- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Can I deduct the registration fee for a boat while living in South Carolina? Also, are the property taxes paid on the boat and jet skis deductible?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct the registration fee for a boat while living in South Carolina? Also, are the property taxes paid on the boat and jet skis deductible?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct the registration fee for a boat while living in South Carolina? Also, are the property taxes paid on the boat and jet skis deductible?

As long as the personal property tax is based on the value of the vehicle, then it would be deductible on your return.

Currently only the following states charge a fee based on the vehicle value:

Alabama

Arizona

Arkansas

California

Colorado

Iowa

Indiana

Kentucky

Louisiana

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hampshire

South Carolina

Washington

Wyoming

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct the registration fee for a boat while living in South Carolina? Also, are the property taxes paid on the boat and jet skis deductible?

Click on the ? mark next to Personal Property Taxes to learn more about the deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct the registration fee for a boat while living in South Carolina? Also, are the property taxes paid on the boat and jet skis deductible?

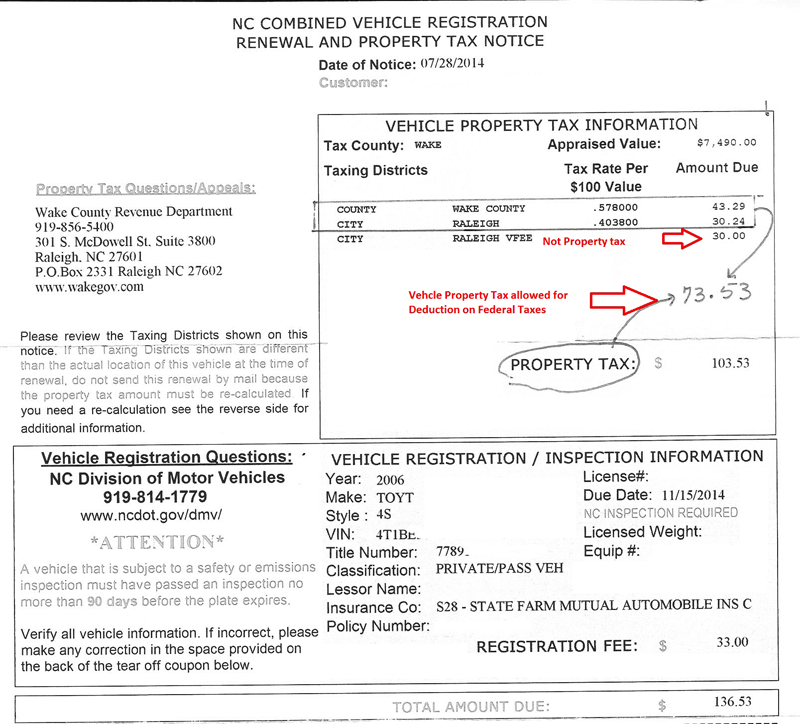

...add North Carolina after New Hampshire.

...at one time, TTX didn't include NC in their list...even though the vehicle property tax did exist. I think because they didn't se it was a separate county-charged bill, but they've long since added it to the regular DMV registration billing

________________

Example:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct the registration fee for a boat while living in South Carolina? Also, are the property taxes paid on the boat and jet skis deductible?

Thank you, but my question was related to SC not NC.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct the registration fee for a boat while living in South Carolina? Also, are the property taxes paid on the boat and jet skis deductible?

......that post was to update Critter's list.

Unlikely that anyone from SC will see this,

..............but IF you have a SC boat/Jet ski registration or tax bill that shows that part of it is a tax based on the current value of the boat or jet ski, then it is a property tax that can be entered as a potential deduction.

Flat yearly registration fees are not property taxes...note in the NC example I showed anyhow.....how the bill shows a tax rate per $100 valuation ? That is a property tax.

(the billing itself mis-labels the city flat fee as a property tax, and that part is NOT)

You need to look at your own billing to see what's in it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct the registration fee for a boat while living in South Carolina? Also, are the property taxes paid on the boat and jet skis deductible?

Thanks for the response. In SC, they separate the registration fees from the property tax. So my question is related specifically to the registration fee for a boat - not the property tax paid on the boat. The registration fee is a flat fee, not based on the boat's value whereas the property tax amount is based on the boat's value. Can the registration fee for the boat be deducted?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct the registration fee for a boat while living in South Carolina? Also, are the property taxes paid on the boat and jet skis deductible?

No...that separate registration fee cannot be used as a deduction.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

realestatedude

Returning Member

Shogun159

Level 3

AndrewA87

Level 4

trjpkhouse

Level 2

cindy-zhangheng

New Member