- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Mortgage Interest Calculation problems?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Calculation problems?

I have entered all of my 1098 forms and I am having a difficulty understanding the calculations. We financed our home twice during 2020 (due to increasing lower interest rates). On our second refinance, our principle home loan value was higher ($420,000) than at the time of our first refinance (~$415,000) due to the taxable value on our home being reassessed, and needing to add extra money to the loan to cover the increased escrow amount (our home taxes were due the month following this second refinance).

Upon entering the second refinance information (and subsequent loan transfer) the mortgage interest from these 1098s is REDUCING the amount of mortgage interest we can actually claim (I have about $15000 in total mortgage interest, but the calculation is only showing about $5400).

I have entered all 1098 forms (the refinances and 1098s associated with the home loan transfer to other lenders) in the order which they occurred. I am unsure why our total mortgage interest is lowered after I enter the second refinance information. We did not take any cash out as part of the refinances, but it seems as if the calculator is treating it that way.

Could someone provide me some assistance with this issue?

Thanks for your assistance!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Calculation problems?

Some TurboTax customers are experiencing an issue with their Home Mortgage Average Balance. This can cause in the the Home Mortgage Interest to be incorrectly limited.

If you're experiencing the issue above, please go here to receive email notifications when any updates related to this issue become available.

Or you can try this work around in the meantime:

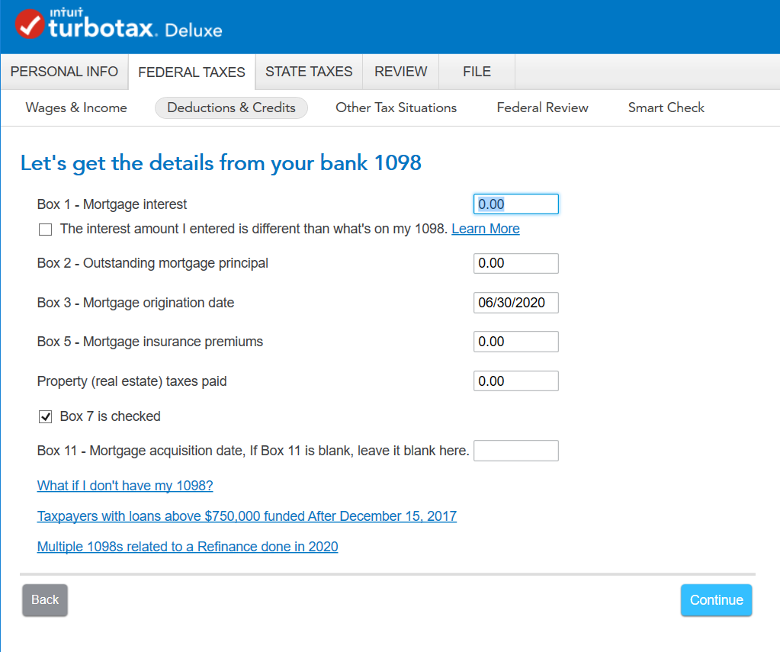

steps to enter your mortgage information:

- Gather all of your 1098 forms related to your refinance (the form from your original lender and the form from your new lender)

- Grab a calculator and add together the box 1 amount from each form. Enter the total in TurboTax as Box 1 Mortgage interest.

- Add the Box 5 amount from each form and enter the total as Box 5 Mortgage insurance premiums. (If you weren’t required to pay mortgage interest, these boxes will be blank on your forms and you won’t enter anything.)

- Add the property tax paid from each form and enter it in the Property (real estate) taxes box.

Next, finish adding info for boxes 2, 3, 7, and 11 using Form 1098 for the original loan.

What if I have more than two 1098s?

You should combine all of the 1098s directly related to the refinance and enter it as one 1098. An example of this is if you refinanced two loans into one loan. Any 1098s not directly related to the refinance should get entered separately.

What if I paid points?

Points on Loans Paid Off in 2020: Enter the points on your 1098 you have started and mark you paid off the loan when promoted.

