- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: One of my dependents has not been listed on IRS tax transcripts for years

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

One of my dependents has not been listed on IRS tax transcripts for years

After a very frustrating several hours to determine why the IRS adjusted my Recovery Rebate Credit Worksheet by $1,100, I finally found the answer. To be clear, I spent nearly 3 hours either on hold or talking to various IRS agents. Finally, one of them suggested that I download my IRS transcripts. Upon review, for the past 4 years (probably longer, but transcripts go only back to 2017), I realized my youngest child is missing from every record. I'm extremely upset since I told every agent that I have 5 dependents and their ages, and in two discussions that IRS agent looked only at the front of the 1040 and failed to recognize the check box and indication to see the rest of the statement if there are more than 4 dependents.

I've been using TurboTax for nearly 20 years and added each of my children as they came into the family. My youngest is 7 years old with a properly issued social security card\number. I checked the 1040 forms generated by TurboTax. All years list all of my dependents with their SSN.

Where and how do I start to fix this situation? Not only was I shorted on the Recovery Rebate Credit for this year, but there's a very good chance that due to this error, I'm due refunds from prior years!!!

Again - all the paperwork\forms generated by TurboTax are correct. It's the transcript\record at the IRS that is incorrect.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

One of my dependents has not been listed on IRS tax transcripts for years

@tccutler wrote:Every time I request a line-by-line review of the Recovery Rebate Credit worksheet, I'm either denied by the agent or get disconnected in way or another. I want to know why my numbers don't align with their numbers... if the tables were turned, they'd have sent me a notice and be demanding payment!!

Unfortunately, if you claimed X qualifying dependents and they revised it down to X-1 qualifying persons, and reduced the payment by $1100, that is probably not something you can recover by filing an amended return, because whatever they thought was wrong the first time will still be wrong. (You could try filing an amended return and maybe get lucky with the person who processes it. But you would have to make manual adjustments in Turbotax--if your return is correct in Turbotax, you won't be able to automatically prepare the amended return.)

The Taxpayer Advocate office exists to help people like you, assuming they actually perform the job they are chartered to perform.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

One of my dependents has not been listed on IRS tax transcripts for years

Did you e-file or file by mail? I have no idea how the IRS could fail to include a child if you listed the child as a dependent on an e-filed tax return. If you correctly included the child in Turbotax, you should have claimed a child tax credit of up to $2000, depending on your overall income and tax situation. Did you not notice a deficit in your refunds?

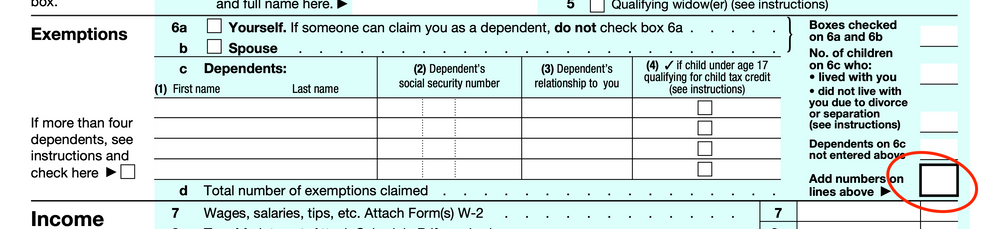

Look at your tax return PDFs. It's possible for a child to be listed in Turbotax as your child but not listed as a dependent, depending on how you answer certain qualification questions. Your tax return PDF should have a checkmark in the box for "more than 4 dependents" and should include an "additional dependent worksheet" listing the name, SSN of the 5th child. It should indicate that the child qualifies for the $2000 child tax credit.

Normally, you would have to file an amended return by May 17, 2021, to claim any additional refund for your 2017 return. (Any refund due for 2016 and earlier is lost.). If your child is already correctly listed in your 2017 tax return data file, Turbotax won't be able to automatically prepare an amended return.

I would tell you to go directly to the office of the taxpayer advocate with your case. However, they are limited service due to COVID, and if you take your case to them, you may miss the May 17, 2021 deadline to file an amended return for 2017. You may also have a hard time proving your case. Part of your problem may be that if you filed electronically, you may have no proof that the electronic return sent to the IRS contained your 5th child. If you filed on paper, those records are microfilmed and you can eventually get copies, but if the data entry clerks just lost the additional dependent info page, you might still have no proof that you correctly claimed your child.

https://www.irs.gov/taxpayer-advocate

For now I would focus on 2017 since that's the deadline that expires first. Do you have a copy of your 2017 tax return PDF from Turbotax and can you download a copy of your 2017 tax return data file onto your computer? How many exemptions did you claim? Does your 1040 PDF match your 2017 transcript, and if not, where are they different?

