- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Dependents & College

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependents & College

Are they my dependents? I have two children that are 20 and attending college. Their father moved to another state in 2017, and they have lived with me full time. Since fall 2019, their father has paid 2/3 of their college room & board and college tuition. I pay the other 1/3 of their college room & board and college tuition, their permanent address is with me, and they live with me on college breaks, summer, etc (their college is 45 minutes away). Their father doesn't think I can claim them, but I meet the IRS Qualifying Child Requirements (Relationship, Age, Support, Residency and Qualifying Child) and believe I have the right to claim them as my dependents. They do not provide more than half of their support and they have part time jobs in the summer only.

Can they file their own tax returns to get the Recovery Rebate Credit? It is my understanding that they do not qualify for the Recovery Rebate Credit since I CAN claim them as my dependents, even if I don't.

Can they file their own tax returns (stating that someone else CAN claim them but won't) to get the American Opportunity Credit? They both had minimal part time jobs in 2020, with little or no federal income taxes taken out.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependents & College

You can and should claim them as dependents and claim the American Opportunity Credit.

They meet all the rules like you said; the rules for a parent to claim a college student are this:

- The student is under the age of 24 on Dec 31 of the tax year and;

- Is enrolled in an undergraduate program at an accredited institution and;

- Is a full time student for some part of 5 months during the year, and;

- the STUDENT did NOT provide more that 50% of the STUDENT’S support

They will not qualify for the Recovery Rebate Credit and they would not qualify for the American Opportunity Credit if they filed by themselves since they are your dependents.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependents & College

To clarify: their father paying 2/3 of their college tuition and room & board does not factor into their "dependent" status for me?

Our income is too high to receive any of the education credits. When creating a tax return for them within turbo tax, my dependents can select "someone else can claim me on their tax return" and "not one will claim me in 2020", and it gives them the American Opportunity Credit. If I didn't claim them, are they allowed to do this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependents & College

This is actually somewhat complicated and I confess to being unclear on the point.

IRS publication 501 says this in the section on special rules for children of divorced or separated parents.

Emancipated child. If a child is emancipated under state law, the child is treated as not living with either parent.

The age of emancipation is 18 in most states. The only state where a 20-year old is not emancipated is Mississippi (age 21).

This is example 5 on page 13, https://www.irs.gov/pub/irs-pdf/p501.pdf

Example 5—child emancipated in May.

When your son turned age 18 in May 2020, he became emancipated under the law of the state where he lives. As a result, he isn't considered in the custody of his parents for more than half of the year. The special rule for children of divorced or separated parents doesn't apply.

The same information is contained on page 10 of publication 504 which covers divorced and separated individuals.

https://www.irs.gov/pub/irs-dft/p504--dft.pdf

Now, my confusion comes from the question, If the special rules for divorced parents don't apply when the child turns 18, doesn't this mean that the normal rules apply instead? Everything in my logical mind says the normal rules still apply (which is also what @CatinaT1 indicated). However, publication 501 and example 5 are pretty clear that the normal rules don't apply for emancipated children of divorced or separated parents. And there is also nothing that says that the emancipation rule only applies in the year in which the emancipation occurs, and the normal rules apply in the following year.

Taking that statement at its word, neither parent can claim the child as a "qualifying child" dependent because the child does not live with either parent. However, they could be a "qualifying relative" dependent of either parent who provides more than 50% of their total support, because residency is not required for a qualifying relative dependent who is a biological child. (Total support includes tuition and college expenses but also room and board where they live. Just because the father pays 2/3 tuition doesn't necessarily mean he pays more than half their total support.). If they have their own taxable income more than $4300, they are disqualified from being a qualifying relative dependent no matter how much support they receive from either parent.

Assuming they have taxable income more than $4300, no one can claim them as a dependent and they answer "no" to the question, "Can another taxpayer claim you as a dependent?"

The effect of this is is that have to claim the AOTC, not you, and unless they have substantial income from working, they probably won't actually get any money from the AOTC. However, for 2020, it also means they will qualify for a recovery rebate on their tax returns. And it may give them better financial aid packages in the future.

@Hal_Al what do you think?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependents & College

@RK06 wrote:

To clarify: their father paying 2/3 of their college tuition and room & board does not factor into their "dependent" status for me?

Our income is too high to receive any of the education credits. When creating a tax return for them within turbo tax, my dependents can select "someone else can claim me on their tax return" and "not one will claim me in 2020", and it gives them the American Opportunity Credit. If I didn't claim them, are they allowed to do this?

First, read my longer answer on the emancipation rule.

