- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: possible bug re 2023 credit for electric vehicle charging station

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

possible bug re 2023 credit for electric vehicle charging station

Working on a return and entered data re purchase and installation of an electric vehicle charging station on my main home property for personal use in summer of 2023. TurboTax computed the credit re form 8911 at 30% of the cost, limited to $1,000. Seemed right until I heard that, for charging stations installed in 2023 and future years, the credit is only available if your property is located in certain census tracts (lower income tracts only) per instructions for F8911. My home is in an urban area and not a low income census tract. Is TurboTax aware of the new requirement? And, if so, how is it checking the taxpayers census tract to determine eligibility or not?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

possible bug re 2023 credit for electric vehicle charging station

The IRS Form 8911 Alternative Fuel Vehicle Refueling Property Credit for tax year 2023 has not been finalized in the TurboTax program.

The Form 8911 for tax year 2023 is scheduled to be available on 01/24/2024 (subject to change)

Go to this TurboTax website for forms availability - https://form-status.app.intuit.com/tax-forms-availability/formsavailability?albRedirect=true&product...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

possible bug re 2023 credit for electric vehicle charging station

I don't think this is one of the credits handled on F5695, but rather it's handled on F8911. However, it appears that TurboTax hasn't gone final on F8911 either, so we'll see if the census tract issue is addressed at that time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

possible bug re 2023 credit for electric vehicle charging station

You are correct, it is reported on the IRS Form 8911. The form shows as being available on 01/24/2024. That date is probably off by one day. TurboTax updates the software on Thursdays so the date should read 01/25/2024.

This discrepancy in dates has been reported. Be aware all of the dates are subject to change.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

possible bug re 2023 credit for electric vehicle charging station

Seems 1/24/2024 has passed and I still have an issue getting the credit. I have tax exposure but TT says I am not eligible to receive a tax credit. After filling out (by hand) form 8911 off the IRS website the form says I should get $236 out of $788 I spent installing the Tesla charging station. Is there still a bug with TT Premium 2023?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

possible bug re 2023 credit for electric vehicle charging station

I just realized on Form 8911 line 17 TT entered a $ amount for Tentative Minimum Tax (TMT). I file married jointly. When I click on the source of line 17 it says it comes from Form 6251 line 9. Once I take my child credit and my $7500 for the Tesla I bought this year the difference between tax I am required to pay and TMT becomes negative cancelling my ability to claim the Alt refueling charging station credit. I still have some dividends and gains to add in (Feb 13th)

maybe this will change making the credit applicable (doubtful though).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

possible bug re 2023 credit for electric vehicle charging station

The problem I was concerned about is turbotax seemed (and still seems) to allow the charging station credit even when someone is not eligible. Congress and/or the IRS added a new eligibility criterion for 2023; namely, for an individual who installed an EV charging station at their residence, one is NOT eligible for the credit unless the residence is in a non-urban area or certain low-income areas within an urban area. I don't know what your situation is, or whether or not you live in one of the eligible census tracts, but it doesn't seem like turbotax is checking that, so you might want to explore that issue yourself if the additional income you are expecting seems to allow you to take the credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

possible bug re 2023 credit for electric vehicle charging station

I am in a non-urban area (checked the IRS Site) but my TT Software says the credit is Zero,. I spent 3346 on a wall charger + installation in July 2023. I live in zip 18344

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

possible bug re 2023 credit for electric vehicle charging station

The DOE /IRS site says this about my area

This census tract in Monroe County, Pennsylvania (Census tract ID = [phone number removed]) is eligible through 2030 because it meets the definition of “not an urban area” according to Treasury/IRS guidance based on 2020 Census definitions of urban area using 2020 census tract boundaries (or “2020 non-urban census tract”).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

possible bug re 2023 credit for electric vehicle charging station

You seem to have determined that your census tract is an eligible census tract for the EV charging station credit. But perhaps TurboTax is still struggling with this. The IRS did issue a notice recently (n2024-20) which addresses this ( https://www.irs.gov/pub/irs-drop/n-24-20.pdf ), and perhaps that is what you used. It provides links, on pages 13 -14 of the pdf, to sites where one can find the census tract number for a particular address and sites with IRS currently approved lists of eligible census tracts for the credit. Maybe TurboTax can use these lookup tools to fully implement F8911.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

possible bug re 2023 credit for electric vehicle charging station

Thank you Muktax. I believe my demise was due to the mininum tax requirement on 8911 which disqualified me for the credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

possible bug re 2023 credit for electric vehicle charging station

Ouch hope they did a great job installing the station.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

possible bug re 2023 credit for electric vehicle charging station

I wouldn't consider it a bug. I don't think it's reasonable to expect TurboTax to figure out what census tract your charger is in, or determine whether your census tract meets the requirements. It tells you what the requirements are. You have to determine whether your installation meets them.

