOnLine.gov

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

received a notice CP87A from the IRS. They say my child cannot file a return if I claim her on my return and want her to amend her return. She checked the "someone can claim you as a dependant box. she made less than 2000 dollars.

I was hoping you could help me; I received the same notice and its sounds like we have the same situation. What was your outcome?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

received a notice CP87A from the IRS. They say my child cannot file a return if I claim her on my return and want her to amend her return. She checked the "someone can claim you as a dependant box. she made less than 2000 dollars.

Since father & daughter both appear to have filed correct returns, my suggestion to the father at this point is to re-file his return on paper (assuming the original return was e-filed). This will result in a more detailed processing by the IRS and hopefully will resolve the problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

received a notice CP87A from the IRS. They say my child cannot file a return if I claim her on my return and want her to amend her return. She checked the "someone can claim you as a dependant box. she made less than 2000 dollars.

can't say what's wrong. so the person to contact is the IRS Tax Advocate in your state.

see this link

https://www.irs.gov/advocate/local-taxpayer-advocate

(free)

click on the state in the map.

or you can use TT audit defense (fee)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

received a notice CP87A from the IRS. They say my child cannot file a return if I claim her on my return and want her to amend her return. She checked the "someone can claim you as a dependant box. she made less than 2000 dollars.

Hello,

My wife and i are married and file jointly. Our daughter is a full time student under 23. she works to make spending money and made less than $1,800. I claimed her as a dependent because I provide 100% of her support and she filed a claim, stating she was a dependent on someone else's claim, and so she is entitled to the less than $80 she paid in taxes.

The IRS phone rep says two people cannot claim the same SSN on their return, but the law allows me to claim her as I meet all the tests for a qualifying dependent and the law allows her to recover what she paid in taxes, stating in her return that someone else can claim her.

So I am at a loss here and do not know what to do next.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

received a notice CP87A from the IRS. They say my child cannot file a return if I claim her on my return and want her to amend her return. She checked the "someone can claim you as a dependant box. she made less than 2000 dollars.

For 2018? Check her return and make sure this box is checked. I guess if it is then send them another copy showing it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

received a notice CP87A from the IRS. They say my child cannot file a return if I claim her on my return and want her to amend her return. She checked the "someone can claim you as a dependant box. she made less than 2000 dollars.

@mikewojo As mentioned by a previous poster, if you haven't been able to get things resolved with the IRS directly, you should contact the Taxpayer Advocate by clicking here: https://www.irs.gov/Advocate/The-Taxpayer-Advocate-Service-Is-Your-Voice-at-the-IRS . The Taxpayer Advocate is there to help you deal with the IRS when you are unable to get things straightened out on your own.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

received a notice CP87A from the IRS. They say my child cannot file a return if I claim her on my return and want her to amend her return. She checked the "someone can claim you as a dependant box. she made less than 2000 dollars.

Thanks and I have been attempting to contact the tax advocate but with no success. Seems they are as busy as the IRS

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

received a notice CP87A from the IRS. They say my child cannot file a return if I claim her on my return and want her to amend her return. She checked the "someone can claim you as a dependant box. she made less than 2000 dollars.

It sounds like your notice was specific enough that it requested that your daughter's return be amended. This would indicate that the return as processed by the IRS doesn't have the box checked that indicates your daughter can be claimed on another person's return. Even if you feel like the return was properly filed the first time, the best way to resolve this is to amend her return and send the amended tax return, form 1040X in to the address specified in your letter.

If your daughter prepared her return in TurboTax, click here for instructions on how to amend it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

XAM330

Level 3

heatherpooh2008

New Member

pmc8969

New Member

hativered

Level 2

nestog33

New Member