- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Did you e-file or file by mail? I have no idea how the IRS could fail to include a child if you listed the child as a dependent on an e-filed tax return. If you correctly included the child in Turbotax, you should have claimed a child tax credit of up to $2000, depending on your overall income and tax situation. Did you not notice a deficit in your refunds?

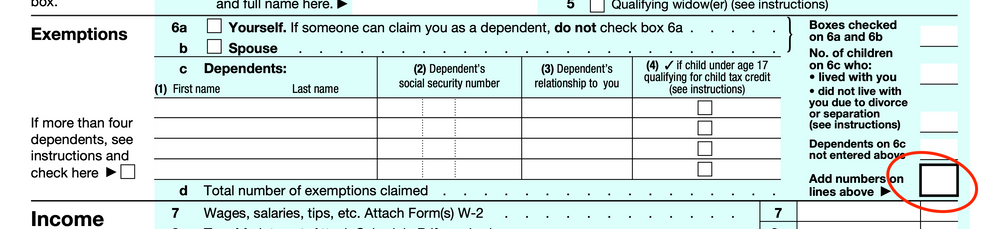

Look at your tax return PDFs. It's possible for a child to be listed in Turbotax as your child but not listed as a dependent, depending on how you answer certain qualification questions. Your tax return PDF should have a checkmark in the box for "more than 4 dependents" and should include an "additional dependent worksheet" listing the name, SSN of the 5th child. It should indicate that the child qualifies for the $2000 child tax credit.

Normally, you would have to file an amended return by May 17, 2021, to claim any additional refund for your 2017 return. (Any refund due for 2016 and earlier is lost.). If your child is already correctly listed in your 2017 tax return data file, Turbotax won't be able to automatically prepare an amended return.

I would tell you to go directly to the office of the taxpayer advocate with your case. However, they are limited service due to COVID, and if you take your case to them, you may miss the May 17, 2021 deadline to file an amended return for 2017. You may also have a hard time proving your case. Part of your problem may be that if you filed electronically, you may have no proof that the electronic return sent to the IRS contained your 5th child. If you filed on paper, those records are microfilmed and you can eventually get copies, but if the data entry clerks just lost the additional dependent info page, you might still have no proof that you correctly claimed your child.

https://www.irs.gov/taxpayer-advocate

For now I would focus on 2017 since that's the deadline that expires first. Do you have a copy of your 2017 tax return PDF from Turbotax and can you download a copy of your 2017 tax return data file onto your computer? How many exemptions did you claim? Does your 1040 PDF match your 2017 transcript, and if not, where are they different?

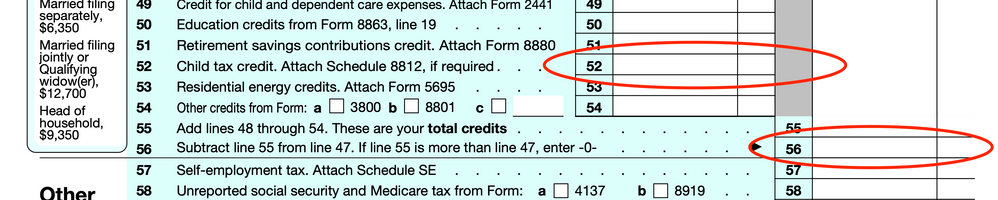

What is your child tax credit on line 52 and your total tax liability on line 56?

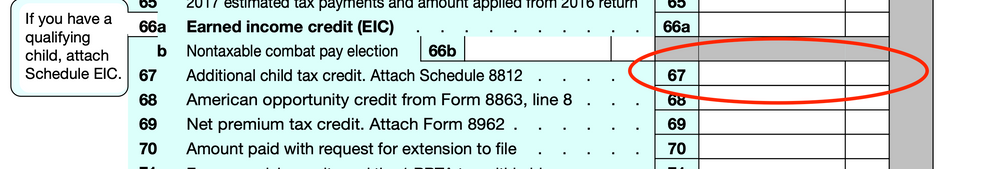

Do you have an amount for "Additional Child Tax Credit" on line 67, and do you have a form 8812 in your PDF or your transcript?