- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: I am having trouble with the Teachers Expenses part of the process. There’s nowhere for me to...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am having trouble with the Teachers Expenses part of the process. There’s nowhere for me to enter how much I spent on classroom supplies.

@staceydyer1971 Not sure what your daughter has to do with the educator expense deduction. That deduction is for teachers who teach in K-12.

TEACHER EXPENSES

Go to Federal>Deductions and Credits>Employment Expenses>Teacher (Educator) Expenses

https://www.irs.gov/taxtopics/tc458

Are you confusing the educator expense deduction with education credits for a college student?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am having trouble with the Teachers Expenses part of the process. There’s nowhere for me to enter how much I spent on classroom supplies.

The problem she's having (and I am too) is that the SOFTWARE is confusing the two. We know the difference.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am having trouble with the Teachers Expenses part of the process. There’s nowhere for me to enter how much I spent on classroom supplies.

@HoneyBadger6198 wrote:

The problem she's having (and I am too) is that the SOFTWARE is confusing the two. We know the difference.

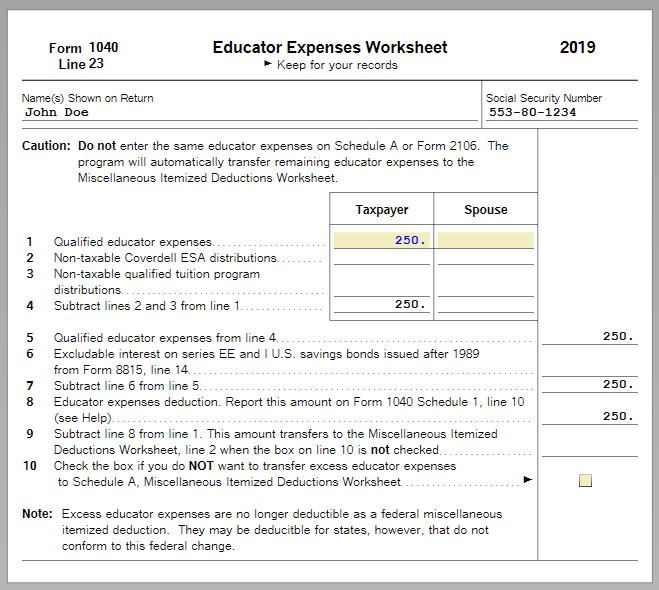

What are you seeing on the Educator Expenses Worksheet in Forms mode? This is what I have if just entering the expenses of $250 -

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am having trouble with the Teachers Expenses part of the process. There’s nowhere for me to enter how much I spent on classroom supplies.

Right, that works for most people including you, but not us. If we have a kid in college and we list those expenses it throws everything off. Those two should have nothing to do with each other, but the result is that thanks to Turbo Tax we could not claim the K-12 educator expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am having trouble with the Teachers Expenses part of the process. There’s nowhere for me to enter how much I spent on classroom supplies.

So you have Non-taxable Coverdell distributions ESA distributions or Non-taxable qualified tuition program distributions entered on the worksheet Lines 2 or 3 for the Taxpayer? If so, those should not be on the worksheet if you entered those distributions for the student and you were NOT the student.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am having trouble with the Teachers Expenses part of the process. There’s nowhere for me to enter how much I spent on classroom supplies.

OK, thanks. I've already done my taxes for this year, but I will certainly look into that for the next.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am having trouble with the Teachers Expenses part of the process. There’s nowhere for me to enter how much I spent on classroom supplies.

I am also having trouble with this. I can enter a value for my husband who is not an educator but I cannot enter anything in for myself. I also bought the program on disk. Not very happy with it this year. :(

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am having trouble with the Teachers Expenses part of the process. There’s nowhere for me to enter how much I spent on classroom supplies.

Same problem. The 529 distributions clearly show my child as the beneficiary and me as the recipient, but TTax desktop program is filling in the amount on the Educator Expenses worksheet as though they were for my unreimbursed classroom expenses instead of my child's tuition. This is for 2023.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am having trouble with the Teachers Expenses part of the process. There’s nowhere for me to enter how much I spent on classroom supplies.

2024 and I'm having the same problem. I have kids in college and 1099-q's listing them as the recipients for 2 and myself as the recipient for one. TT asked who it (the one with myself as recipient) was for and I picked the child. However, when I go to the form for educator expenses, it lists "non-taxable qualified tuition program distributions".

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

litzyrios13

Level 1

fldcdeb

Level 1

jonequest2

Level 2

madivicki13

New Member

Polywog1

Level 1