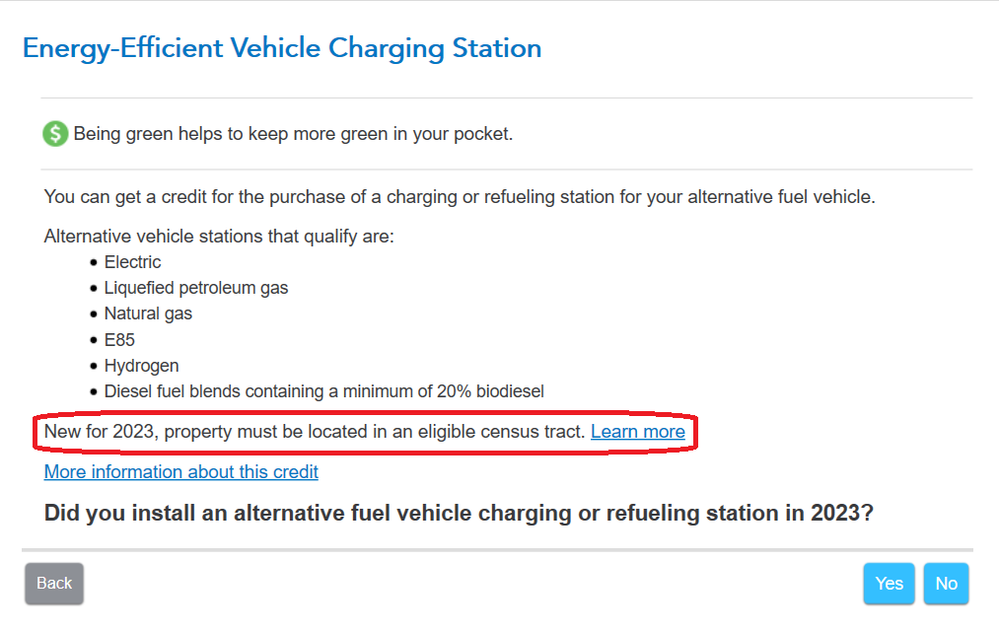

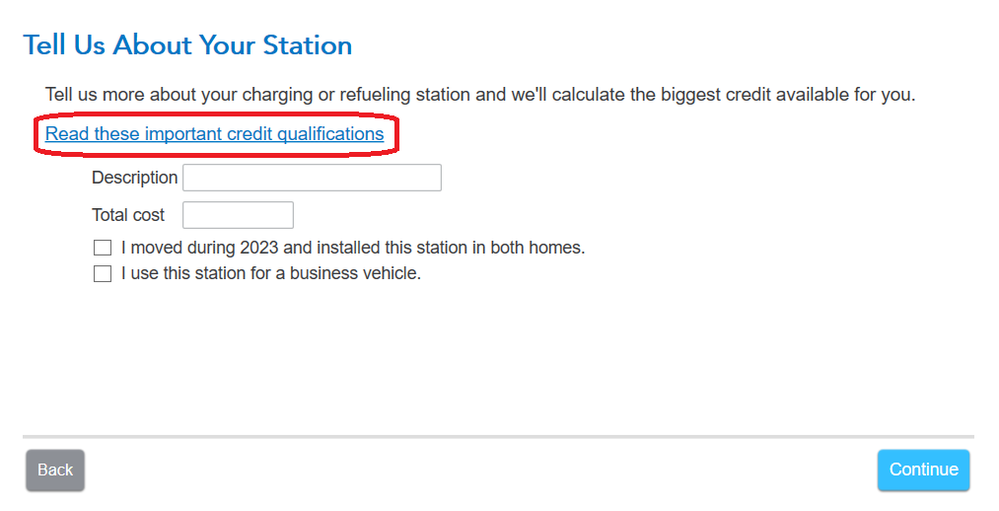

The first page of the interview for Energy-Efficient Vehicle Charging Station says "New for 2023, property must be located in an eligible census tract." The "Learn more" link on that line brings up a help window that describes the census tract requirements. The next screen of the interview, where you enter the cost, has a link that says "Read these important credit qualifications" and opens the same help text. See the screen shots below.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

possible bug re 2023 credit for electric vehicle charging station

[post removed]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

possible bug re 2023 credit for electric vehicle charging station

This appears to be a helpful site for figuring out if an address is eligible (and even what year for the complex phase ins)

https://experience.arcgis.com/experience/3f67d5e82dc64d1589714d5499196d4f/page/Page/

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sseger03

New Member

jrphillips28

New Member

teewilly1962

New Member

jwicklin

Level 1

bmoore4718

New Member