Points on Loans on New Loans: You will want to enter a separate 1098 to cover these points paid. When prompted, enter 0.00 for Boxes 1, 2, 5, and the Property (real estate) taxes box, and checkbox 7, as you’ve already entered the details on your first 1098. For Box 3, add the date in 2020 when the loan originated.

WHERE TO ENTER THE LOOK BACK CREDIT

If you're referring to the IRS Taxpayer Certainty and Disaster Tax Relief Act of 2020 EIC special look back provision, see the steps below.

- Type EIC in the search and select the Jump to.

- Continue with the onscreen interview until you get to the Do you want to use last year's earned income? screen.

- Continue with the onscreen interview until complete.

Per IRS: If your earned income was higher in 2019 than in 2020, you can use the 2019 amount to figure your EITC for 2020. This temporary relief is provided through the Taxpayer Certainty and Disaster Tax Relief Act of 2020.

Note: If you earned income was higher in 2020 versus 2019, you won't be able to use the EIC special look back.

On the Tell us about any points paid to bank screen, answer in regards to the new loan when asked about points.

On the Tell us about any points paid to bank screen, answer in regards to the new loan when asked about points If your total home debt is under $375,000 ($250,000 for married filing separate) there is nothing new for you to do in 2020. Enter each 1098 as you normally would.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Calculation problems?

I followed the steps provided above and run into the same problem as before (the total amount of mortgage interest deduction is being reduced due to the outstanding mortgage principle being higher than at the start of the year).

Is this normal practice despite me not having actually taking money out during the refinance? The difference in mortgage interest is the difference between taking the standard deduction, or having an additional few thousand dollar tax basis removed.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Calculation problems?

Could you provide further explanation into my specific situation? After following the directions you provided, I am still encountering an issue where the second refinance is REDUCING my mortgage interest deduction.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Calculation problems?

Certainly, I think the outstanding balances is making your total Loan balance exceed the $750,000 maximum. Read the following instructions but I think the only change you will need to make is the Loan Balances. You have to show the paid off loan balances as $0. The only balance should be for the new loan. For clarity, please read this:

If there is a refi and there was an outstanding mortgage principal listed in both of them on Line 2 on the 1098. When you do put an outstanding balance in both forms, then the program adds them together and if that number is greater than $750k, then it puts you in the category to "limit interest". To get that to go away, you need to go back to the deductions section and click on "edit" mortgage interest statement. Change the line 2 of the mortgage that you no longer owe on (like the one that you refinanced and paid off) to a 0 (zero) because you have refinanced out of that loan and no longer have an "outstanding mortgage principal". Once you change one of them to zero (the one that was paid off by the refinance) then it should no longer pop up with that error at the end when you go to file.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Calculation problems?

Hi @Cynthiad66

Thanks for your help. I'm having the same exact problem described by others, and am trying to implement your solution.

When entering a value of $0.00 on line 2 for my original mortgage, Turbo Tax tells me (in red font), "Outstanding mortgage principal must have a value." What am I doing wrong? It appears that Turbo Tax requires that line 2 is greater than 0 when entering a non-zero value in line 1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Calculation problems?

In the Box 2 amount for the mortgage that is paid off use $1 instead of a zero and this should allow you to proceed. Please update here is you continue to experience problems.

This link may also be helpful for your experience. What to do if I have multiple 1098s

NOTE: If the amount of your mortgage is more than the cost of the home plus the cost of any substantial improvements, only the debt that isn't more than the cost of the home plus substantial improvements qualifies as home acquisition debt. This means that if 'cash out' proceeds were not used to improve the home they would not be part of home acquisition debt.

Any additional debt not used to buy, build, or substantially improve a qualified home isn't home acquisition debt. TurboTax will calculate the amount of allowed mortgage interest deduction based on your entry or you can choose to make the entries yourself.

- To review the information and worksheets you can use this link: IRS Publication 936, page 12

[Edited: 02/28/2021 | 8:55a PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

christoph-hammer

New Member

RJEFFS

New Member

Mike6174

Level 2

ardilla123

New Member

bryan-tansill

New Member