- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@RK06 wrote:

Thanks for all the information.

To clarify, are you saying that emancipation overrides letter b of the test below (from page 9 of your link) or that you're not sure if it overrides? If we look strictly at emancipation detail that would mean that no person over the age of majority could be claimed by their parent which contradicts the test.

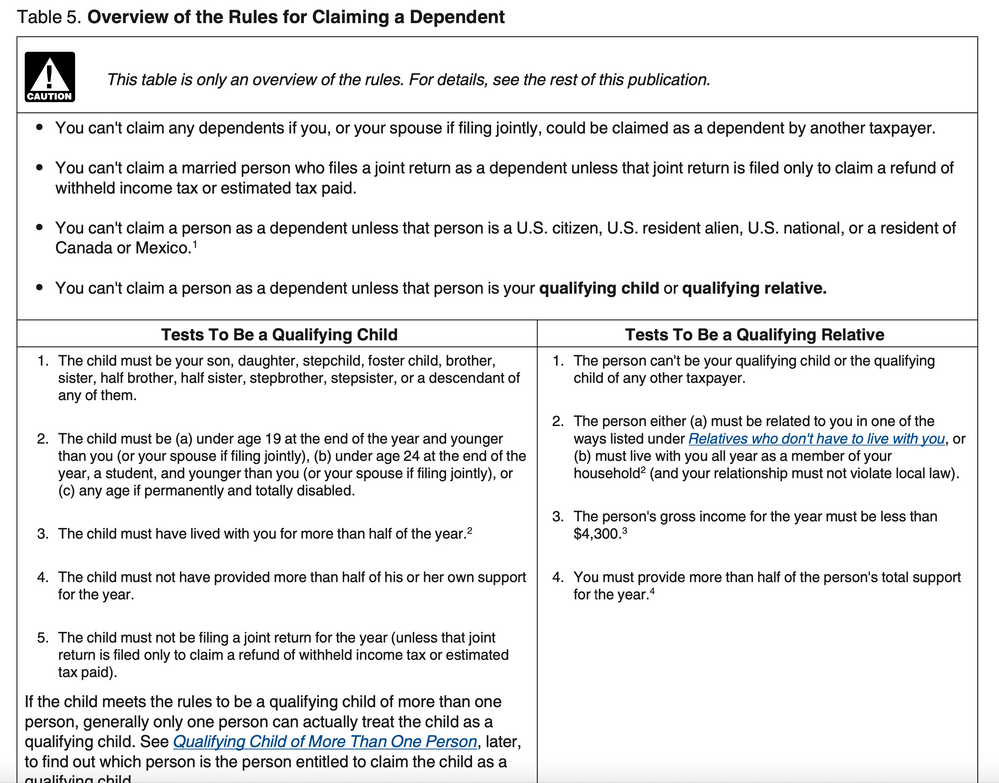

Test for qualifying child: "The child must be (a) under age 19 at the end of the year and younger than you (or your spouse if filing jointly), (b) under age 24 at the end of the year, a student, and younger than you (or your spouse if filing jointly), or (c) any age if permanently and totally disabled."

The emancipation test only applies to children of parents who are divorced or separated and share custody, not all children. See publication 501 page 13, starting with "Children of divorced or separated parents (or parents who live apart)." https://www.irs.gov/pub/irs-pdf/p501.pdf

The emancipation rule does not override the age test, it overrides the residency test. See #3 in the table below.

If the child is not considered to have lived with either parent, then neither parent meets test 3 and the child can't be a qualifying child dependent. They still could be a qualifying relative dependent, depending on their taxable income and who supports them.