- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@ThomasM125 cites the IRS from Publication 501 which means that if a couple is Married Filing Separately and one person itemizes their deductions, then the other person must itemize also.

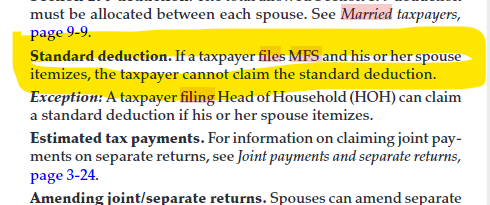

This is from the TaxBook that is found in most CPA firms:

To paraphrase this, if one spouse itemizes, the other cannot claim the standard deduction. They have to Itemize.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 14, 2022

6:03 PM