- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: How do I find the Recovery Rebate Credit for my 2020 taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I find the Recovery Rebate Credit for my 2020 taxes?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I find the Recovery Rebate Credit for my 2020 taxes?

The first Stimulus Check is really based on 2020 tax return. Any amount you already got will be reconciled on your 2020 return line 30. If you didn't get a Stimulus Check (and qualify) or you qualify for more it will be added to your 2020 return. But the good news is if they paid you too much they won't take it back.

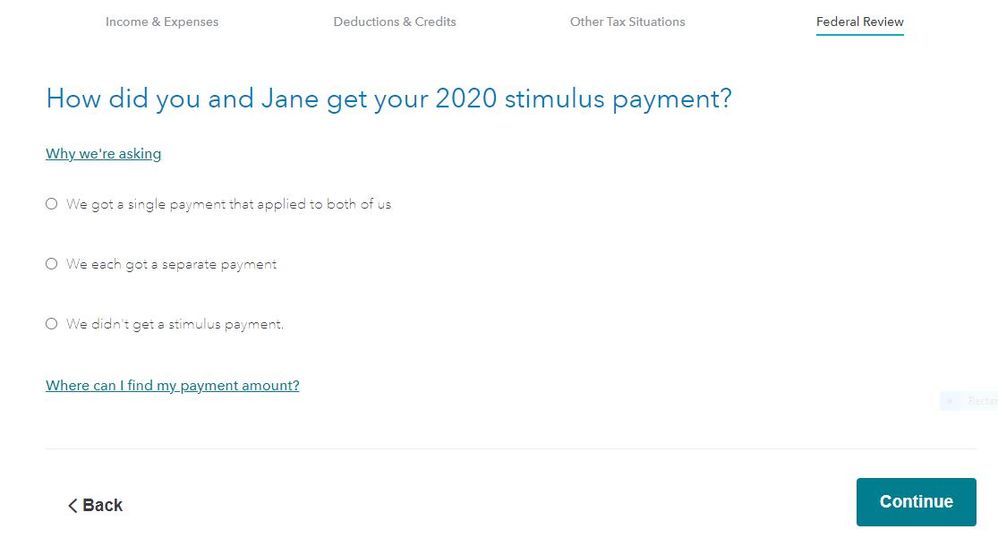

When you go through the federal review tab it will ask how much you got if any. Or to enter your stimulus payment in TurboTax, type "stimulus" (without the quotes) in the Search box, then click the link that says "Jump to stimulus."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I find the Recovery Rebate Credit for my 2020 taxes?

Thank you. I am interested in the newest Recovery Rebate Credit. Will that apply to 2020 taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I find the Recovery Rebate Credit for my 2020 taxes?

Go to this IRS website for stimulus information - https://www.irs.gov/newsroom/treasury-and-irs-begin-delivering-second-round-of-economic-impact-payme...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I find the Recovery Rebate Credit for my 2020 taxes?

Thank you. I did and it says to add to 2020 taxes if you don't receive the latest stimulus payment but I dn't see an option to do so.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I find the Recovery Rebate Credit for my 2020 taxes?

It will be included in the TurboTax program after the IRS gives guidance in adding the second stimulus to the Recovery Rebate Credit Worksheet—Line 30 of the Form 1040.

TurboTax currently asks about the stimulus payment received or not received in 2020 after completing the Other Tax Situations section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I find the Recovery Rebate Credit for my 2020 taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I find the Recovery Rebate Credit for my 2020 taxes?

It doesn’t give me the option to look over my federal taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I find the Recovery Rebate Credit for my 2020 taxes?

You can review your 1040 in the following steps:

- While in your TurboTax account, select Tax Tools in the left margin

- Select Tools

- Select View a Tax Summary

- In the left margin, select Preview my 1040

- The Recovery Rebate credit will be on line 30 of the 1040

With your increased refund, you can apply a portion to your 2021 taxes, purchase Savings Bonds, or split it for deposit into 3 different direct deposit accounts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I find the Recovery Rebate Credit for my 2020 taxes?