If we ignore the emancipation rule and assume that normal rules apply then,

- your children can answer "yes" I can be claimed as a dependent and "no" the person who could claim me will not actually claim me.

- this will disqualify them from a recovery rebate but allow them to claim AOTC. (The situation where the parent's income is too high to claim the AOTC is the one time that second question--"will the person who could claim you actually claim you" makes a difference.

- as long as the children live in your home and don't provide more than half the own support, the amount of support provided by the other parent is irrelevant.

If we follow the emancipation rule, then

- your children answer "no" I can't be claimed as a dependent by another taxpayer. The second question won't even come up.

- As long as each child has taxable income more than $4300, support provided by either parent is irrelevant.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependents & College

I also need to update my answer above on the emancipation rule.

Emancipated child. If a child is emancipated under state law, the child is treated as not living with either parent

If the child is treated as not living with either parent, they can't be a "qualifying child" dependent of either parent. However, they could be a "qualifying relative" dependent of either parent who provides more than 50% of their total support, because residency is not required for a qualifying relative dependent who is a biological child. (Total support includes tuition and college expenses but also room and board where they live. Just because the father pays 2/3 tuition doesn't necessarily mean he pays more than half their total support.) They are, however, disqualified from being a qualifying relative dependent of anyone if they have taxable income more than $4300.

I will make a revision above as well.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependents & College

I have to admit I don't understand the emancipation rule. If they live with me full time when they aren't in school, and in 2020 it was for over 58% due to covid and college being closed, and they aren't paying for more than 50% of their support, how are they "emancipated"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependents & College

I also did some research with our state website, and it states that "You can't be legally emancipated after you are an adult."...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependents & College

@RK06 wrote:

I have to admit I don't understand the emancipation rule. If they live with me full time when they aren't in school, and in 2020 it was for over 58% due to covid and college being closed, and they aren't paying for more than 50% of their support, how are they "emancipated"?

Emancipated simply means, no longer under the legal control of their parents. Below the age of emancipation, children are considered legally incompetent to enter into binding contracts and handle their own affairs. Minor children may be unable to consent to medical procedures, get married, or do other things that require permission of a parent or guardian. Emancipation means they are of legal age and can make contracts, make medical decisions for themselves, and so on. It's about legal independence, not financial independence.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependents & College

@RK06 wrote:

I also did some research with our state website, and it states that "You can't be legally emancipated after you are an adult."...

Don't get yourself confused. Being a legal adult means you are emancipated. "Emancipation" also refers to a legal proceeding where a minor child can go to court and petition for an early emancipation -- to be released from their parent's control before the normal legal age -- due to abuse, financial mismanagement, or other reasons. When your state says "you can't be emancipated after you are a legal adult," another way of saying that is "you can't petition the court for early emancipation after you have been automatically emancipated by turning 18." In other words, you can't ask the court to do something that has already happened automatically.

The IRS is using the terminology to mean "once a child is a legal adult, these rules no longer apply."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependents & College

Thanks for all the information.

To clarify, are you saying that emancipation overrides letter b of the test below (from page 9 of your link) or that you're not sure if it overrides? If we look strictly at emancipation detail that would mean that no person over the age of majority could be claimed by their parent which contradicts the test.

