- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Premium Tax Credits excess repayment for 2020 in the American Rescue Plan

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Premium Tax Credits excess repayment for 2020 in the American Rescue Plan

Does anyone know how long it will take TurboTax to implement the new tax provision in the latest stimulus bill that was just passed? Specifically, the fact that 2020 premium tax credit excess will not have to be repaid? I've pasted the language from the bill below.

Premium tax credit

The act expands the Sec. 36B premium tax credit for 2021 and 2022 by changing the applicable percentage amounts in Sec. 36B(b)(3)(A). Taxpayers who received too much in advance premium tax credits in 2020 will not have to repay the excess amount. A special rule is added that treats a taxpayer who has received, or has been approved to receive, unemployment compensation for any week beginning during 2021 as an applicable taxpayer.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Premium Tax Credits excess repayment for 2020 in the American Rescue Plan

After the legislation has passed Congress and after the President has signed the legislation and after the IRS has written the rules, regulations and procedures. And after the IRS has changed any forms or schedules to accept the tax code changes. And after the IRS has approved the changes in the TurboTax program that apply to the tax code changes, then it will be available for the users of the tax preparation software.

This can take anywhere from several weeks to several months before it becomes available.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Premium Tax Credits excess repayment for 2020 in the American Rescue Plan

I have this same question. I will save about $2000 with this provision, so I am very excited about it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Premium Tax Credits excess repayment for 2020 in the American Rescue Plan

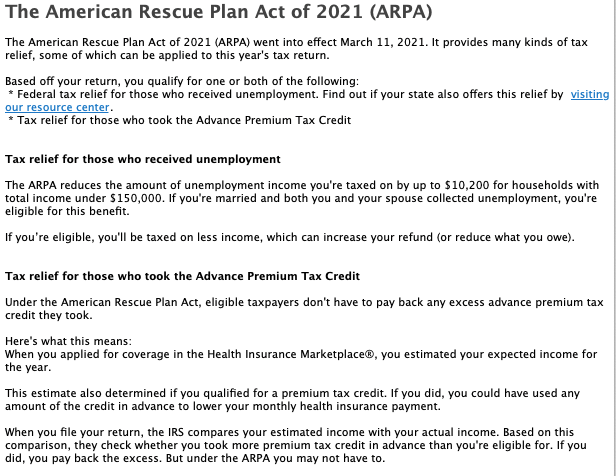

This notice is now posted in TT Desktop when you run a Smart Check:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Premium Tax Credits excess repayment for 2020 in the American Rescue Plan

As customers continue to have questions regarding the Economic Impact Payments (EIP), we’re continuing to work with the IRS for guidance. We’re updating our customer and expert-facing articles with information as soon as we get it! The IRS is reviewing implementation plans for the newly enacted American Rescue Plan Act of 2021. Additional information about a new round of economic impact payments, including the unemployment benefit will be forthcoming.

For those who haven't filed yet, the IRS will provide a worksheet for paper filers and work with software industry to update current tax software so that taxpayers can determine how to report their unemployment income on their 2020 tax return.

TurboTax is developing the software required to process all of the new conditions.

@zacknauth

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Premium Tax Credits excess repayment for 2020 in the American Rescue Plan

Since it looks like I will not need to pay the excess Premium tax credit for tax year 2020, should I then not include the Premium tax credit in my return. Thereby avoiding waiting for the IRS to refund me this overpayment if I included it on my 2020 tax return. IRS is advising those who already filed to not submit an amended return for this issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Premium Tax Credits excess repayment for 2020 in the American Rescue Plan

Correct, the IRS is urging taxpayers to wait until more information is released about issues affecting refunds and stimulus payments with regards to the American Rescue Plan.

Here is a TurboTax article about the American Rescue Plan

The IRS is reviewing implementation plans for the newly enacted American Rescue Plan Act of 2021. Additional information about a new round of economic impact payments, including the unemployment benefit will be forthcoming.

The IRS strongly urges taxpayers not to file amended returns related to the new legislative provisions or take other unnecessary steps at this time. The IRS will provide taxpayers with additional guidance on those provisions that could affect their 2020 tax return, including the excess premium tax credit.

TurboTax is developing the software required to process all of the new conditions.

@bw269

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Premium Tax Credits excess repayment for 2020 in the American Rescue Plan

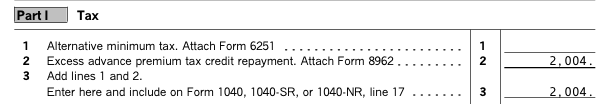

TT states in its update that this issue was fixed, but it is not in my download version of Home and Business. My return still shows me paying back $2004.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Premium Tax Credits excess repayment for 2020 in the American Rescue Plan

Your tax return isn't due until May 17, 2021, so it may be best to wait until guidelines on how to report and comply with the regulations are finalized and TurboTax has updated the program.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Premium Tax Credits excess repayment for 2020 in the American Rescue Plan

I guess i am confused. TT says they have adjusted the federal tax portion to accommodate the ARP and over payment of premium credit but my schedule 2 still shows I have to pay back almost $1400. Have they fixed it or not? It doesn't look like it as I review the individual forms. I guess i will wait, but how can we get an answer from TT that they believe it is fixed or not?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Premium Tax Credits excess repayment for 2020 in the American Rescue Plan

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Premium Tax Credits excess repayment for 2020 in the American Rescue Plan

Unfortunately, because the IRS has not updated, TurboTax cannot update. The only thing to do right now is wait.

If you file the return as is, the IRS will automatically recalculate the Premium Tax Credit. However, that will cause a processing delay.

Resources to check for updates:

IRS: Premium Tax Credit: Claiming the Credit and Reconciling Advance Credit Payments

TurboTax: How will the third stimulus impact me?

@ddrfill

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Premium Tax Credits excess repayment for 2020 in the American Rescue Plan

It's fixed! I have Home and Business desktop download and the premium tax credit repayment has been fixed!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Premium Tax Credits excess repayment for 2020 in the American Rescue Plan

I just download an update and the ACA excess premium tax credits on Form 8692 that were previously being paid back have now disappeared and my refund has gone up. Is this due to the new law update and is this correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Premium Tax Credits excess repayment for 2020 in the American Rescue Plan

@jimgarrison wrote:

I just download an update and the ACA excess premium tax credits on Form 8692 that were previously being paid back have now disappeared and my refund has gone up. Is this due to the new law update and is this correct?

Yes, that is due to the American Rescue Plan Act of 2021 and it is correct.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

EKrish

Level 2

tessy82000

New Member

skylee_hall

New Member

in Education

manusod

Level 1

btaclark9607

Level 1