- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

It depends on the total amount of income she recieved in 2023.

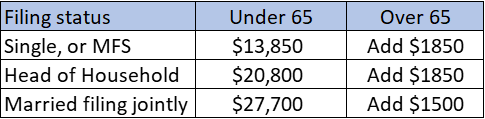

Just like anyone else, a deceased taxpayer's return must be filed if the total income exceeds the filing threshold for her filing status. See the chart below to find the amount of income that requires a return be filed.

If a final 1040 is required, you would include all income received before the date of death.

I am sorry for your loss. If you need additional help, or have more questions, please feel free to reach out again.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 24, 2024

3:12 PM