- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Generally, your LTC reimbursement is only taxable if they...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is long term care insurance reimbursement considered income?

I receive long term care checks and pay my son to take care of me.does he have to pay tax on that money

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is long term care insurance reimbursement considered income?

I rec reimbursement checks from my local ins co and pay my son to care for me .does he have to pay tax on that money

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is long term care insurance reimbursement considered income?

@Winifred65454 Your son pays taxes on that money if you want to take a medical deduction for having him as your caregiver.

If you do not want to take a medical deduction for the money that you have paid him then you may owe taxes on the money you receive from your insurance company.

Here are some answers on what a household employee is.

Here are the instructions on how to enter a household employee into TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is long term care insurance reimbursement considered income?

I rec reimbursement from my long term ins co and paid my wife.does she have to pay tax on that money

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is long term care insurance reimbursement considered income?

If you and your wife are filing a joint tax return then the long term care reimbursement belongs to both of you so it is not taxable for her. If you do not have medical deductions to match the insurance payouts then they can become taxable, however.

If you want your wife to be able to claim income and be a deduction against the long term care then you can set your wife up as a household employee just as @robertb1326 details above.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is long term care insurance reimbursement considered income?

If I'm reading the help documents, it states that for something to be a Qualified reimbursement, it must be for a licensed practitioner. If the care being provided is by a relative, in a home environment, is that not considered Qualified, and therefore no tax implications, so you would not put anything in the response to # of Days, Total Cost, or Total Reimbursement?

Appreciate any guidance you can provide.

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is long term care insurance reimbursement considered income?

Qualified LTC services are necessary diagnostic, preventive, therapeutic, curing, treating, mitigating, and rehabilitative services, and maintenance or personal care services required to treat a chronically ill individual under a plan of care prescribed by a licensed health care practitioner.

Personal care services performed by others can be included if a licensed health care practitioner prescribes a plan of care that includes those services.

See the Instructions for Form 8853 for more details.

If you received a Form 1099-LTC, enter it in TurboTax, as shown below:

- Less Common Income.

- Choose Miscellaneous Income, 1099-A, 1099-C / Start

- Scroll down to Long-term care account distributions (Form 1099-LTC), and continue to follow the prompts.

In most cases, long-term care insurance contracts are treated as accident and health insurance contracts. Amounts you receive from them (other than policyholder dividends or premium refunds) are excludable in most cases from income as amounts received for personal injury or sickness. See IRS Publication 525 for more information.

When you receive benefits under the policy, you can only deduct the medical expenses that exceed the insurance proceeds.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is long term care insurance reimbursement considered income?

My mother passed away last year (Jan 2023) but, she received LTC reimbursement in 2023 for expenses incurred in 2022. If the LTC provider sent her a 1099-LTC, will I need to complete a tax return for her for 2023?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is long term care insurance reimbursement considered income?

It depends on the total amount of income she recieved in 2023.

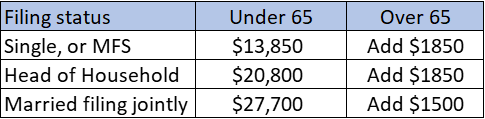

Just like anyone else, a deceased taxpayer's return must be filed if the total income exceeds the filing threshold for her filing status. See the chart below to find the amount of income that requires a return be filed.

If a final 1040 is required, you would include all income received before the date of death.

I am sorry for your loss. If you need additional help, or have more questions, please feel free to reach out again.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17521061672

New Member

mcfdlf

Level 1

in Education

ashley-evans2460

New Member

christinebradlee80

New Member

joseph-mcneil234

New Member