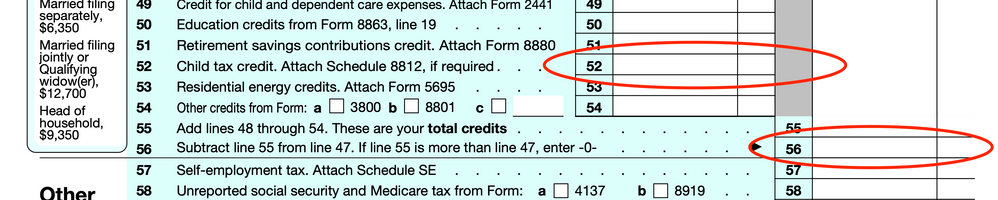

What is your child tax credit on line 52 and your total tax liability on line 56?

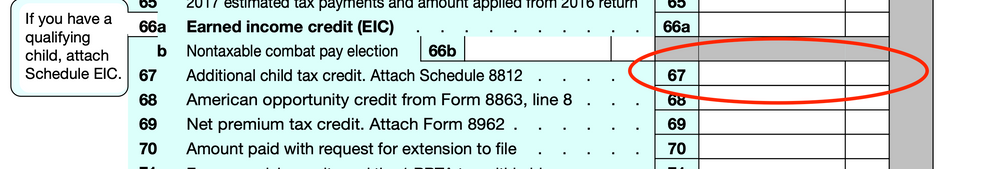

Do you have an amount for "Additional Child Tax Credit" on line 67, and do you have a form 8812 in your PDF or your transcript?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

One of my dependents has not been listed on IRS tax transcripts for years

Hi - Thank you for the tips.

I always e-File. Looking back at my saved TurboTax files, my 2 youngest have X marks on "Qualifying Child for Child Tax Credit" for last two years. Going back another year, my 3rd child has the X mark. I'll have to grab my 2017 PDF\backup and look through it. However, considering that I import the prior year's info, it's very likely this issue has been going on for awhile.

Looking through my records, I don't appear to have form 8812. Weird.

I read about the requirements at https://turbotax.intuit.com/tax-tips/family/what-is-the-irs-form-8812/L1HbgYQqE and nothing stood out as to why I wouldn't have a form 8812.

I've got more investigation to do once I get to my system with TurboTax loaded on it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

One of my dependents has not been listed on IRS tax transcripts for years

@tccutler wrote:

Hi - Thank you for the tips.

I always e-File. Looking back at my saved TurboTax files, my 2 youngest have X marks on "Qualifying Child for Child Tax Credit" for last two years. Going back another year, my 3rd child has the X mark. I'll have to grab my 2017 PDF\backup and look through it. However, considering that I import the prior year's info, it's very likely this issue has been going on for awhile.

Looking through my records, I don't appear to have form 8812. Weird.

I read about the requirements at https://turbotax.intuit.com/tax-tips/family/what-is-the-irs-form-8812/L1HbgYQqE and nothing stood out as to why I wouldn't have a form 8812.

I've got more investigation to do once I get to my system with TurboTax loaded on it.

You would only have form 8812 if you were claiming the "additional child tax credit."

First, the child tax credit is available for "qualifying child" dependents age 16 and under. If you have a qualifying child dependent who is younger than 16 but that box is not checked, then something else is wrong. Once the child turns 16 at any time during the year, they aren't eligible for that credit any longer, although they are still dependents for other tax purposes.

(Remember, certain dependents, such as relatives more distant than niece or nephew, or children who live with you but are not relatives and were not placed by a state licensed foster program, don't qualify you for the child tax credit or for the stimulus/rebate. That may also be an issue.)

The Additional Child Tax Credit is figured if your tax bill is less than your regular child tax credit. For example, if you had 3 children under age 16, your CTC eligibility is $6000. If your tax is $5000, then your maximum CTC is $5000, even though your eligibility is $6000. The additional child tax credit uses form 8812 to figure out if you are eligible for any of that last $1000 to be added to your refund. If your tax was more than your CTC, then form 8812 won't be needed or created.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

One of my dependents has not been listed on IRS tax transcripts for years

OK - looking through my 2020 return, my tax is greater than my CTC (Child Tax Credit). Reading comments below and online, and looking directly at form 8812, that explains why it's not listed in my return.

BUT - I'm still confused why a child clearly shown on my return with a "Qualifying Child for Child Tax Credit" is not showing on the IRS transcript. I went back into TurboTax and validated all entries for that child\dependent.

What am I missing? The information was submitted via e-File. The youngest child's birth year was 2013 and SSN is listed correct. How do I correct this mistake?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

One of my dependents has not been listed on IRS tax transcripts for years

At this point, I’m still primarily concerned with your 2017 tax return, because the deadline is fast approaching to file an amended return if you need to.

I have no idea why your transcripts might be incomplete, but if you have filed correct tax returns each year and you have been paid your correct refund each year, then the only issue we might be concerned about are the various stimulus payments.

