- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Charitable contributions error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

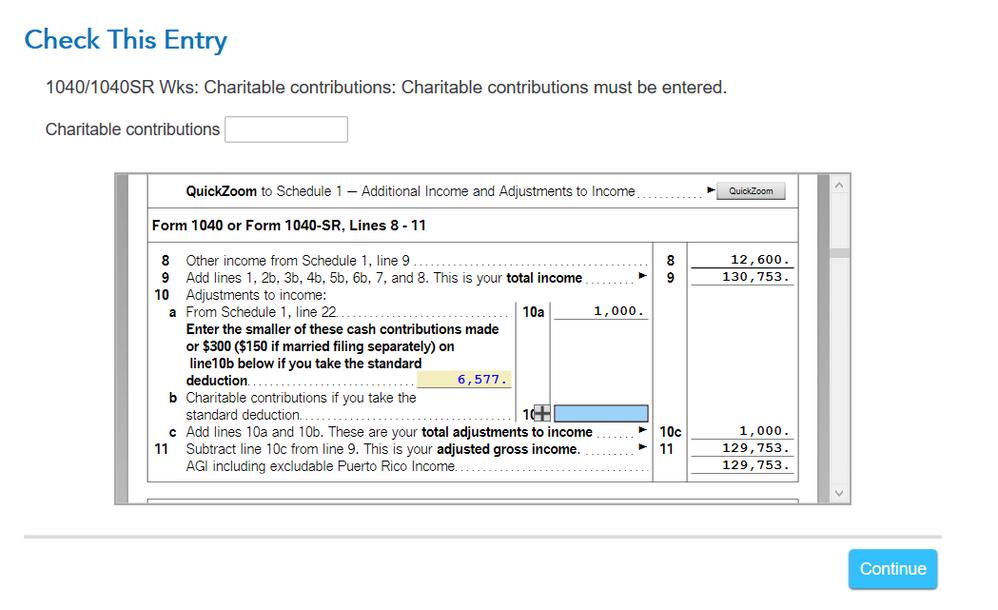

Charitable contributions error

see image below. Not sure what to enter. I think it's $25, that's the smallest cash contribution made. please advise.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

WAIT! You are getting the Standard Deduction. You must both be over 65. The Standard Deduction is 24,800+1,300 each = 27,400 for Joint. So go though the deduction section and enter your charity amounts. Then keep going and finish that section. It should say the Standard Deduction is right for you. Then it will add the amount to line 10b.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

are you itemizing? if so you don't get the page 1 deduction. if you aren't, despite what TT may say

10b has to be entered manually . note I use desktop version and found no matter how I entered contributions for schedule A nothing flowed to 10a or b

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

yes, our itemized deds is $27,400 (line 12, 1040), standard deds is $24,800. still not sure what to enter in line 10b?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

Enter nothing. You don't get a credit on that line. You are already taking it as part of your Itemized Deductions. You only get the extra on 10b if you are taking the Standard Deduction. And if you do qualify for an amount on 10b Turbo Tax will automatically fill it in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

WAIT! You are getting the Standard Deduction. You must both be over 65. The Standard Deduction is 24,800+1,300 each = 27,400 for Joint. So go though the deduction section and enter your charity amounts. Then keep going and finish that section. It should say the Standard Deduction is right for you. Then it will add the amount to line 10b.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

You're right VolvoGirl. I went thru the deductions again and it did use the standard deduction and posted $300 to line 10b. Thank You

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

This is not working for me. I am taking the standard deduction and entered my charitable contributions. This amount did not show up on 1040 line 10b or line 10c. I had to enter the amount on the 1040 worksheet.

Still the amount is not showing up on line 10c but the adjusted gross income is lower by that amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

Update - 1040 wks line 10b and line 10c is not being automatically updated after I enter the chariatable contributions. However 1040 line 10b and 10c is being updated with the worksheet 10b and 10c

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

To make sure all the forms are working as intended, please be sure that any overrides are deleted.

Second, the order of operations to get the above-the-line deduction requires you to recalculate your tax breaks before the CARES Act Charitable Donation screen will be prompted. Only qualifying contributions will be included.

To qualify for the above-the-line charitable donation deduction, the IRS clarifies that the contribution must be:

- a cash contribution;

- made to a qualifying organization;

- made during the calendar year 2020

To do this in TurboTax CD/Download, go to Deductions & Credits and select I'll choose what I work on.

- First, enter in the charitable donation amount as you normally would in the Charitable Donations section of Deductions & Credits.

- When finished entering all donations, select Done with Charitable Donations and Continue.

- Scroll to the end of the Deductions & Credits page and select Done with Deductions.

- You may need to respond to any other additional questions. You will eventually see: The Standard Deduction is Right for You!

- Click Continue

- Now, you will see Charitable Cash Contributions under Cares Act where you will see any qualified contribution amount already entered from your earlier posts. Select Continue.

When I tested this, I did get the worksheet and Form 1040 to be in agreement.

For more information, see IRS Charitable Contributions Deductions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

Thanks for the reply and support!

My Bad I did not properly follow thru with selecting Done and now it is working OK

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

The TurboTax form 1040 [after Feb-5 update] says limit is $300 for MFJ when not itemizing. Actually it was raised to $600 for MFJ. The limit is $300 for an individual. So it should NOT report an error for amounts over $300.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

@mark-D1 wrote:

The TurboTax form 1040 [after Feb-5 update] says limit is $300 for MFJ when not itemizing. Actually it was raised to $600 for MFJ. The limit is $300 for an individual. So it should NOT report an error for amounts over $300.

The maximum is $300 on a 2020 tax return.

IRS Form 1040 (2020) Instructions page 29 - https://www.irs.gov/pub/irs-pdf/i1040gi.pdf#page=29

Line 10b

If you don't itemize deductions on Schedule A (Form 1040), you (or you and your spouse if filing jointly) may be able to take a charitable deduction for cash contributions made in 2020.

Enter the total amount of your contributions on line 10b. Don't enter more than:

• $300 if single, head of household, or qualifying widow(er);

• $300 if married filing jointly; or

• $150 if married filing separately.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

So, I went to the link and was surprised. As I track back what I saw, is it for tax year 2021 [not reporting 2020 taxes] that it is $300 per person?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

For tax year 2021 it would be a max of $600 if filing as Married Filing Jointly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

I am struggling with this for a week now.

I am single and head of household

getting the standard deduction

under deductions & credits - Charitable cash contributions under cares act

I enter 250.00

I then go into review and get error: Cash Charitable is too Large

on check this entry this entry looks like this:

line 10

box 10a - 1837.00

then a box to the left and in the middle of 10a and 10b which states enter the smaller of these cash contributions made or 300.00 (150.00 if married) on line 10b below if you take standard deduction - which has the 250.00 in this box

box 10b has 250.00

What am I doing wrong and how do I fix this

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17729212199

New Member

Fun_with_Taxes

Returning Member

lookto0411

New Member

kjp3070

New Member

mkhalbert

New Member