- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Not able to e-file due to simplified AMT foreign tax credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not able to e-file due to simplified AMT foreign tax credit

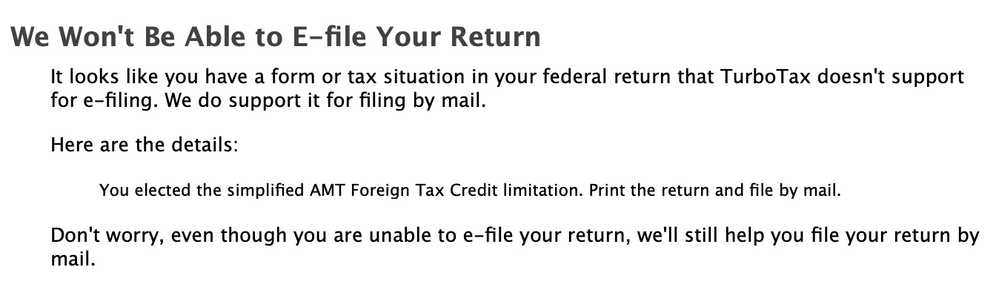

I'm getting the following message:

We Won't Be Able to E-file Your Return

You elected the simplified AMT Foreign Tax Credit limitation. Print the return and file by mail.

My situation is not much different from last year, and I was able to e-file then. What could be causing this, and is there a way to fix it?

I tried going back in the questions, but got to a page that says I used the simplified method last year and must continue to use it.

It seems quite odd that I would not be able to e-file in my situation.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not able to e-file due to simplified AMT foreign tax credit

I'm a "survivor" from that thread. Basically, if you use the simplified AMT Foreign Tax Credit, TurboTax cannot efile your taxes. The IRS made a field required this year, and TurboTax needs to update their software to handle it, but they have decided not to (and their support is mostly really terrible, rude, incompetent, and liars - they definitely won't be able to help you with this issue).

Before a recent update, TurboTax used to allow you to actually e-file with simplified AMT Foreign Tax Credit, but it'd get quickly rejected by the IRS because of that required field. After weeks of waiting and a 15+ page thread, their "solution" was to update the software to block you from e-filing. Seems pretty clear to me that they're not going to fix it.

According to the IRS, it sounds like they'll change it back next year; so hopefully it'll work again for 2021 taxes. Perhaps that's also why TurboTax decided not to bother fixing it 🙄.

I filed by mail earlier this week and asked TurboTax for a refund of my state e-filing fee, though it's been almost a week without a response...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not able to e-file due to simplified AMT foreign tax credit

Regarding my decision to use the non-simplified Form 1116-AMT:

1. I tried looked at all three of the non-AMT, the simplified-AMT, and the non-simplified-AMT. Each gave a different number for the maximum allowed credit, but since all were greater than my foreign taxes it did not affect my bottom line.

2. The non-simplified method did not require any more input on my part than the simplified method. Turbotax did all the calculations, mostly involving picking some numbers from my Form 6251 instead of from my 1040 and using them in calculations with some different parameters.

3. My return was accepted!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not able to e-file due to simplified AMT foreign tax credit

There are e-file issues with the Form 1116 in general. Please sign up for notification here: Form 1116 reject error

[Edited 4/6/2021 3:44 PM]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not able to e-file due to simplified AMT foreign tax credit

I am having the same exact issue. Do I understand correctly that the 1099-DIV fix that you're working on will correct this and allow for e-file?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not able to e-file due to simplified AMT foreign tax credit

I also have this same issue, in addition, California requires that I e-file based on a previous year, but TurboTax desktop will not let me file-by-mail for federal and e-file for state. Am I stuck until one of these are patched?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not able to e-file due to simplified AMT foreign tax credit

I am having the exact same problem. Earlier in the year (mid February) I do not believe I was having this problem as it appeared that all the checks were successful and I stopped short of efiling as I was waiting for one more 1099 to arrive. Now it appears that I can not efile. I get a screen that says I need to fix this problem during the 'complete check' review, which I do not recall seeing before.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not able to e-file due to simplified AMT foreign tax credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not able to e-file due to simplified AMT foreign tax credit

It seems counterproductive to have everyone with this issue (4 people so far) contact support individually. It would be best if Support can update this thread directly so that everyone following it is aware of the latest.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not able to e-file due to simplified AMT foreign tax credit

Also experiencing the same issue, and just spent 2 hours on the phone with multiple agents. When will this be resolved?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not able to e-file due to simplified AMT foreign tax credit

I am experiencing the exact same issue. I do not have any issue with 1099-DIV. I live overseas and all income is foreign-earned. I have e-filed many years with no issue, but when I try to file this year I get the same error message stating Turbotax can't handle AMT simplified method for Form 1116, requiring paper filling. Clearly there is a glitch. This is extremely frustrating and really the customer service being provided has been extremely unhelpful/unsupportive

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not able to e-file due to simplified AMT foreign tax credit

I have contacted and they have no solution. Hopeless!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not able to e-file due to simplified AMT foreign tax credit

Same -- Calling from overseas at great expense. No one can provide assistance except to say, perhaps try deleting form 1116 and all inputs and try to manually complete the form again. Extremely frustrating as you are unable to make an electronic payment without e-filing, and living overseas limits the ability to make electronic payments without huge fees

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not able to e-file due to simplified AMT foreign tax credit

I have done that and spent an hour on the phone at my expense (calling from overseas) without any resolution. There's clearly a glitch here and TT needs to resolve this

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not able to e-file due to simplified AMT foreign tax credit

Me, too. Rejected merely because I have to use the Simplified AMT FTC form. The 1116 seems to be ok, but not the AMT version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not able to e-file due to simplified AMT foreign tax credit

It looks like that same issue is being discussed on this thread. However, that's a super long thread that seems to discuss several different issues at the same time, so it's quite confusing. It's marked as Solved, but I couldn't really see any solution there...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not able to e-file due to simplified AMT foreign tax credit

I'm a "survivor" from that thread. Basically, if you use the simplified AMT Foreign Tax Credit, TurboTax cannot efile your taxes. The IRS made a field required this year, and TurboTax needs to update their software to handle it, but they have decided not to (and their support is mostly really terrible, rude, incompetent, and liars - they definitely won't be able to help you with this issue).

Before a recent update, TurboTax used to allow you to actually e-file with simplified AMT Foreign Tax Credit, but it'd get quickly rejected by the IRS because of that required field. After weeks of waiting and a 15+ page thread, their "solution" was to update the software to block you from e-filing. Seems pretty clear to me that they're not going to fix it.

According to the IRS, it sounds like they'll change it back next year; so hopefully it'll work again for 2021 taxes. Perhaps that's also why TurboTax decided not to bother fixing it 🙄.

I filed by mail earlier this week and asked TurboTax for a refund of my state e-filing fee, though it's been almost a week without a response...

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

girigiri

Level 3

dezquerro

Returning Member

blueeyes3079

New Member

aprilshowersrt75

New Member

gingersnap2

New Member