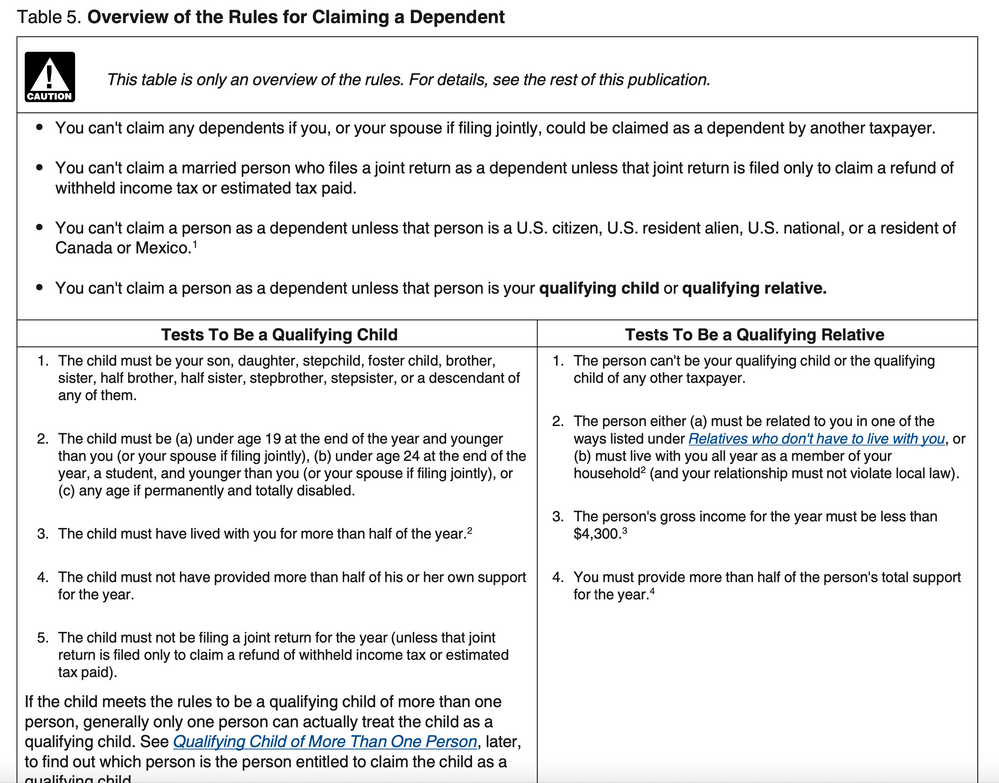

Test for qualifying child: "The child must be (a) under age 19 at the end of the year and younger than you (or your spouse if filing jointly), (b) under age 24 at the end of the year, a student, and younger than you (or your spouse if filing jointly), or (c) any age if permanently and totally disabled."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependents & College

@RK06 wrote:

Thanks for all the information.

To clarify, are you saying that emancipation overrides letter b of the test below (from page 9 of your link) or that you're not sure if it overrides? If we look strictly at emancipation detail that would mean that no person over the age of majority could be claimed by their parent which contradicts the test.

Test for qualifying child: "The child must be (a) under age 19 at the end of the year and younger than you (or your spouse if filing jointly), (b) under age 24 at the end of the year, a student, and younger than you (or your spouse if filing jointly), or (c) any age if permanently and totally disabled."

The emancipation test only applies to children of parents who are divorced or separated and share custody, not all children. See publication 501 page 13, starting with "Children of divorced or separated parents (or parents who live apart)." https://www.irs.gov/pub/irs-pdf/p501.pdf

The emancipation rule does not override the age test, it overrides the residency test. See #3 in the table below.

If the child is not considered to have lived with either parent, then neither parent meets test 3 and the child can't be a qualifying child dependent. They still could be a qualifying relative dependent, depending on their taxable income and who supports them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependents & College

The bottom line is fairly simple (despite the confusing wording).

The children cannot claim themselves and the stimulus/rebate credit because they qualify as the mother's Qualifying Child (QC) dependent (they live with her, they don't support themselves and they are Fulltime students under 24).

The father cannot claim them, as a qualifying relative, because they are the QC of another taxpayer (the mother). He cannot claim them as QC because they don't live with him and the special rules for divorced & separated parents no longer apply, due to emancipation.

The mother is allowed to forego the dependent, to allow the children to claim the tuition credit, but not the refundable portion.

@RK06 said " When creating a tax return for them within turbo tax, my dependents can select "someone else can claim me on their tax return" and "not one will claim me in 2020", and it gives them the American Opportunity Credit. If I didn't claim them, are they allowed to do this?

Yes & no. As previously stated they can claim the non refundable portion. There is a question in the personal info section that asks them if they provided more than half their own support with earned income. When they answer no, TurboTax will not give them the (up to) $1000 refundable portion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependents & College

@Hal_Al wrote:

The bottom line is fairly simple (despite the confusing wording).

The children cannot claim themselves and the stimulus/rebate credit because they qualify as the mother's Qualifying Child (QC) dependent (they live with her, they don't support themselves and they are Fulltime students under 24).

Why do they qualify as "qualifying children" when the rules specifically say that emancipated child "is treated as not living with either parent."

That's what I was asking about, not the AOTC rules.

If the children are counted as living with their mother (which they in fact did) then why is the emancipation rule quoted in pub 501 and 504? Why does that rule even exist? If the children are "treated as not living with either parent" then they can't be QC dependents of the mother and we have to look at the QR rules only.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependents & College

@Opus 17 said "Emancipated child. If a child is emancipated under state law, the child is treated as not living with either parent".

Not exactly. He is treated as not being in the "custody" of either parent. And, that is what makes the special rule (for separated parents) void. Once the child is emancipated, the parents can no longer split the tax benefits and the custodial parent can no longer release the exemption (dependency) to the non custodial parent. If the child physically lives with one of the parents, including temporary absence to attend college, the child is still the QC of that parent (the mother in this case).

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

berniek1

Returning Member

apena3

Level 1

qzhangny

New Member

in Education

westerman161

New Member

rmeades

New Member