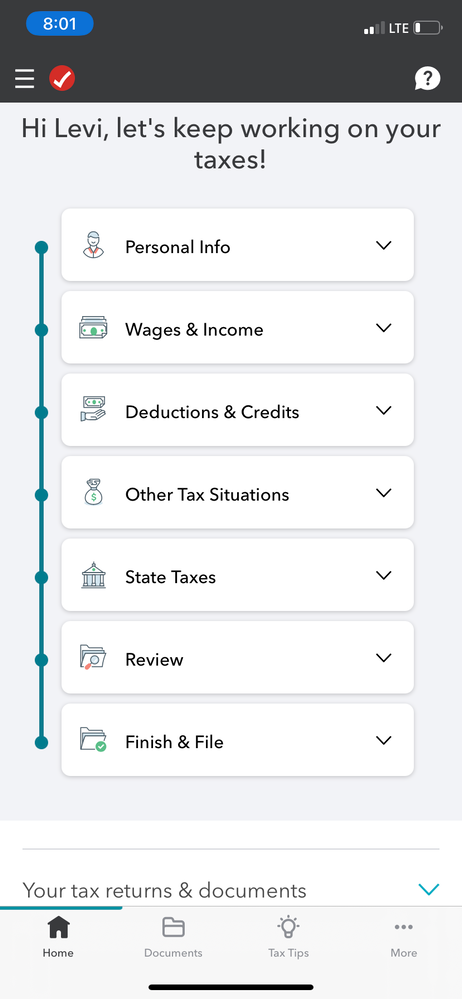

Try opening the menus using the 3 stacked lines in the top upper left. https://ttlc.intuit.com/community/accessing/help/how-do-i-preview-my-turbotax-online-return-before-f...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I find the Recovery Rebate Credit for my 2020 taxes?

I claimed my grandchild in 2019 and never received any stimulus for her. Her mother as a SSI non-filer tried to claim the stimulus and IRS said she was claimed by someone else. I have filed 2020 and turbo tax did not afford me the opportunity to claim the missing stimulus assuming I had what I was suppose to get. Help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I find the Recovery Rebate Credit for my 2020 taxes?

Are you claiming your grandchild in 2020?

The payments were an advance credit for 2020. 2019 information was used in sending out the payments since 2020 tax returns had not been filed at the point the stimulus payments were sent out. They are being reconciled when you do your 2020 return. In some cases, people may have been given a stimulus payment based on their 2019 dependents that did not qualify based on their 2020 dependents, and vice versa.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I find the Recovery Rebate Credit for my 2020 taxes?

Mine didnt show that and I never got my stimulus please tell me what I need to do thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I find the Recovery Rebate Credit for my 2020 taxes?

@osnoobz If you were due a stimulus payment and filed your tax return for 2020, you should get any stimulus payment due you when the IRS processes your return. Even if you entered the wrong amount of stimulus payments that you received on the tax return, it is likely that the IRS will correct the entry if necessary and add your stimulus payment to your refund.

If you receive your refund and see that it does not include your stimulus payment, then you can prepare an amended return in TurboTax to get your stimulus payment.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I find the Recovery Rebate Credit for my 2020 taxes?

Can I just say that TurboTax is a terrible service I am a college student who qualifies for the stimulus check but NOTHING about any stimulus, recovery rebate, Nothing came up when I filed my taxes and I did everything I've seen in this thread nothing works now everyone is getting their stimulus while I just got my normal tax return I am very frustrated because there is nobody I can call and there's nothing I can do. Also I never entered a wrong amount of stimulus because I got nothing about it on the tax return I searched up about an amended return and there are a ton of articles saying don't do it. Just terrible.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kac42

Level 2

Naren_Realtor

New Member

elliottulik

New Member

Garyb3262

New Member

nalee5

New Member