- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Is the turbotax system is updated to account for the $300 charitable deductions under the CARES Act for those who take the standard deduction?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the turbotax system updated to account for the $300 charitable deductions under the CARES Act for those who take the standard deduction?

There is some text on the site that clarifies this, but the Turbo tax system still encourages me not to submit my charitable deductions when taking a standard deduction, even though the CARES Act allows for $300 for those who take the standard deduction.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the turbotax system updated to account for the $300 charitable deductions under the CARES Act for those who take the standard deduction?

I had the same problem, waiting for there to be a correction that allows you to take it and still e-file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the turbotax system updated to account for the $300 charitable deductions under the CARES Act for those who take the standard deduction?

This is a known bug and has been reported. Remove the amount as requested.

Go to the Charitable Donations section under Deductions & Credits to enter the $300 cash donation. This will correct the problem.

To enter charitable donations -

- Click on Federal Taxes (Personal using Home and Business)

- Click on Deductions and Credits

- Click on I'll choose what I work on (if shown)

- Scroll down to Charitable Donations

- On Donations to Charity in 2020, click on the start or update button

Or enter charitable donation in the Search box located in the upper right of the online program screen. Click on Jump to charitable donation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the turbotax system updated to account for the $300 charitable deductions under the CARES Act for those who take the standard deduction?

Thank you for this feedback. However, inputting the charitable donations does not change the amount of federal tax (in progress) turbotax says I owe, so perhaps the bug is still working there when someone takes a standard deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the turbotax system updated to account for the $300 charitable deductions under the CARES Act for those who take the standard deduction?

@bmatty wrote:

Thank you for this feedback. However, inputting the charitable donations does not change the amount of federal tax (in progress) turbotax says I owe, so perhaps the bug is still working there when someone takes a standard deduction.

It should change after you work all the way through the Deductions & Credits section or by the time you get through Federal Review.

Look at your Form 1040 on Line 10b is where the cash contribution is entered. It must be a cash contribution and not more than $300.

You can view your Form 1040 at any time. Click on Tax Tools on the left side of the screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the turbotax system updated to account for the $300 charitable deductions under the CARES Act for those who take the standard deduction?

I loaded the updates today, 1/22/21. The $300 still not showing on 1040!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the turbotax system updated to account for the $300 charitable deductions under the CARES Act for those who take the standard deduction?

@hundie6369 wrote:

I loaded the updates today, 1/22/21. The $300 still not showing on 1040!

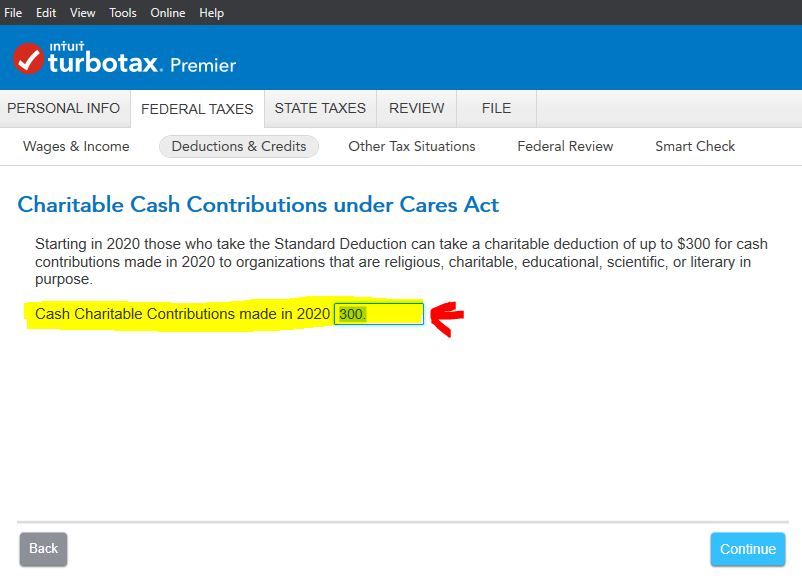

You have to complete the Deductions & Credits section. Then go through several screen until the program indicates you are receiving the Standard Deduction. The next screen asks for the charitable contribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the turbotax system updated to account for the $300 charitable deductions under the CARES Act for those who take the standard deduction?

