- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Married Filing Separately

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married Filing Separately

Wife and I are legally separated in S Carolina. She and I both have our own homes, in our own names, and pay our own mortgage, taxes, interest etc.

When we file, do we each get to itemize our mortgage interest etc on our own taxes, as we are filing married filing separately.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married Filing Separately

Yes, you can file and each itemizes your deductions including mortgage interest and property taxes on Schedule A. One rule for Married filing separately is that if one person itemizes their deductions, then the other person must itemize too.

See this TurboTax Help article about Married Filing Separately

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married Filing Separately

Thank you for your response. My wifes CPA says no, only one can. I think he is confused..

She wasnt able to last year.

I was specifically told that we file the same and we itemize..

Is there a specific IRS code to go by? The article you linked to doesnt specifically go into two homes, separated mortgages etc?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married Filing Separately

If you file married-separate, both of you must itemize your deductions if either one of you does.

You should enter the deductions you each pay for on your respective tax returns.

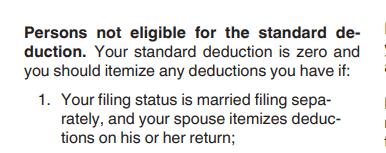

Per IRS publication 501:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married Filing Separately

We have separate tax returns.

The only time her name is on the 1040, is right after I check the MFS box. Other than that, we share nothing on our separate tax returns.

Her CPA is stressing us out..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married Filing Separately

@ThomasM125 cites the IRS from Publication 501 which means that if a couple is Married Filing Separately and one person itemizes their deductions, then the other person must itemize also.

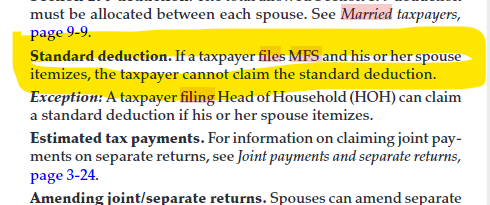

This is from the TaxBook that is found in most CPA firms:

To paraphrase this, if one spouse itemizes, the other cannot claim the standard deduction. They have to Itemize.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married Filing Separately

Thnk you. Then why is the CPA saying she cant itemize her mortgage. She is a realtor too, and she itemizes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married Filing Separately

I filed MFS and he put single on her 1040. Is that why hers was rejected. Should she just change it to MFS, and re send it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married Filing Separately

Yes, she should change her filing status to MFS and resend the return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married Filing Separately

@Steve40th396 wrote:

I filed MFS and he put single on her 1040. Is that why hers was rejected. Should she just change it to MFS, and re send it?

If she is legally married, she must file as MFS, unless she provides care in her home for a qualifying person, usually a child dependent, which would allow her to file as head of household.

You of course, always have the option of filing jointly, if you agree to do so, but that may not be practical in your situation. Also, signing a joint return makes you equally liable for all your spouse's tax information and problems, if any come up in the future.

There is a provision that says if a person is "considered unmarried" under state law, they can file as single. This is a complicated discussion, and I have never actually seen a situation in which the IRS ruled in favor of a married but separated person and allowed them to file as single. If your wife's CPA thinks she can be "considered unmarried", she can file as single, but your wife should make sure that CPA will stand behind her if audited, and will cover any penalties if she loses.

The rules for itemizing are quoted above. Essentially, if spouse A itemizes, they control the situation and spouse B must also itemize even if they don't want to. Spouse B can't force spouse A to use the standard deduction.

I don't know why your spouse's CPA is giving the advice they are giving. Your spouse might want a second opinion.

Or, just stay out of it. If your spouse has hired a CPA, they are capable of taking their advice or ignoring it, and a responsible CPA will have professional errors and omissions insurance to cover any mistakes they make. It probably should be none of your business at this point. When filing MFS, you list your income and deductions and have no responsibility for your spouse's income and deductions, so why get involved at all?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married Filing Separately

@Steve40th396 wrote:

I filed MFS and he put single on her 1040. Is that why hers was rejected. Should she just change it to MFS, and re send it?

This question concerns me. If the "CPA" was using professional software, there would be no way for "she" (the client) to change and re-file a tax return by herself. Only the CPA could re-file the return.

A CPA can not legally use Turbotax. Turbotax is individual/consumer/non-professional software. Among other things, Turbotax has no place for a paid tax preparer to include their paid preparer ID number as required by law, and so a paid preparer who uses Turbotax is violating IRS regulations as well as the Turbotax terms of service.

If this is not a simple misunderstanding and your wife's tax person really is using Turbotax, your wife would be well advised to back away from this tax preparer and find someone more reputable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married Filing Separately

I am almost positive he uses professional software. He spoke of the cost and licensing years ago to us at his office.

I can only do so much.. I am here to assist if she asks for it. Being separated doesnt mean being uncivilized.

Everyones help has been fantastic.. I will update if a resolve happens, of course.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married Filing Separately

@Steve40th396 wrote:

I am almost positive he uses professional software. He spoke of the cost and licensing years ago to us at his office.

I can only do so much.. I am here to assist if she asks for it. Being separated doesnt mean being uncivilized.

Everyones help has been fantastic.. I will update if a resolve happens, of course.

Hope so, in which case "she" can't re-file but can ask the accountant to make the change and re-file. (Alternatively, if the accountant thinks single is legally defensible, they can file the tax return by mail.)

Civilized is all well and good, but sometimes and with respect to certain situations, you may have to draw a line and say, on this topic, I stop here and no farther. If you're not careful, pretty soon you'll be listening to her boyfriend troubles (I speak from experience).

Cheers.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married Filing Separately

I dont want to even think boyfriend stuff, none of my business or relevant right now. Lol, I just want it fixed and for her to be happy etc with results of her tax filing.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

abhishek-potnuru

New Member

tanmay-kulkarni22

New Member

hhlai4

New Member

NJMo

New Member

cory_g72

New Member