- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Some TurboTax customers are experiencing an issue with their Home Mortgage Average Balance. This can cause in the the Home Mortgage Interest to be incorrectly limited.

If you're experiencing the issue above, please go here to receive email notifications when any updates related to this issue become available.

Or you can try this work around in the meantime:

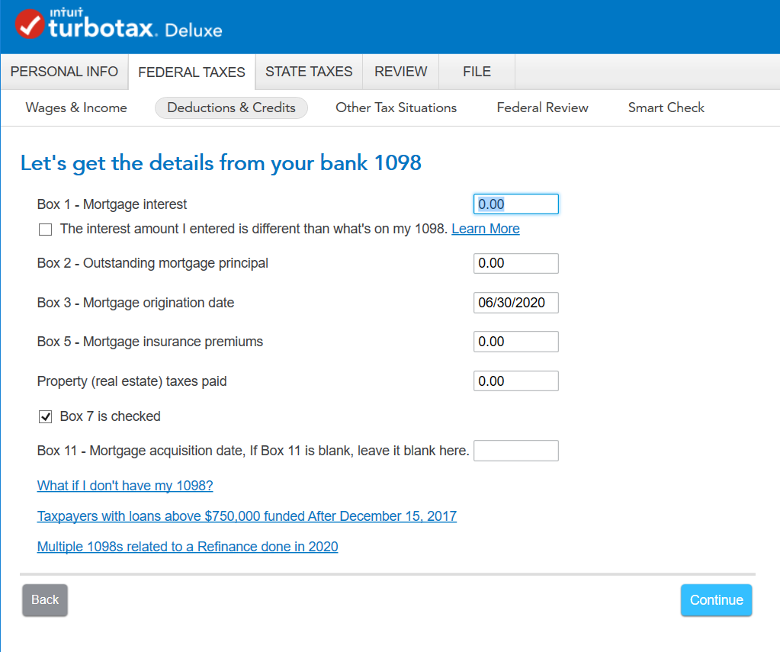

steps to enter your mortgage information:

- Gather all of your 1098 forms related to your refinance (the form from your original lender and the form from your new lender)

- Grab a calculator and add together the box 1 amount from each form. Enter the total in TurboTax as Box 1 Mortgage interest.

- Add the Box 5 amount from each form and enter the total as Box 5 Mortgage insurance premiums. (If you weren’t required to pay mortgage interest, these boxes will be blank on your forms and you won’t enter anything.)

- Add the property tax paid from each form and enter it in the Property (real estate) taxes box.

Next, finish adding info for boxes 2, 3, 7, and 11 using Form 1098 for the original loan.

What if I have more than two 1098s?

You should combine all of the 1098s directly related to the refinance and enter it as one 1098. An example of this is if you refinanced two loans into one loan. Any 1098s not directly related to the refinance should get entered separately.

What if I paid points?

Points on Loans Paid Off in 2020: Enter the points on your 1098 you have started and mark you paid off the loan when promoted.

Points on Loans on New Loans: You will want to enter a separate 1098 to cover these points paid. When prompted, enter 0.00 for Boxes 1, 2, 5, and the Property (real estate) taxes box, and checkbox 7, as you’ve already entered the details on your first 1098. For Box 3, add the date in 2020 when the loan originated.

WHERE TO ENTER THE LOOK BACK CREDIT

If you're referring to the IRS Taxpayer Certainty and Disaster Tax Relief Act of 2020 EIC special look back provision, see the steps below.

- Type EIC in the search and select the Jump to.

- Continue with the onscreen interview until you get to the Do you want to use last year's earned income? screen.

- Continue with the onscreen interview until complete.

Per IRS: If your earned income was higher in 2019 than in 2020, you can use the 2019 amount to figure your EITC for 2020. This temporary relief is provided through the Taxpayer Certainty and Disaster Tax Relief Act of 2020.

Note: If you earned income was higher in 2020 versus 2019, you won't be able to use the EIC special look back.

On the Tell us about any points paid to bank screen, answer in regards to the new loan when asked about points.

On the Tell us about any points paid to bank screen, answer in regards to the new loan when asked about points If your total home debt is under $375,000 ($250,000 for married filing separate) there is nothing new for you to do in 2020. Enter each 1098 as you normally would.

**Mark the post that answers your question by clicking on "Mark as Best Answer"