- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: CARES Act payments for first-time filing daughter

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CARES Act payments for first-time filing daughter

My daughter filed her own tax return for the first time last year (for 2019), as a single filer, not as always before as a dependent. We of course did not get a CARES Act stimulus payment (the first one, in April 2020) for her as she was over the cut-off age limit and the IRS would only have known her as a dependent at that time (her tax return was only filed in June). But now that I'm preparing her 2020 return, shouldn't there be somewhere on that regarding the 2020 stimulus payments (I just went through TT's process online and there was nothing), or does the IRS just recognize that she was not a dependent in 2020 and send the payment without being asked?

Thanks

PS Sorry if this is not the right forum, please direct me to the correct one if not

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CARES Act payments for first-time filing daughter

She should have completed the section at the beginning of the Federal review for the Recovery Rebate Credit.

The amount of the Rebate Recovery Credit is based upon her actual 2020 income tax return she files. Therefore, if she meets the criteria for the credit, she will receive it when she prepares her 2020 income tax return. The credit is intended to give those who should have received a stimulus payment but never did a tax credit on their tax returns. Any excess credit is then refunded to you if there is an overpayment on your tax return.

Please see the attached link for more information on who can claim the credit.

Recovery Rebate Credit eligibility

When you prepare her 2020 income tax return, be sure to do the following to ensure the credit is calculated correctly on her income tax return.

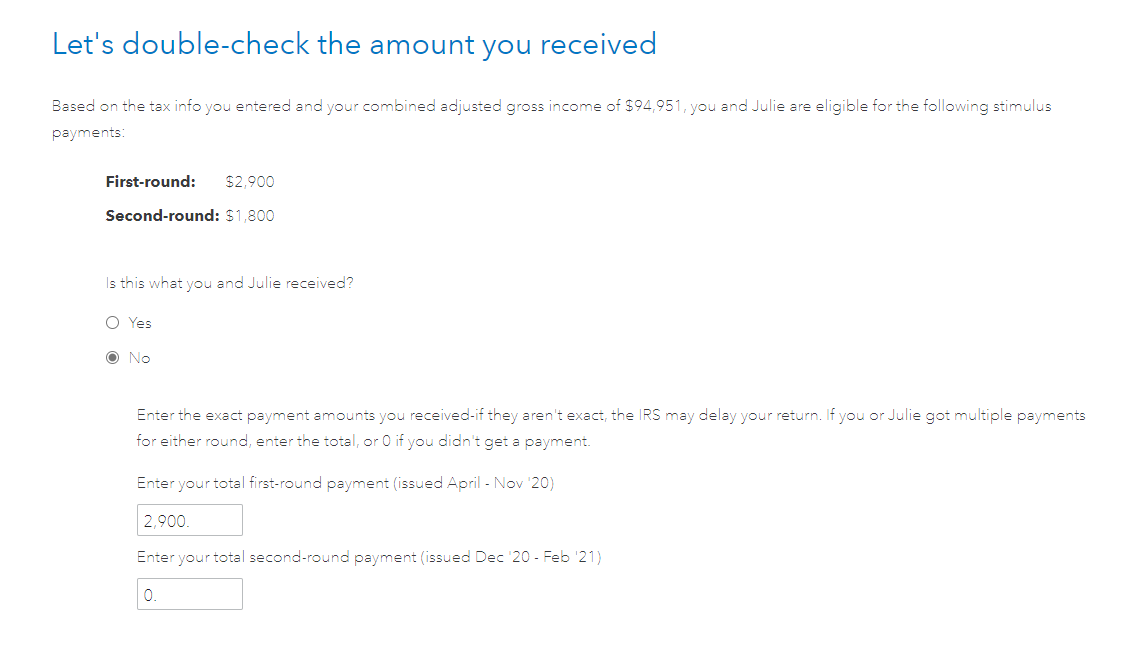

- In the Federal section, select the Federal Review interview section at the top of the screen.

- This will take you to the input section for the Recovery Rebate credit.

- Be sure to indicate the actual amount of each stimulus payment she received on the page that asks if she received a stimulus payment.

- There will be two boxes and both need to be completed. If she did not receive any stimulus payments, please indicate zero for both boxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CARES Act payments for first-time filing daughter

Thanks, I'll follow those leads and see what happens.

One question though - does it make a difference if I check the box saying she "can" be claimed as a dependent even if we're not going to?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CARES Act payments for first-time filing daughter

Yes, it will make a difference. If you check the box saying she ''can'' be claimed as a dependent, TurboTax will not allow her to take the Recovery Rebate. You can search for stimulus then use the Jump to stimulus link to be taken to the questions. If you mark the box, the questions will not appear and you need to answer those questions to get the Recovery Rebate amount to show up on Line 30 of her Form 1040.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CARES Act payments for first-time filing daughter

Thanks, I figured that had to be why the questions weren't showing at all.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Foxylady 69

New Member

pgpg

Level 1

studio-re-design

New Member

in Education

gmesward

New Member

Ockham

Level 2