Update: The above instructions are correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the turbotax system updated to account for the $300 charitable deductions under the CARES Act for those who take the standard deduction?

Is this question only asked in the Premier version? I purchased the Deluxe version and it has not popped up despite going through the Charitable Contributions section several times.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the turbotax system updated to account for the $300 charitable deductions under the CARES Act for those who take the standard deduction?

The Charitable Donation screen will come up in all versions of TurboTax. Here are the steps to follow with your Online Deluxe

Click Deductions and Credits

- Select Review/Edit

- Click Edit to the right of Standard Deduction Click OK, Sounds Good

- Click Wrap Up Tax Breaks

- Click Continue

- Make sure that $300 is filled in and then click Continue

- Click Lets Keep Going

Unlike a credit (which is a dollar-for-dollar reduction in the amount of tax you owe), a deduction impacts your tax liability differently depending on your tax bracket.

For example, an individual who falls into the 10 percent tax bracket would see a $30 change as a result of this deduction. For someone in the 37% bracket, however, the charitable contribution deduction this year would be worth $111.

The CARES Charitable Donation is a deduction, not a credit. That means that your tax bill will be computed as though you had made $300 less money in 2020. Your taxes will be reduced according to the tax bracket that you are in. If your income is in the 10% bracket, then your taxes will be reduced by 10% or $300 or $30.

A person in a higher tax bracket the deduction will be higher. If a person is in the 37% tax bracket, then their savings would be $111.

Tax Credits and Deductions explains the difference between these often confused terms.

@ nosandhokies

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the turbotax system updated to account for the $300 charitable deductions under the CARES Act for those who take the standard deduction?

I used the free version to file, last night, using the Standard Deduction, and was allowed to enter $300 of my church tithes and offerings. The glitch seems to have been fixed, at least for the Free Version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the turbotax system updated to account for the $300 charitable deductions under the CARES Act for those who take the standard deduction?

frustrating that TT has not fixed this bug yet, but I guess it's early - here's my experience that my help

I have the Deluxe version and have 220 of charitable deductions. Current 1040 indicates that I am taking the SD. The easiest thing to do is to use the 1040 Worksheet to Override that amount on Line 10b.

Interestingly, when I ran the Federal Review, one of the errors was "Charitable Deductions must be entered" with box 10b highlighted.

Nothing in the Charitable Contribution section which asks for any Cares Act stuff

I know, frustrating but an easy fix or wait and see if TT eventually fixes the bug

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the turbotax system updated to account for the $300 charitable deductions under the CARES Act for those who take the standard deduction?

think I have figured it out, unforetunately by trying a few things. I will try to explain how I got it to work because it is not very straight forward.

Do under Deductions & Creit in the Step by Step - you have 2 choices - Guide me through (or something) & I'll choose - select guide me through it

go through all questions and you'll choose Done with Deductions - it provides a summary of your tax situation, then if you choose "continue" it will say "We have chosen the Standard Deduction for you"

Hit continue again and it will bring you to the Cares Act contribution and hitting "continue" again - this should deduct the amou nt

hopefully this helps - way to much time spent for the amount of tax savings

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the turbotax system updated to account for the $300 charitable deductions under the CARES Act for those who take the standard deduction?

Different issue related to this. Turbo tax is suggesting I itemize and I want to itemize because Maryland does not recognize the federal standard deduction . So it says I should itemize but then includes the $300 and makes me take the Standard Deduction and it won't let me go back and change. Any advice

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the turbotax system updated to account for the $300 charitable deductions under the CARES Act for those who take the standard deduction?

The federal tax reform of 2017 significantly raised the federal standard deduction. Under current Maryland law, if you take the standard deduction the federal level, you cannot itemize at the Maryland level. You may take the federal standard deduction, while this may reduce your federal tax liability, it may result in an increase to your Maryland income tax liability.

Go back to Deductions & Credits in the Federal section and click on Wrap up tax breaks at the bottom. Look for the screen below and look above "Change my deduction" if you do not see the "You've chosen itemized deductions, so let's keep going and lock that in for you."- click on the "Change my deduction" and it will take you back to this screen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rtoler

Returning Member

bobking13

New Member

botin_bo

New Member

bkeenze1

New Member

Kh52

Level 2