- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Job related expenses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Job related expenses

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Job related expenses

The next page after the one you are describing will have an itemized entry field. I have included two screen shots below - one showing the expense page detailing the one you are describing and the next showing the Other Expenses. It gives a sample list of items to include, but it is not all inclusive - you can add any other business expenses in the boxes below.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Job related expenses

The next page after the one you are describing will have an itemized entry field. I have included two screen shots below - one showing the expense page detailing the one you are describing and the next showing the Other Expenses. It gives a sample list of items to include, but it is not all inclusive - you can add any other business expenses in the boxes below.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Job related expenses

Business travel expenses standard mileage rate I enter total business miles 8 and X Federal standard miles rate Line 6 I put four I need this erased put 0 for no travel expenses please on my income tax 2018 amended forum to send them please

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Job related expenses

What? No one has access to your tax return or to your amended tax return forms. No one else can make changes for you. Only you can access your return and make changes.

If you are a W-2 employee then mileage as a job-related expense was eliminated as a deduction on your 2018 federal return, so it is not clear what you are trying to do.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Job related expenses

Where do I enter job related expenses for things like uniforms and shoes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Job related expenses

You can no longer claim any miscellaneous itemized deductions, unless you fall into one of the qualified categories of employment claiming a deduction relating to unreimbursed employee expenses. Miscellaneous itemized deductions are those deductions that would have been subject to the 2% of adjusted gross income limitation.

If you are a W-2 employee, you can deduct unreimbursed employee expenses only if you qualify as an Armed Forces reservist, qualified performing artist, fee-basis state or local government official, and employee with impairment-related work expenses.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Job related expenses

DavidD66;

Thank you for your reply. Question, I am a Reservist and I still cannot find the section that allows for the deduction of personally purchased equipment and uniforms. Can you assist?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Job related expenses

The job-related expenses deduction is still available to people who work in one of these specific professions or situations:

- Armed Forces reservist

- Qualified performing artist

- Fee-basis state or local government official

- You're disabled and have impairment-related expenses

Here's how to enter your job-related expenses in TurboTax:

- Open (continue) your return in TurboTax if it's not already open.

- In TurboTax, search for 2106 and then select the Jump to link in the search results.

- At the Tell us about the occupation you have expenses for screen, enter your occupation, then select Continue.

- If you land on the Job-Related Expenses Summary screen, you can select Add Another Occupation (to add another 2106), Edit (for an existing 2106), or Delete.

- Follow the onscreen instructions to enter your employee expenses.

Source: TurboTax FAQ

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Job related expenses

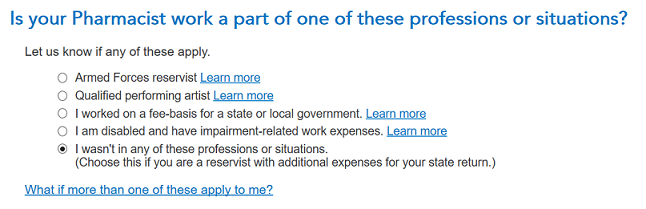

The TurboTax 2019 software step-by-step (see the attached pic) on this topic seems to have problem and quite confusing to me.

As a Pharmacist, I naturally choose the fifth option of 'I wasn't in any of these professions or situations' as it is actually the correct choice for my profession. Then it also allows the job related expenses to go forward without any further checking. I was prepared to claim this expenses and I see this reply saying I wouldn't be qualified. Please see if this can be fixed in the TurboTax software.

- Joseph

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Job related expenses

The program allows you to enter the employee business expenses but not for the federal return since they are no longer deductible but for the state return IF your state still allows the deduction. Review your returns carefully to see what happened with the figures you entered if anything ...

You can peek at only the Federal form 1040 and the summary of the state info by going here:

1) lower- Left side of the screen...click to the left side of the "Tax Tools" text selection.

2) then select "Tools"

3) then select "View Tax Summary" from the pop-up

4) then back to the left-side and "Preview 1040"

Then hit the "Back" on the left side to get back to your tax entries.

To view your entire return using the online editions (including the state) before you file, you will need to pay for your online account.

To pay the TurboTax online account fees by credit card, without completing the 2019 return at this time, click on Tax Tools >>> Tools and then Print Center. Then click on Print, save or preview this year's return. On the next page, to pay by credit card, click Continue. On the next screen it will ask if you want Audit Defense, if you do not want this option just click on the Continue button. The next screen will ask for all your credit card information so you can pay for the account.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Job related expenses

Turbo tax didn't give me the page asking if my work is "part of one of these professions or situations" at all! It asked me to enter my expenses just like last year. I wouldn't even know I'm not eligible if I hadn't clicked on "What's new with job-related expenses this year."

Now I'm not sure if I should leave it and continue to follow the prompts or if Turbo Tax is going to use that information on my state filing.

I'm confused!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Job related expenses

Although not applicable for federal filing - won't this info be used for my state filing (as applicable)?

I have more than one paid position including the National Guard for the USAF (medical) and work at a hospital as a patient care tech while attending school. In the jobs related expense summary under my Patient Care Tech position under the miscellaneous items where one can type in what does not fall into one of the pre-set categories , when I list the "scrubs" that I am required to buy for my hospital job (specificl colors) and then go back and review when done with the entire section for each job , TurboTax has changed my entry to "Reservist meals and incidentals". It makes the same change for my National Guard position (NOT RESERVIST BUT NATIONAL GUARD) for my ranking up's required purchase of the new patches and and the alterations to have them sewn on . . . TurboTax also changes that to "Reservist meals and incidentals". Additionally, it does so for the part time job I had in retail that required us to wear its high end clothing when working. Upon review, that required clothing also gets changed to "Reservist meals and incidentals". I can not file like that! PLEASE make an appropriate fix and provide an update ASAP! Thank you!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Job related expenses

@Irshays Your state may allow the expense, the federal does not. Only a few states allow it. If yours does, it boils down to a few lines and dollars on a form.

The line description changing is related to how you are entering the information. When you go to employment expenses, you type in the occupation, the next page you mark if reservist is related to that expense. It sounds like you marked reservist for all of them. Go back and edit your entries.

You should check with your state to see what is allowed. Many use the 2018 federal laws, see 2018 Instructions for Form 2106 - Internal Revenue Service

So patches, scrubs, and alterations make sense. Anything that would not be worn on the street qualifies. You said high end clothing. That sounds like street wear and is not deductible.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

fldcdeb

Level 1

bhsong206

Level 2

nvappraisal

New Member

Polywog1

Level 1

jtupp72

Returning Member