- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

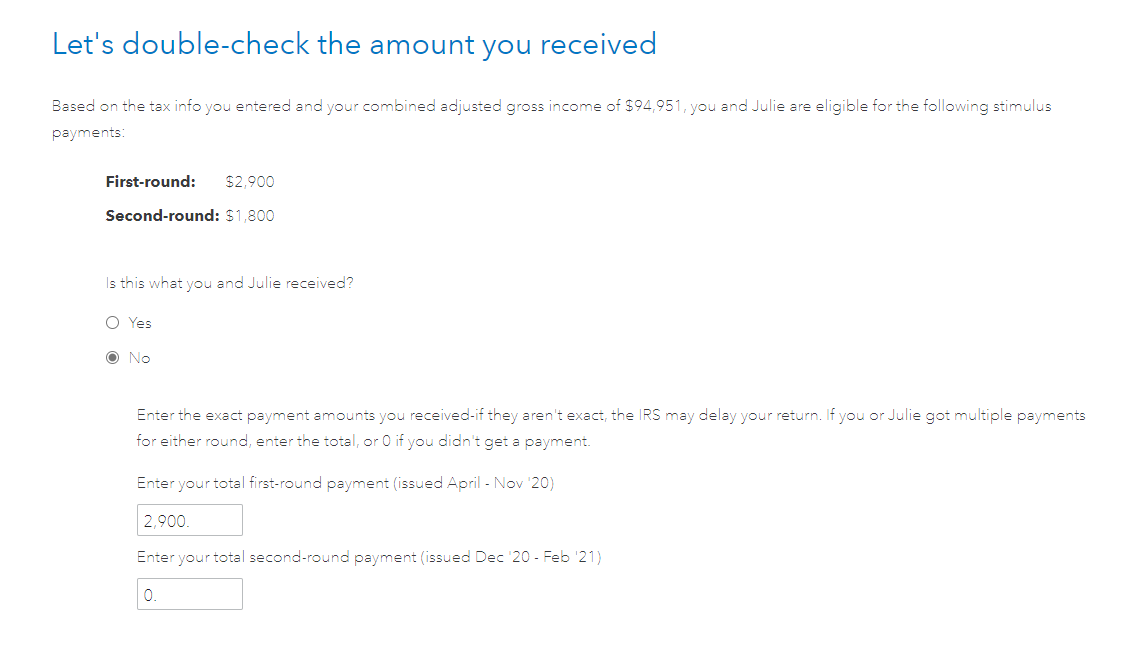

She should have completed the section at the beginning of the Federal review for the Recovery Rebate Credit.

The amount of the Rebate Recovery Credit is based upon her actual 2020 income tax return she files. Therefore, if she meets the criteria for the credit, she will receive it when she prepares her 2020 income tax return. The credit is intended to give those who should have received a stimulus payment but never did a tax credit on their tax returns. Any excess credit is then refunded to you if there is an overpayment on your tax return.

Please see the attached link for more information on who can claim the credit.

Recovery Rebate Credit eligibility

When you prepare her 2020 income tax return, be sure to do the following to ensure the credit is calculated correctly on her income tax return.

- In the Federal section, select the Federal Review interview section at the top of the screen.

- This will take you to the input section for the Recovery Rebate credit.

- Be sure to indicate the actual amount of each stimulus payment she received on the page that asks if she received a stimulus payment.

- There will be two boxes and both need to be completed. If she did not receive any stimulus payments, please indicate zero for both boxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"