So what I would focus on first, is whether each of your tax returns since 2017 has been correct as prepared, and if you received the correct amount of refund as claimed on the tax return. That will help us narrow down what needs to be fixed, if anything.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

One of my dependents has not been listed on IRS tax transcripts for years

I briefly looked over my 2017 return, even installing TurboTax 2017 and reloading the data file. It appears to be correct.

Number of dependents is 5, plus my wife and myself. Checkmarks in place indicating additional information for all 5 children to be listed. At that time of 2017, three of my children were under 17 years of age. However, form 8812 for Child Tax Credit was not filled out because our adjusted gross income as married filing jointly exceeded the amounts.

But still, the IRS transcripts do not show my youngest child which is impacting Recovery Rebate Credit. Our adjusted gross income dropped significantly in the past 2 year for reasons I will not explain here, except to summarize that we are within range of the AGI requirements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

One of my dependents has not been listed on IRS tax transcripts for years

Your transcripts have nothing to do with the recovery rebate, unless you filed for a rebate in 2020 and it was not paid, or it was reduced. The fact that your 2017 through 2019 transcripts might not show the child has no effect on 2020.

So are we trying to fix 2017 through 2020 or are we only trying to fix 2020?

Then if we are only trying to fix 2020:

1. How many dependents did you claim on your 2020 tax return who were age 16 or less on December 31, 2020?

2. How much did you receive in round 1 and round 2 of the stimulus during 2020 and early 2021?

3. Was your tax refund reduced from what you claimed on your 2020 return when you filed it?

It may also be important here to emphasize that the stimulus rebate calculated on the tax return is based on the number of dependents you claim and not their identity. For example, consider a family with a 17-year-old child and a newborn. They may have been paid a stimulus payment that reflected one child, because they had a qualifying child in 2019. On the 2020 tax return they are adding a newborn dependent, but the 17 year old has aged out of eligibility. Because they received a stimulus payment for one eligible dependent, and they are claiming one eligible dependent on their 2020 tax return, they will not receive an additional rebate, even though the identity of the dependents has changed.

The round one stimulus payment, the round two stimulus payment, and the economic recovery rebate on the 2020 tax return are all based on qualifying dependents who must be age 16 or less at the time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

One of my dependents has not been listed on IRS tax transcripts for years

I spoke with a few IRS associates today and learned the following:

- My 5th child does indeed exist on their records. For whatever reason, the downloaded transcripts don't show that individual, but we confirmed all 7 household members.

- I'm still in disagreement on line 30 of the 1040, the Recovery Rebate Credit. What TurboTax 2020 generated and what I generated by hand match up. What the IRS revised the amount to, lowering it be ~$1,100 does not make sense to me.

- Every time I request a line-by-line review of the Recovery Rebate Credit worksheet, I'm either denied by the agent or get disconnected in way or another. I want to know why my numbers don't align with their numbers... if the tables were turned, they'd have sent me a notice and be demanding payment!!

Still - the whole process thus far has been awful. I have written notes all over my desk about every call, every agents' ID\code, and so forth. Over 5 hours thus far between yesterday and today.

I'll open a separate discussion on the Recovery Rebate Credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

One of my dependents has not been listed on IRS tax transcripts for years

@tccutler wrote:Every time I request a line-by-line review of the Recovery Rebate Credit worksheet, I'm either denied by the agent or get disconnected in way or another. I want to know why my numbers don't align with their numbers... if the tables were turned, they'd have sent me a notice and be demanding payment!!

Unfortunately, if you claimed X qualifying dependents and they revised it down to X-1 qualifying persons, and reduced the payment by $1100, that is probably not something you can recover by filing an amended return, because whatever they thought was wrong the first time will still be wrong. (You could try filing an amended return and maybe get lucky with the person who processes it. But you would have to make manual adjustments in Turbotax--if your return is correct in Turbotax, you won't be able to automatically prepare the amended return.)

The Taxpayer Advocate office exists to help people like you, assuming they actually perform the job they are chartered to perform.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

One of my dependents has not been listed on IRS tax transcripts for years

Thanks. I'll follow-up with Tax Payer advocate office.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

One of my dependents has not been listed on IRS tax transcripts for years

The tax advocate service (https://www.taxpayeradvocate.irs.gov/notices/notice-cp12/) was the answer.

Although the phone call tool over an hour..... Great news! I will get my FULL REFUND!!!

After nearly 6 hours of frustrating experiences with IRS agents, I'm glad this was resolved in my favor.

What a crazy journey....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

One of my dependents has not been listed on IRS tax transcripts for years

I have had the same issue since my youngest came into our family. I'm so glad I found your post. I'm going to try to call them tomorrow. Did you ever get your situation fixed?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

preppyg34

New Member

mcmikecasey1

New Member

mshaikh010

Level 2

jaimdin

New Member

taxes54321

Level 1